- China

- /

- Energy Services

- /

- SZSE:002629

Investors in Zhejiang Renzhi (SZSE:002629) from a year ago are still down 54%, even after 12% gain this past week

This week we saw the Zhejiang Renzhi Co., Ltd. (SZSE:002629) share price climb by 12%. But that's not enough to compensate for the decline over the last twelve months. During that time the share price has sank like a stone, descending 54%. The share price recovery is not so impressive when you consider the fall. Arguably, the fall was overdone.

While the stock has risen 12% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Zhejiang Renzhi

Zhejiang Renzhi isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Zhejiang Renzhi increased its revenue by 20%. That's definitely a respectable growth rate. Meanwhile, the share price tanked 54%, suggesting the market had much higher expectations. It is of course possible that the business will still deliver strong growth, it will just take longer than expected to do it. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

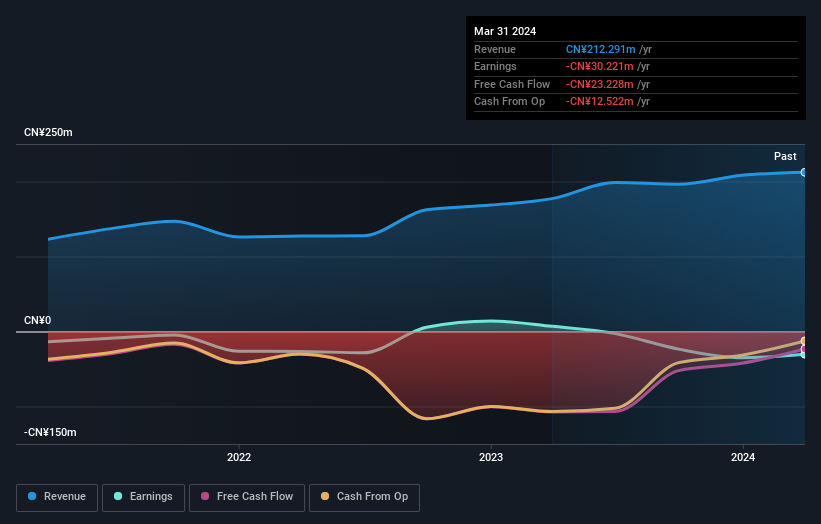

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Zhejiang Renzhi's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 18% in the twelve months, Zhejiang Renzhi shareholders did even worse, losing 54%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Zhejiang Renzhi that you should be aware of before investing here.

Of course Zhejiang Renzhi may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Renzhi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002629

Zhejiang Renzhi

Provides professional services in the oil and gas drilling and engineering fields primarily in China.

Flawless balance sheet low.