China's recent announcement of robust stimulus measures has significantly boosted market sentiment, leading to a surge in Chinese stocks. The Shanghai Composite Index and the blue-chip CSI 300 have experienced impressive gains, reflecting renewed investor confidence in the country's economic recovery. In this favorable environment, dividend stocks can offer both income and potential for capital appreciation. A good dividend stock typically combines a solid yield with strong fundamentals and stability, making it an attractive option for investors looking to benefit from China's economic resurgence.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 3.94% | ★★★★★★ |

| Lao Feng Xiang (SHSE:600612) | 3.10% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.13% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.18% | ★★★★★★ |

| Changchun High-Tech Industry (Group) (SZSE:000661) | 4.09% | ★★★★★★ |

| Zhejiang HangminLtd (SHSE:600987) | 3.80% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.49% | ★★★★★★ |

| China Merchants Bank (SHSE:600036) | 5.24% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.91% | ★★★★★★ |

Click here to see the full list of 177 stocks from our Top Chinese Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

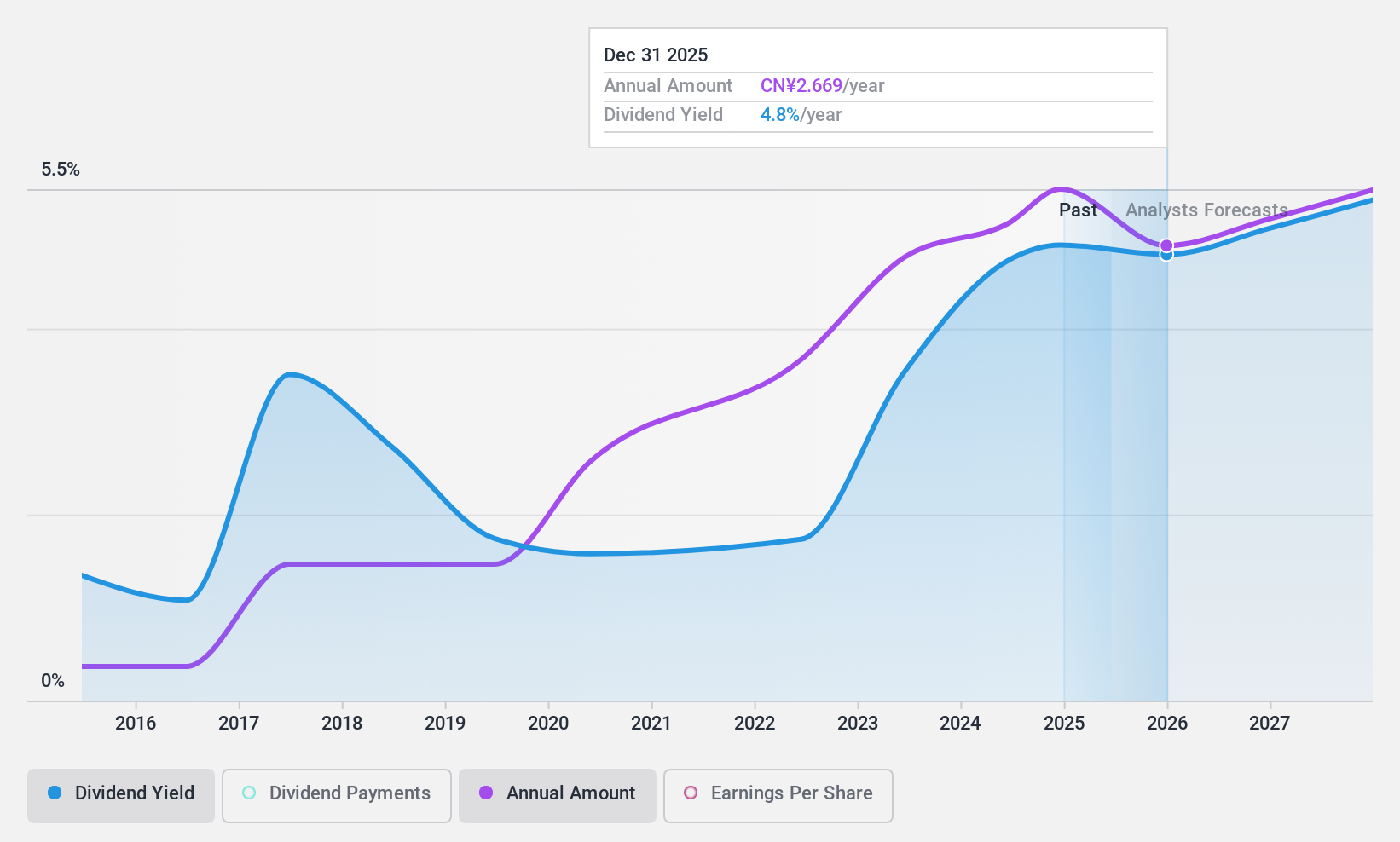

Chongqing Brewery (SHSE:600132)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chongqing Brewery Co., Ltd. produces and sells beers and non-alcoholic beverages in China, with a market cap of CN¥33.94 billion.

Operations: Chongqing Brewery Co., Ltd. generates CN¥15.17 billion in revenue from its beer segment.

