- China

- /

- Consumer Finance

- /

- SHSE:600599

Even after rising 11% this past week, Panda Financial Holding (SHSE:600599) shareholders are still down 28% over the past five years

This week we saw the Panda Financial Holding Corp., Ltd. (SHSE:600599) share price climb by 11%. But over the last half decade, the stock has not performed well. After all, the share price is down 28% in that time, significantly under-performing the market.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Panda Financial Holding

Panda Financial Holding wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Panda Financial Holding saw its revenue increase by 10% per year. That's a pretty good rate for a long time period. We doubt many shareholders are ok with the fact the share price has fallen 5% each year for half a decade. Clearly, the expectations from back then have not been satisfied. There is always a big risk of losing money yourself when you buy shares in a company that loses money.

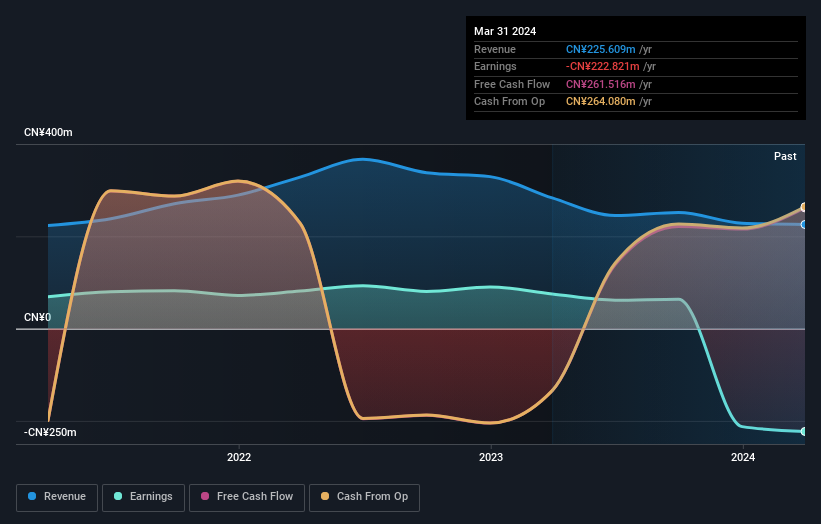

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Panda Financial Holding shareholders have received a total shareholder return of 0.6% over one year. That certainly beats the loss of about 5% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600599

Panda Financial Holding

Engages in the granting micro-loans to individuals and enterprises in China.

Excellent balance sheet and overvalued.