- China

- /

- Energy Services

- /

- SHSE:603727

Fewer Investors Than Expected Jumping On BOMESC Offshore Engineering Company Limited (SHSE:603727)

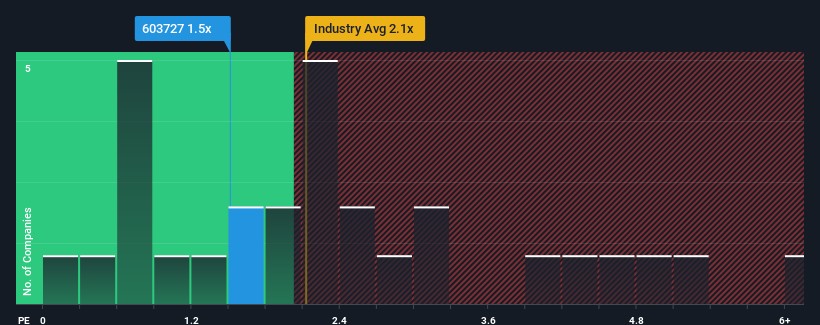

When you see that almost half of the companies in the Energy Services industry in China have price-to-sales ratios (or "P/S") above 2.1x, BOMESC Offshore Engineering Company Limited (SHSE:603727) looks to be giving off some buy signals with its 1.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for BOMESC Offshore Engineering

How Has BOMESC Offshore Engineering Performed Recently?

BOMESC Offshore Engineering could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on BOMESC Offshore Engineering will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

BOMESC Offshore Engineering's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. This means it has also seen a slide in revenue over the longer-term as revenue is down 46% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 73% during the coming year according to the three analysts following the company. With the industry only predicted to deliver 21%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that BOMESC Offshore Engineering's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On BOMESC Offshore Engineering's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

BOMESC Offshore Engineering's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You always need to take note of risks, for example - BOMESC Offshore Engineering has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BOMESC Offshore Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603727

BOMESC Offshore Engineering

Provides engineering, procurement, and construction (EPC) services for offshore oil and gas industries.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives