- Hong Kong

- /

- Construction

- /

- SEHK:1618

3 Dividend Stocks Offering Yields Up To 4.9%

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets experienced some turbulence, with major indices like the Nasdaq Composite and S&P 500 seeing fluctuations amid cautious corporate forecasts. As investors navigate these volatile conditions, dividend stocks stand out for their potential to provide steady income streams regardless of market swings. In this context, identifying dividend stocks that offer attractive yields can be a prudent strategy for those looking to balance growth with income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Innotech (TSE:9880) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.21% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.03% | ★★★★★★ |

Click here to see the full list of 2022 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

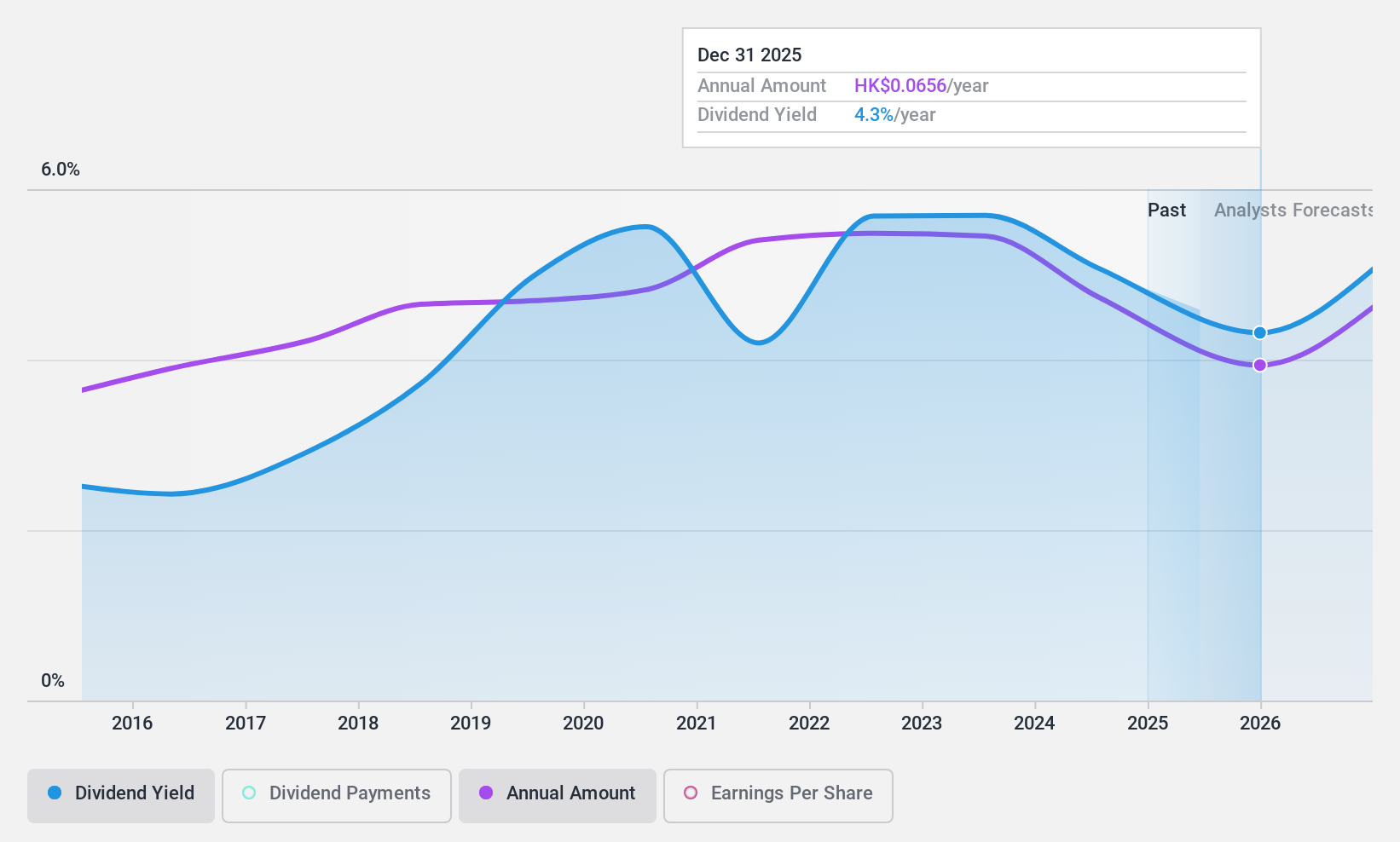

Metallurgical Corporation of China (SEHK:1618)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Metallurgical Corporation of China Ltd., along with its subsidiaries, operates in engineering contracting, property development, equipment manufacturing, and resource development both in China and globally, with a market cap of HK$72.02 billion.

