As global markets continue to climb, with indices like the Russell 2000 reaching new heights, small-cap stocks are gaining attention amid a backdrop of robust consumer spending and policy shifts. In this dynamic environment, identifying undiscovered gems involves seeking companies that demonstrate resilience and growth potential despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Beijing Jingyeda TechnologyLtd (SZSE:003005)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Jingyeda Technology Co., Ltd. specializes in providing system integration services and has a market cap of CN¥4.80 billion.

Operations: Jingyeda Technology generates revenue primarily through system integration services. The company's financial data does not provide specific segment details or cost breakdowns, making it challenging to analyze individual revenue streams further.

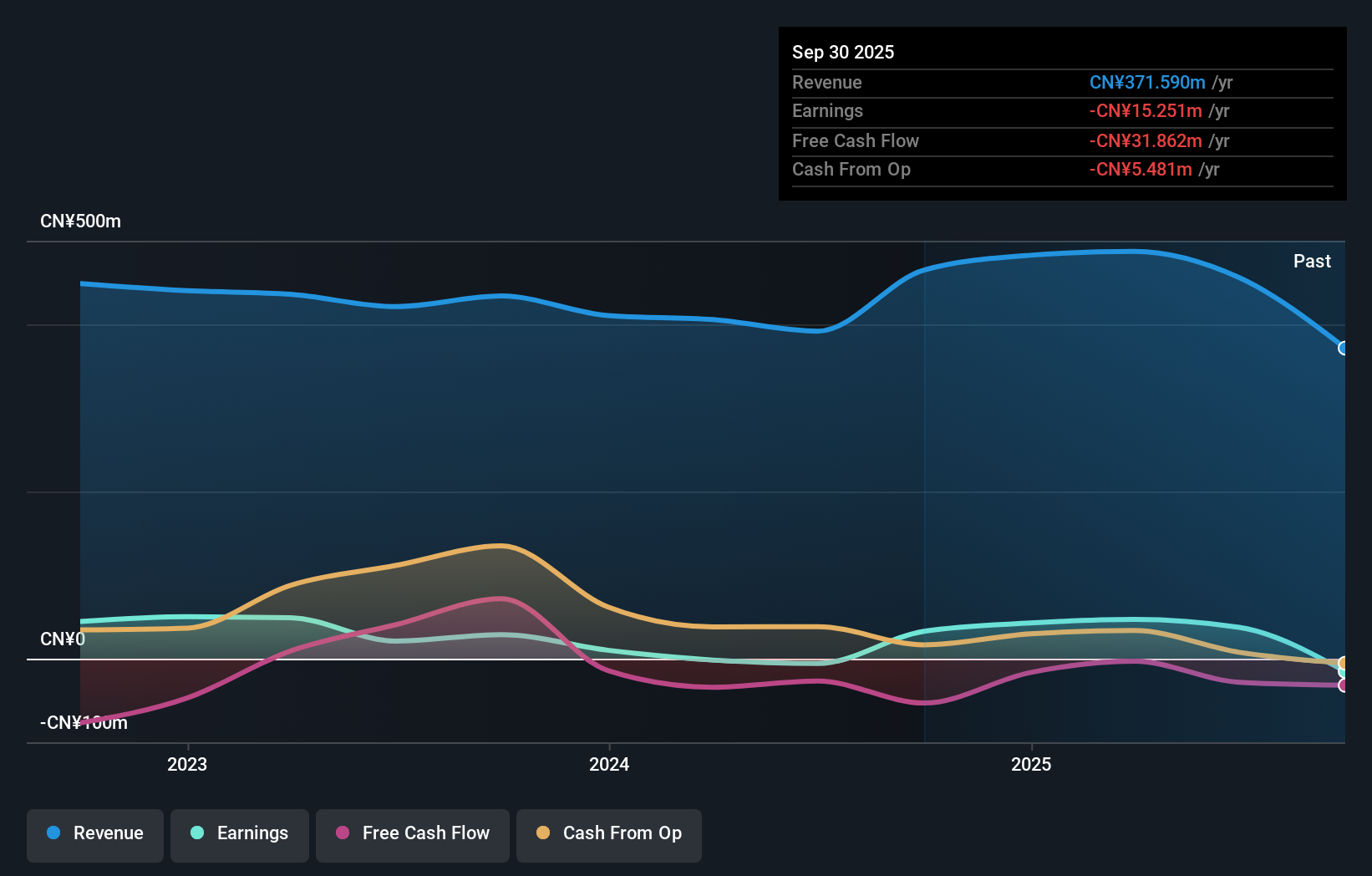

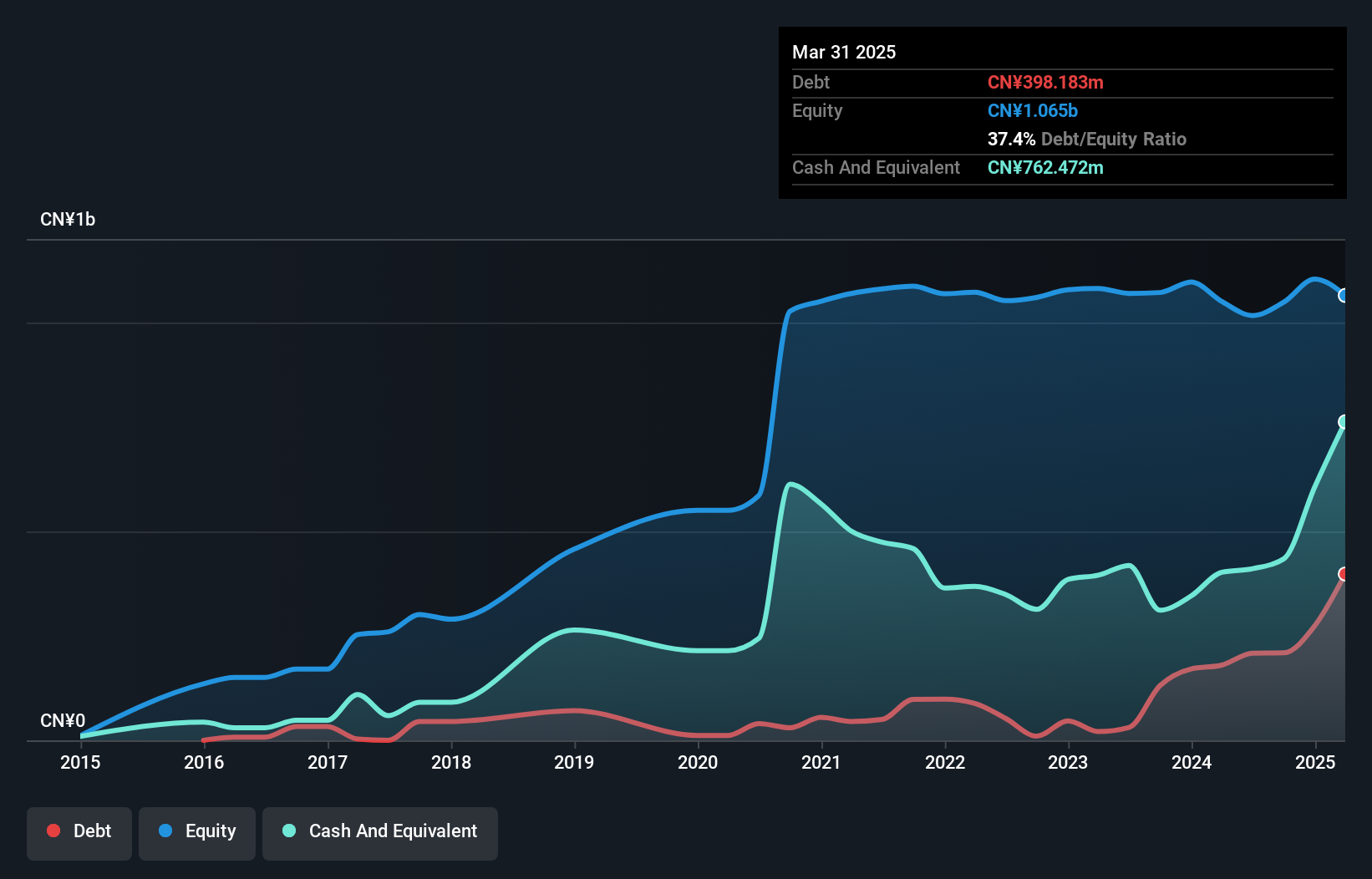

Jingyeda Technology, a small player in the tech space, has shown promising growth with earnings surging 14.2% over the past year, outpacing the IT industry's -8.1%. The company is debt-free now compared to a debt-to-equity ratio of 8.4% five years ago. Recent financials reveal net income of CN¥24.34 million for nine months ending September 2024, a significant rise from CN¥1.65 million last year, indicating strong operational performance despite one-off gains impacting results by CN¥5.8 million. A private placement aims to raise approximately CNY 351 million net proceeds to fuel further growth initiatives.

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. offers brand integrated marketing solutions in China and has a market cap of CN¥3.64 billion.

Operations: Ruoyuchen Technology generates revenue primarily from the E-Commerce Service Industry, totaling CN¥1.69 billion.

Guangzhou Ruoyuchen Technology, a dynamic player with a knack for innovation, has shown impressive financial performance recently. The company's revenue soared to CNY 1.15 billion for the nine months ending September 2024, up from CNY 828.76 million the previous year, while net income rose to CNY 57.7 million from CNY 33.73 million. With earnings per share climbing to CNY 0.35 from last year's CNY 0.20, it seems poised for growth despite its small size in the market landscape. Additionally, having more cash than total debt and being free cash flow positive highlights its robust financial health and potential resilience in future endeavors.

Okinawa Financial Group (TSE:7350)

Simply Wall St Value Rating: ★★★★★☆

Overview: Okinawa Financial Group, Inc. offers a range of financial services and has a market capitalization of ¥56.09 billion.