Dividend Yield: 4%

Chongqing Brewery reported H1 2024 sales of CNY 8.86 billion and net income of CNY 901.29 million, showing modest growth from the previous year. Despite a high dividend yield of 3.99%, the dividend has been volatile over the past decade and is not well-covered by earnings with a payout ratio of 98.9%. However, it is reasonably covered by cash flows with a cash payout ratio of 65.9%.

- Get an in-depth perspective on Chongqing Brewery's performance by reading our dividend report here.

- Our valuation report unveils the possibility Chongqing Brewery's shares may be trading at a discount.

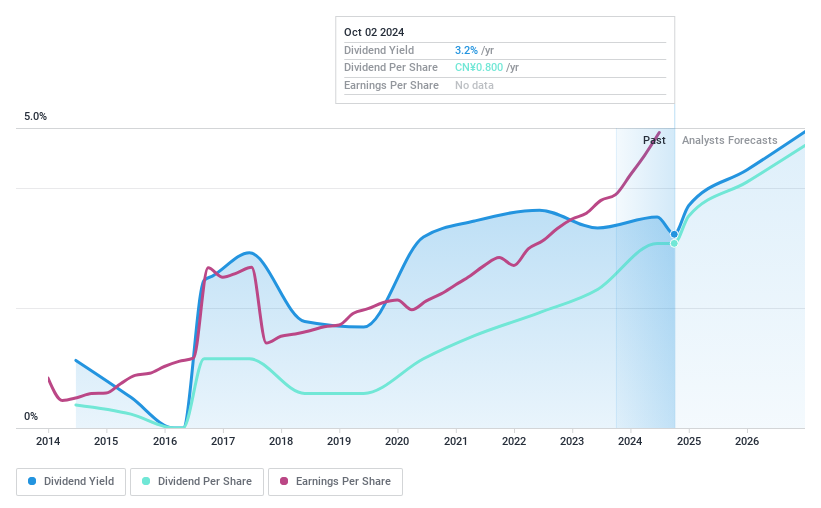

Henan Lingrui Pharmaceutical (SHSE:600285)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Henan Lingrui Pharmaceutical Co., Ltd. produces and sells medicines in China and has a market cap of CN¥13.96 billion.

Operations: Henan Lingrui Pharmaceutical Co., Ltd. generates revenue through the production and sale of medicines in China.

Dividend Yield: 3.2%

Henan Lingrui Pharmaceutical's H1 2024 earnings showed strong growth, with net income rising to CNY 413.03 million from CNY 316.98 million a year ago. Despite a high dividend yield of 3.23%, the company's dividend history has been volatile and unreliable over the past decade. However, dividends are covered by both earnings (payout ratio: 67.7%) and cash flows (cash payout ratio: 66.1%). The stock trades at good value compared to peers and industry standards.

- Click to explore a detailed breakdown of our findings in Henan Lingrui Pharmaceutical's dividend report.

- Our comprehensive valuation report raises the possibility that Henan Lingrui Pharmaceutical is priced lower than what may be justified by its financials.

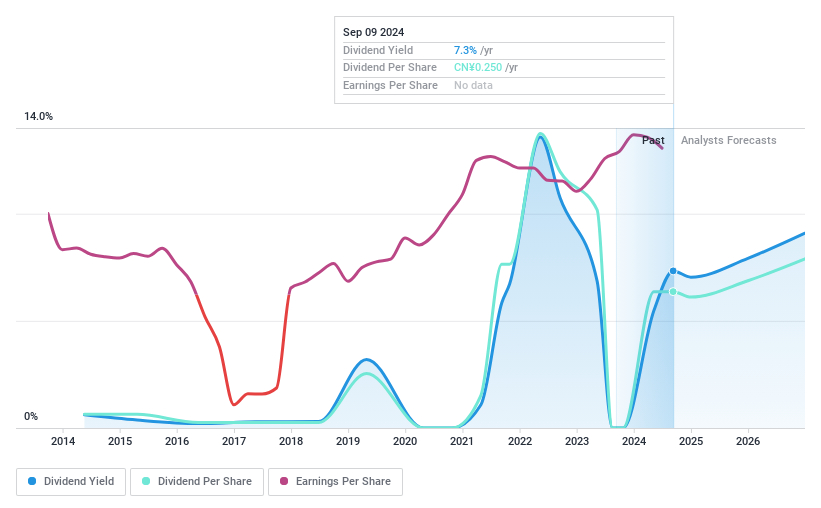

Baoxiniao Holding (SZSE:002154)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Baoxiniao Holding Co., Ltd. engages in the research, development, production, and sale of branded clothing products in China and has a market cap of CN¥6.39 billion.

Operations: Baoxiniao Holding Co., Ltd. generates CN¥5.11 billion from its Textile and Apparel segment.

Dividend Yield: 3.2%

Baoxiniao Holding's interim dividend of CNY 0.70 per 10 shares, approved in September 2024, reflects a reasonable payout ratio of 72.8%, indicating dividends are covered by earnings. Despite a net income drop to CNY 343.99 million for H1 2024, the company's dividend yield (3.2%) remains in the top quartile of CN market payers. However, its dividend history has been volatile over the past decade, raising concerns about reliability despite strong cash flow coverage (32.8%).

- Click here to discover the nuances of Baoxiniao Holding with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Baoxiniao Holding is trading behind its estimated value.

Seize The Opportunity

- Explore the 177 names from our Top Chinese Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henan Lingrui Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600285

Outstanding track record with flawless balance sheet and pays a dividend.