- China

- /

- Semiconductors

- /

- SZSE:300604

Exploring Three Growth Companies With High Insider Stakes

Reviewed by Simply Wall St

As global markets show resilience, with indices like the S&P 500 nearing record highs amid fluctuating economic indicators, investors continue to seek stable yet promising opportunities. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often signal confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| UNISEM (KOSDAQ:A036200) | 29.8% | 38.6% |

| Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Nordic Halibut (OB:NOHAL) | 29.9% | 97.1% |

| Vow (OB:VOW) | 31.8% | 99.4% |

| EHang Holdings (NasdaqGM:EH) | 33% | 97.1% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 25.1% | 92.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 50.9% |

| Adocia (ENXTPA:ADOC) | 12.8% | 104.5% |

Underneath we present a selection of stocks filtered out by our screen.

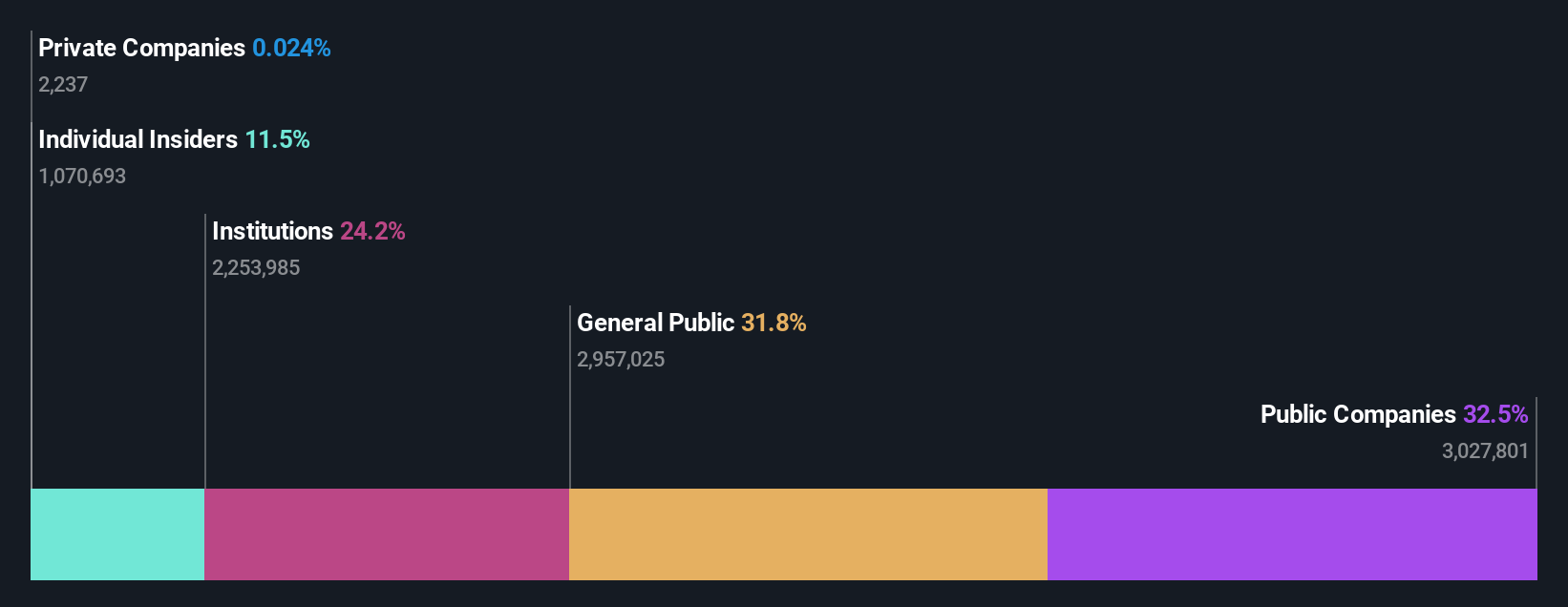

Localiza Rent a Car (BOVESPA:RENT3)

