In a week marked by high volatility, global markets saw major indices like the S&P MidCap 400 and Nasdaq Composite reach record highs before retreating, while small-cap stocks demonstrated resilience amid cautious earnings reports and mixed economic signals. As investors navigate these turbulent waters, identifying undiscovered gems with strong fundamentals and growth potential becomes crucial in capitalizing on opportunities within the small-cap sector.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 40.13% | 22.83% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Poly Property Group (SEHK:119)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Poly Property Group Co., Limited is an investment holding company involved in property investment, development, and management across Hong Kong, the People’s Republic of China, and internationally, with a market cap of HK$6.73 billion.

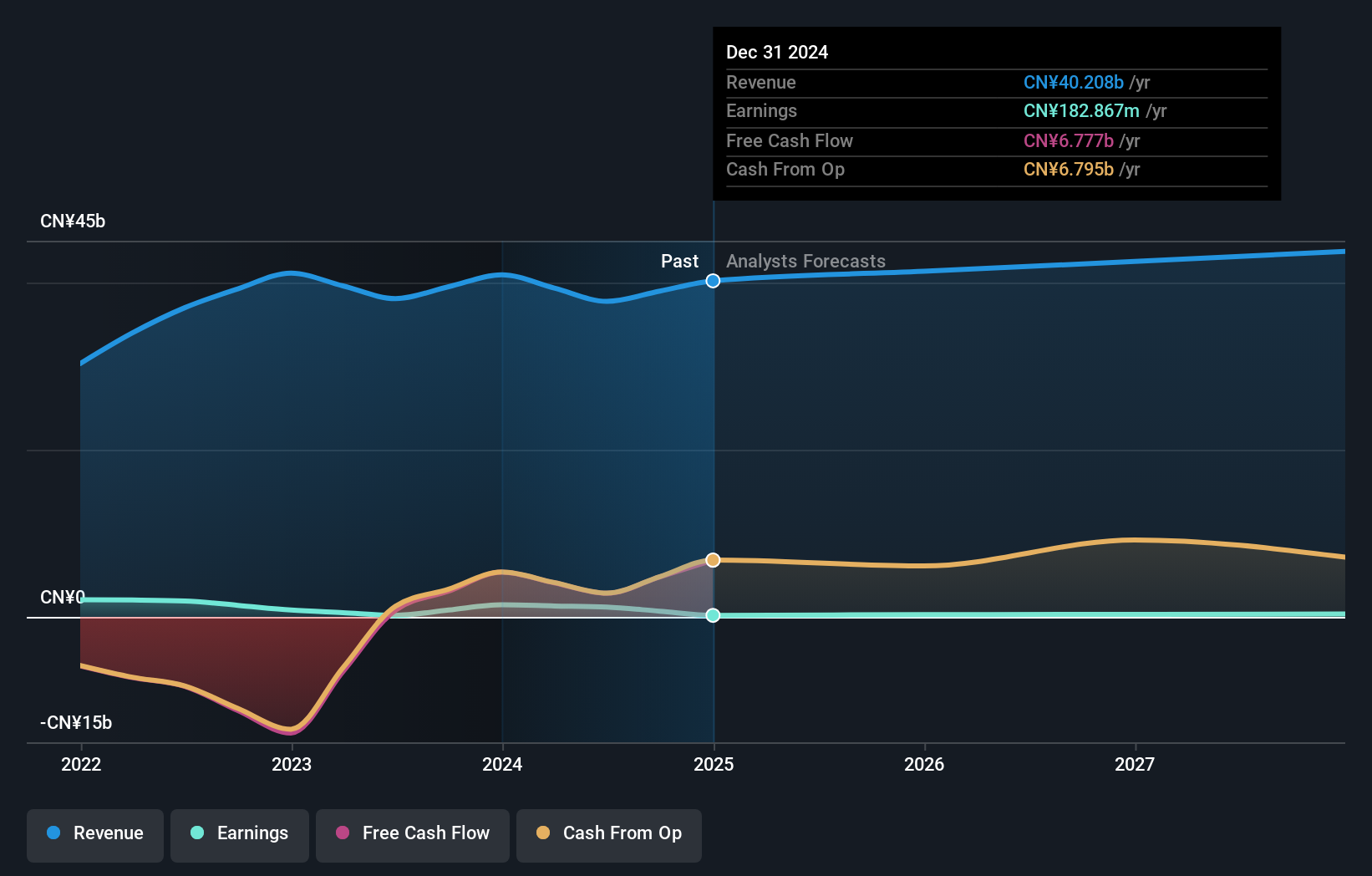

Operations: The primary revenue stream for Poly Property Group comes from its property development business, generating CN¥35.59 billion. Additional income is derived from property investment and management, contributing CN¥1.87 billion, and hotel operations with CN¥377.21 million in revenue.

Poly Property Group, a notable player in the real estate sector, has seen its earnings surge by 531% over the past year, significantly outpacing the industry's -13.2% performance. Despite this impressive growth, its debt situation remains a concern with a net debt to equity ratio of 91.1%, which is considered high. The company recently completed a CNY 1.5 billion fixed-income offering at 2.98%, aiming to strengthen its financial position amid declining sales and profit margins as reported in their recent interim results, where sales fell from CNY 15.64 billion to CNY 12.46 billion year-on-year.