Operations: Okinawa Financial Group generates revenue through diverse financial services. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management over time.

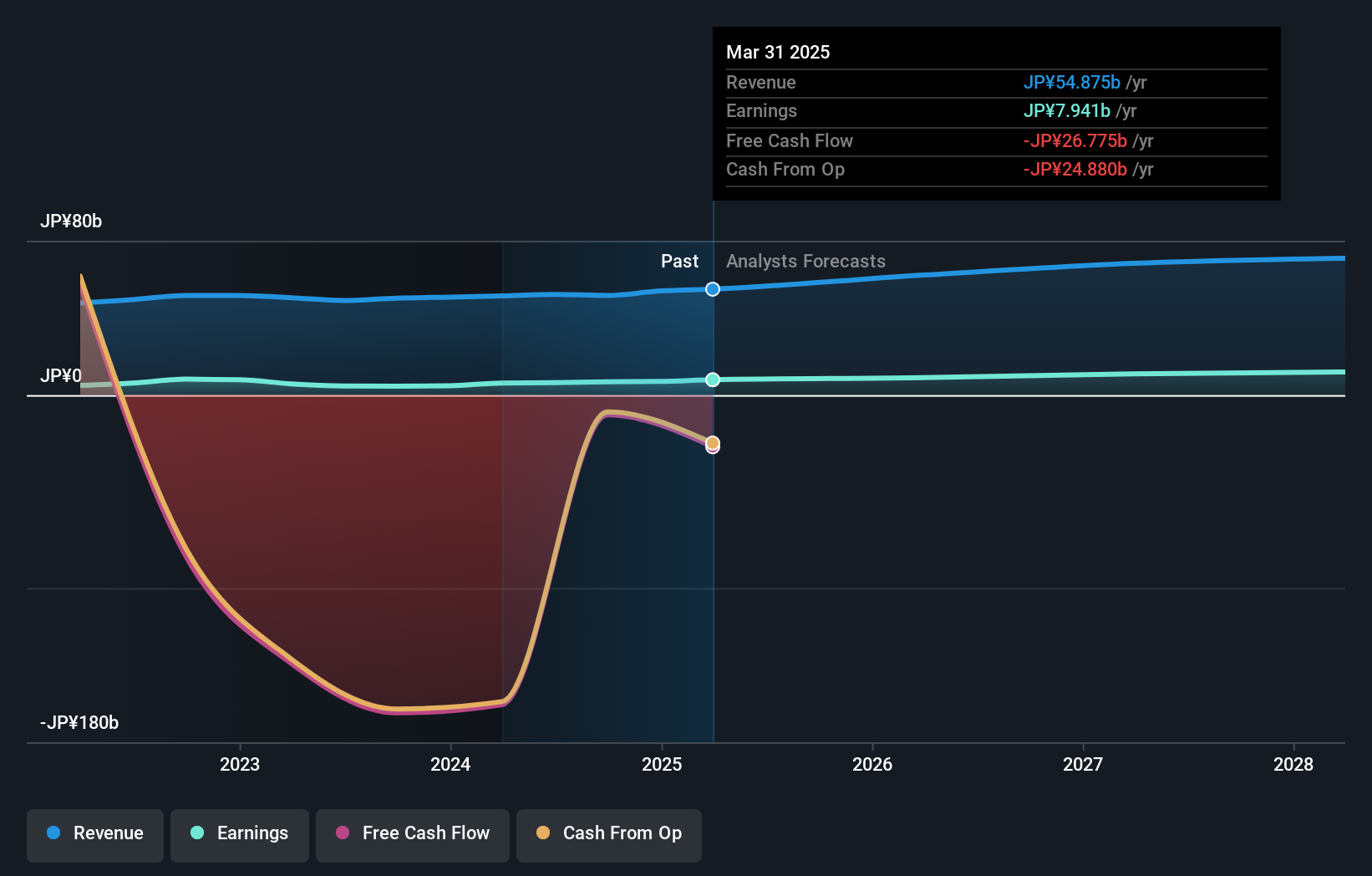

Okinawa Financial Group, with total assets of ¥2,979.3 billion and equity of ¥157.3 billion, shows promise as an intriguing investment option. The bank's deposits stand at ¥2,689.5 billion against loans of ¥1,847.1 billion and a net interest margin of 1.1%. Despite having a low allowance for bad loans at 46%, its non-performing loan ratio is appropriately low at 1.4%. Earnings surged by 51% last year, outpacing the industry average growth rate of 22%. Trading nearly 40% below estimated fair value suggests potential upside if earnings continue to grow as forecasted by 15% annually.

- Delve into the full analysis health report here for a deeper understanding of Okinawa Financial Group.

Learn about Okinawa Financial Group's historical performance.

Taking Advantage

- Get an in-depth perspective on all 4638 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingyeda TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003005

Flawless balance sheet with acceptable track record.