Simply Wall St Growth Rating: ★★★★☆☆

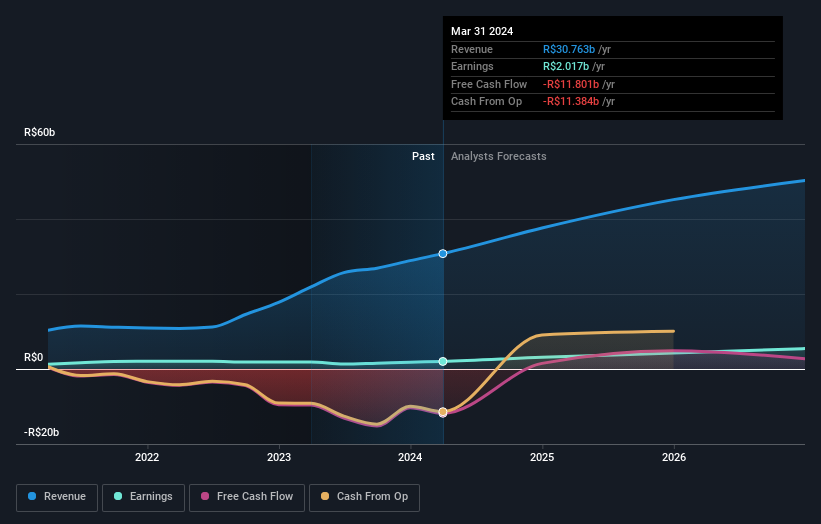

Overview: Localiza Rent a Car S.A. operates in the car and fleet rental industry, with a market capitalization of approximately R$51.62 billion.

Operations: The company generates revenue primarily through its car and fleet rental services, totaling R$30.75 billion.

Insider Ownership: 19.1%

Earnings Growth Forecast: 34.2% p.a.

Localiza Rent a Car has demonstrated robust growth, with its first quarter 2024 sales reaching BRL 8.69 billion, up from BRL 6.83 billion the previous year, and net income increasing to BRL 733.82 million from BRL 522.81 million. Analysts anticipate the company's revenue will grow faster than the Brazilian market average, at a rate of 19% per year, and expect earnings to surge by approximately 34% annually over the next three years. Despite these positives, concerns include substantial shareholder dilution in the past year and a dividend that is not well-covered by cash flows.

- Click to explore a detailed breakdown of our findings in Localiza Rent a Car's earnings growth report.

- Upon reviewing our latest valuation report, Localiza Rent a Car's share price might be too optimistic.

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hyosung Heavy Industries Corporation, which operates both in South Korea and internationally, specializes in the manufacturing and selling of heavy electrical equipment with a market capitalization of approximately ₩2.93 trillion.

Operations: The company's revenue is primarily generated from its construction and heavy industry segments, totaling approximately ₩1.71 billion and ₩3.09 billion respectively.

Insider Ownership: 19.8%

Earnings Growth Forecast: 35.7% p.a.

Hyosung Heavy Industries has seen a significant uptick in earnings, growing by over 1000% last year, with forecasts suggesting a robust annual growth of 35.7%, outpacing the Korean market's 27.5%. Although its revenue growth at 11.9% annually is below some high-growth benchmarks, it remains above the market average of 9.5%. The company trades at a substantial discount to estimated fair value but carries a high debt load and experiences considerable share price volatility.

- Delve into the full analysis future growth report here for a deeper understanding of Hyosung Heavy Industries.

- Our comprehensive valuation report raises the possibility that Hyosung Heavy Industries is priced lower than what may be justified by its financials.