Operations: Metallurgical Corporation of China Ltd. generates revenue through its operations in engineering contracting, property development, equipment manufacturing, and resource development across both domestic and international markets.

Dividend Yield: 4.4%

Metallurgical Corporation of China's dividend payments have been stable and reliable over the past decade, though its current yield of 4.43% is below the top tier in Hong Kong. Despite a low payout ratio of 29%, dividends are not covered by free cash flows, raising sustainability concerns. Recent earnings show a decline in sales to CNY 412.62 billion and net income to CNY 6.83 billion for the first nine months of 2024, reflecting pressure on margins and profitability.

- Click here to discover the nuances of Metallurgical Corporation of China with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Metallurgical Corporation of China is priced lower than what may be justified by its financials.

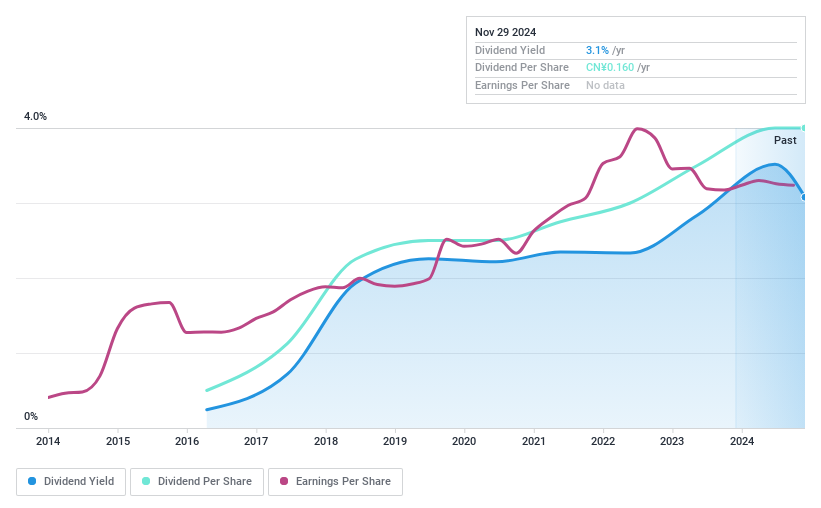

NanJing Pharmaceutical (SHSE:600713)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NanJing Pharmaceutical Company Limited operates in the pharmaceutical wholesale and retail sectors in China, with a market cap of CN¥6.64 billion.

Operations: NanJing Pharmaceutical Company Limited generates revenue through its pharmaceutical wholesale and retail operations in China.

Dividend Yield: 3.1%

NanJing Pharmaceutical's dividend yield of 3.12% is among the top 25% in China, supported by a low payout ratio of 36%, indicating strong earnings coverage. The cash payout ratio is just 7.1%, ensuring dividends are well-covered by free cash flow despite its high debt levels. However, the company has only paid dividends for nine years, reflecting an unstable track record despite recent modest earnings growth and stable dividend payments.

- Take a closer look at NanJing Pharmaceutical's potential here in our dividend report.

- Our valuation report here indicates NanJing Pharmaceutical may be undervalued.

IDEC (TSE:6652)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IDEC Corporation develops human machine interfaces, industrial switches, control devices, and daily life scenes for markets in Japan and internationally with a market cap of ¥72.57 billion.

Operations: IDEC Corporation's revenue segments include human machine interfaces, industrial switches, control devices, and daily life scenes.

Dividend Yield: 5%

IDEC's dividend yield of 4.98% ranks in the top 25% in Japan, yet its sustainability is questionable due to a high cash payout ratio of 130.5%, indicating dividends are not well-covered by cash flow. Although earnings cover the current payout ratio of 76.1%, dividends have been volatile over the past decade with periods of significant reduction, and recent profit margins have declined from last year’s levels.

- Get an in-depth perspective on IDEC's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that IDEC is trading beyond its estimated value.

Turning Ideas Into Actions

- Investigate our full lineup of 2022 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1618

Metallurgical Corporation of China

Engages in the engineering contracting, property development, equipment manufacture, and resource development businesses in China and internationally.

Excellent balance sheet, good value and pays a dividend.