- China

- /

- Electrical

- /

- SZSE:002606

Top Chinese Growth Companies With High Insider Ownership For August 2024

Reviewed by Simply Wall St

As Chinese equities navigate mixed signals from weak manufacturing data and industrial profit growth, investors are increasingly focused on identifying resilient opportunities. In this context, growth companies with high insider ownership can offer a compelling mix of stability and potential upside, making them particularly attractive in today's market environment.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 28.4% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| UTour Group (SZSE:002707) | 23% | 36.1% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 82.1% |

Let's uncover some gems from our specialized screener.

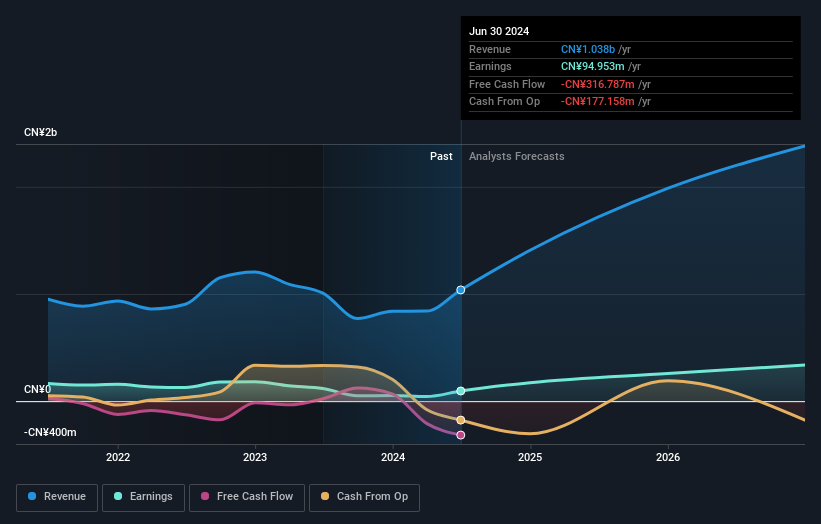

Dalian Insulator Group (SZSE:002606)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dalian Insulator Group Co., Ltd (SZSE:002606) specializes in the research, development, manufacture, and sale of porcelain insulators both in China and internationally, with a market cap of CN¥3.57 billion.

Operations: The company generates revenue primarily from the research, development, manufacture, and sale of porcelain insulators in domestic and international markets.

Insider Ownership: 13%

Earnings Growth Forecast: 51% p.a.

Dalian Insulator Group exhibits strong growth potential with forecasted revenue growth of 33.7% per year, significantly outpacing the Chinese market average. Earnings are expected to grow at an impressive 51% annually over the next three years. Despite a decline in profit margins from 13.1% to 5.1%, recent share buybacks totaling CNY 30 million indicate insider confidence in the company's future prospects, although dividend payouts have decreased recently.

- Click here to discover the nuances of Dalian Insulator Group with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Dalian Insulator Group's share price might be too optimistic.