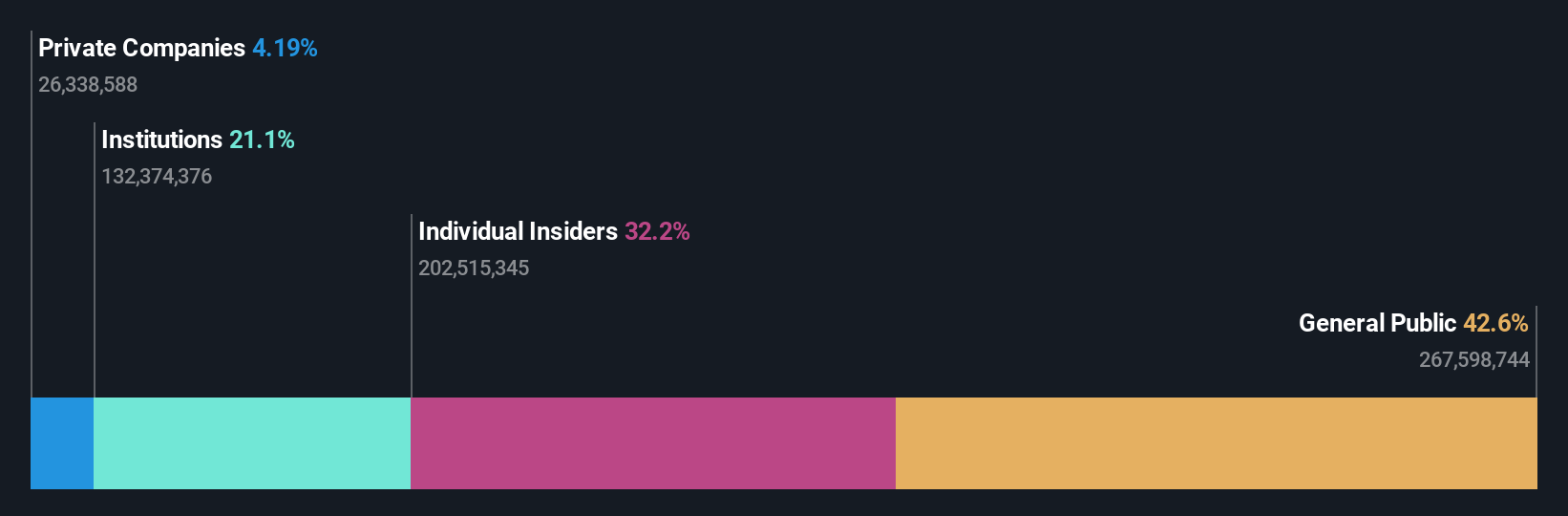

Hangzhou Changchuan TechnologyLtd (SZSE:300604)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hangzhou Changchuan Technology Co., Ltd. focuses on the research, development, production, and sale of integrated circuit equipment and high-frequency communication materials, with a market capitalization of approximately CN¥17.77 billion.

Operations: The company generates revenue primarily from the sale of integrated circuit equipment and high-frequency communication materials.

Insider Ownership: 32.2%

Earnings Growth Forecast: 63.4% p.a.

Hangzhou Changchuan Technology Co., Ltd has demonstrated a strong rebound with first-quarter sales rising to CNY 559.39 million from CNY 320 million year-over-year, and shifting from a net loss to a net income of CNY 4.08 million. Despite a challenging previous year with significant earnings drop, the company is set for rapid growth, with revenue and earnings expected to outpace the market significantly. However, profit margins have contracted and shareholder dilution occurred over the past year, signaling mixed financial health signals amidst growth prospects.

- Take a closer look at Hangzhou Changchuan TechnologyLtd's potential here in our earnings growth report.

- According our valuation report, there's an indication that Hangzhou Changchuan TechnologyLtd's share price might be on the expensive side.

Key Takeaways

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1500 more companies for you to explore.Click here to unveil our expertly curated list of 1503 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Changchuan TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300604

Hangzhou Changchuan TechnologyLtd

Researches and develops, produces, and sells integrated circuit equipment and high-frequency communication materials.

Exceptional growth potential with mediocre balance sheet.