- Get an in-depth perspective on Poly Property Group's performance by reading our health report here.

Explore historical data to track Poly Property Group's performance over time in our Past section.

Beijing Haohua Energy Resource (SHSE:601101)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing Haohua Energy Resource Co., Ltd. is involved in the mining, washing, processing, export, and sale of coal in China with a market capitalization of CN¥12.61 billion.

Operations: Haohua Energy generates revenue primarily from the sale of coal, focusing on mining, washing, processing, and export activities within China. The company's financial performance is reflected in its market capitalization of CN¥12.61 billion.

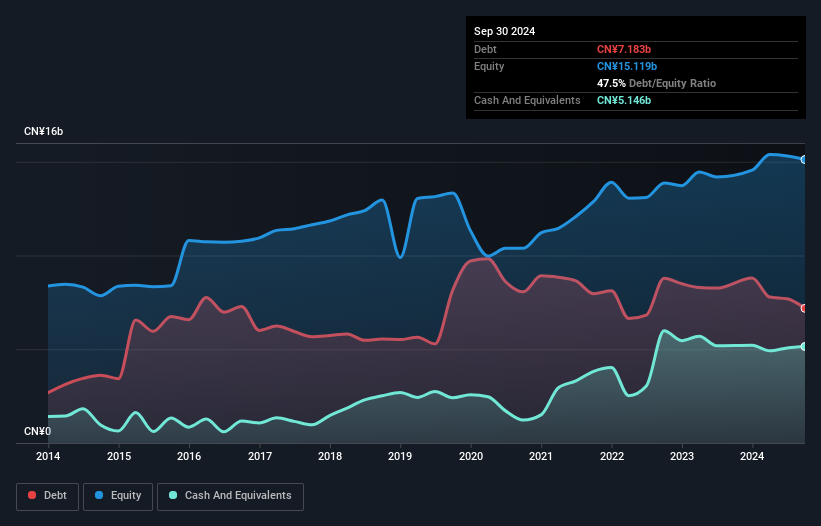

Beijing Haohua Energy Resource, a promising player in the energy sector, has shown impressive growth with earnings up by 39% over the past year, significantly outpacing the Oil and Gas industry's -16.6%. The firm reported sales of CNY 6.84 billion for nine months ending September 2024, an increase from CNY 6.12 billion last year. Its net income rose to CNY 1.12 billion from CNY 1.01 billion in the previous period. With a debt-to-equity ratio reduced to 47% over five years and interest payments well covered at a multiple of EBIT by 25x, it offers good relative value compared to peers and industry standards while trading below estimated fair value by nearly half (48%).

- Navigate through the intricacies of Beijing Haohua Energy Resource with our comprehensive health report here.

Learn about Beijing Haohua Energy Resource's historical performance.

Musashino Bank (TSE:8336)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Musashino Bank, Ltd., along with its subsidiaries, offers a range of banking products and financial services in Japan and has a market capitalization of ¥93.58 billion.

Operations: Musashino Bank generates revenue primarily through its banking products and financial services in Japan.

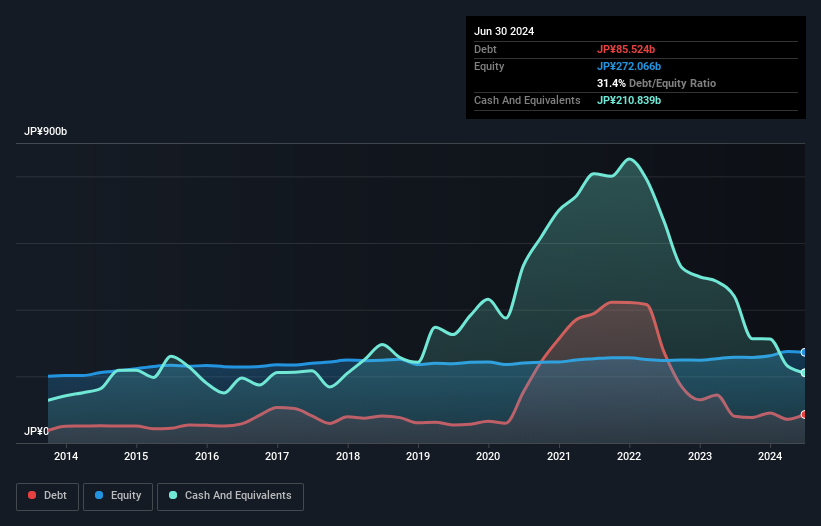

With total assets of ¥5,420 billion and equity at ¥272.1 billion, Musashino Bank showcases a stable foundation. Total deposits stand at ¥5,015.3 billion against loans of ¥3,967 billion. However, it seems the bank's allowance for bad loans is insufficient with non-performing loans at 1.8%. Customer deposits make up 97% of its liabilities, indicating low-risk funding sources which are generally safer than external borrowing options. Despite trading nearly 49% below estimated fair value and boasting high-quality earnings growth averaging 11% annually over five years, recent growth hasn't matched industry pace at just 7%.

- Take a closer look at Musashino Bank's potential here in our health report.

Assess Musashino Bank's past performance with our detailed historical performance reports.

Make It Happen

- Reveal the 4704 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8336

Musashino Bank

Provides banking products and financial services in Japan.

Excellent balance sheet established dividend payer.