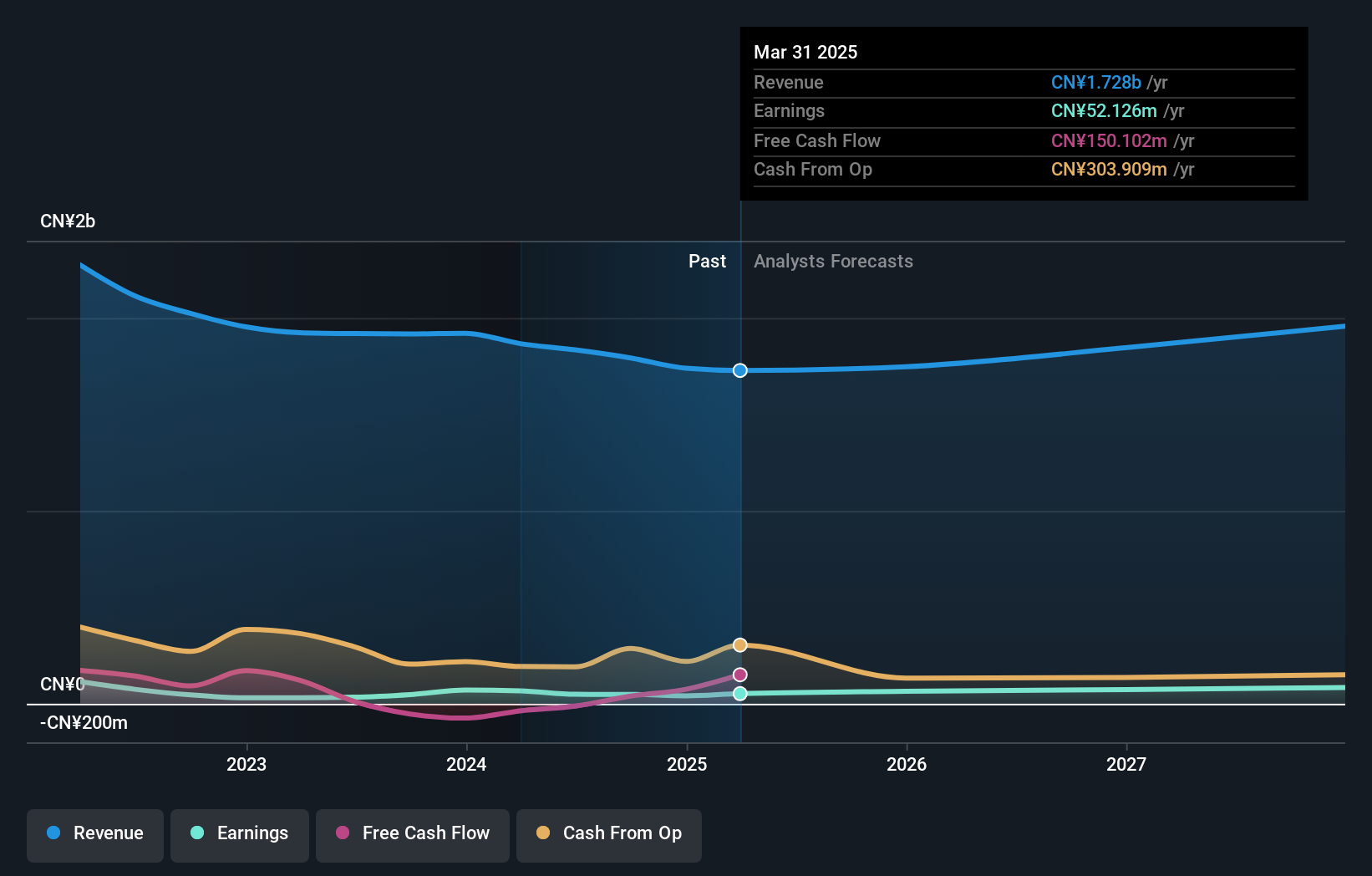

Jiangxi Huangshanghuang Group Food (SZSE:002695)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangxi Huangshanghuang Group Food Co., Ltd. develops, produces, and sells braised meat products in China, with a market cap of CN¥3.71 billion.

Operations: The company's revenue segments include the development, production, and sale of braised meat products in China.

Insider Ownership: 11.5%

Earnings Growth Forecast: 49% p.a.

Jiangxi Huangshanghuang Group Food's earnings grew by 119.7% last year and are forecast to grow 49% annually, significantly outpacing the Chinese market's 22.1%. Revenue is expected to increase by 22.6% per year, faster than the market average of 13.5%. However, shareholders faced dilution over the past year and dividends of 2.7% are not well-covered by earnings or free cash flows, with large one-off items impacting financial results.

- Unlock comprehensive insights into our analysis of Jiangxi Huangshanghuang Group Food stock in this growth report.

- In light of our recent valuation report, it seems possible that Jiangxi Huangshanghuang Group Food is trading beyond its estimated value.

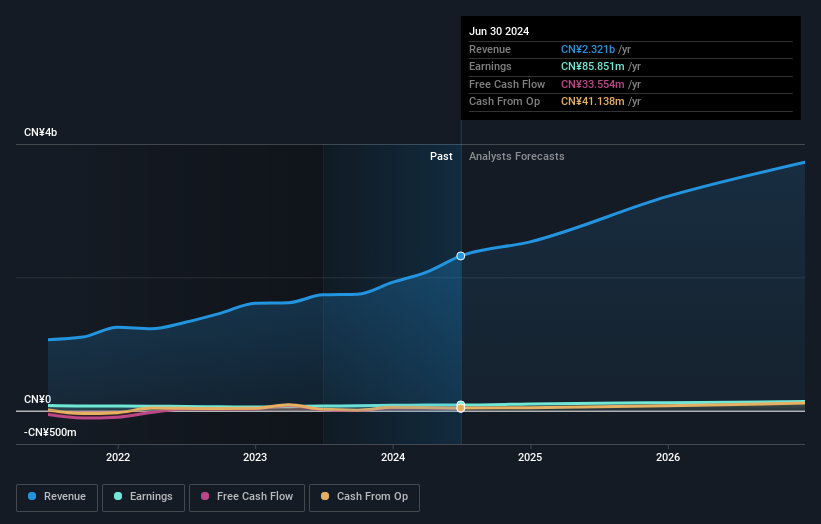

MCLON JEWELLERYLtd (SZSE:300945)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MCLON JEWELLERY Co., Ltd. engages in jewelry retail both in China and internationally, with a market cap of CN¥2.38 billion.

Operations: MCLON JEWELLERY Co., Ltd. generates revenue through its jewelry retail operations in both domestic and international markets.

Insider Ownership: 12.1%

Earnings Growth Forecast: 20.8% p.a.

MCLON JEWELLERY Ltd. is forecast to grow its revenue by 23.4% annually, outpacing the Chinese market's 13.5%. Earnings are expected to increase by 20.78% per year, slightly below market expectations of 22.1%. The company has a volatile share price and an unstable dividend track record but offers a competitive Price-to-Earnings ratio of 27.7x compared to the market average of 28x. Recent events include a special shareholders meeting and dividend increases for A shares in June and May 2024 respectively.

- Take a closer look at MCLON JEWELLERYLtd's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of MCLON JEWELLERYLtd shares in the market.

Summing It All Up

- Investigate our full lineup of 363 Fast Growing Chinese Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002606

Dalian Insulator Group

Engages in the research, development, manufacture, and sale of porcelain insulators in China and internationally.

High growth potential with adequate balance sheet.