- China

- /

- Electronic Equipment and Components

- /

- SHSE:688665

Discover 3 High Growth Chinese Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

Despite recent market volatility and mixed economic signals, China's stock market continues to capture investor interest due to its potential for high growth. In this article, we explore three Chinese companies that not only exhibit strong growth prospects but also have significant insider ownership—a factor often seen as a vote of confidence in the company's future by those who know it best.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 22.9% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

We're going to check out a few of the best picks from our screener tool.

Cubic Sensor and InstrumentLtd (SHSE:688665)

Simply Wall St Growth Rating: ★★★★★☆

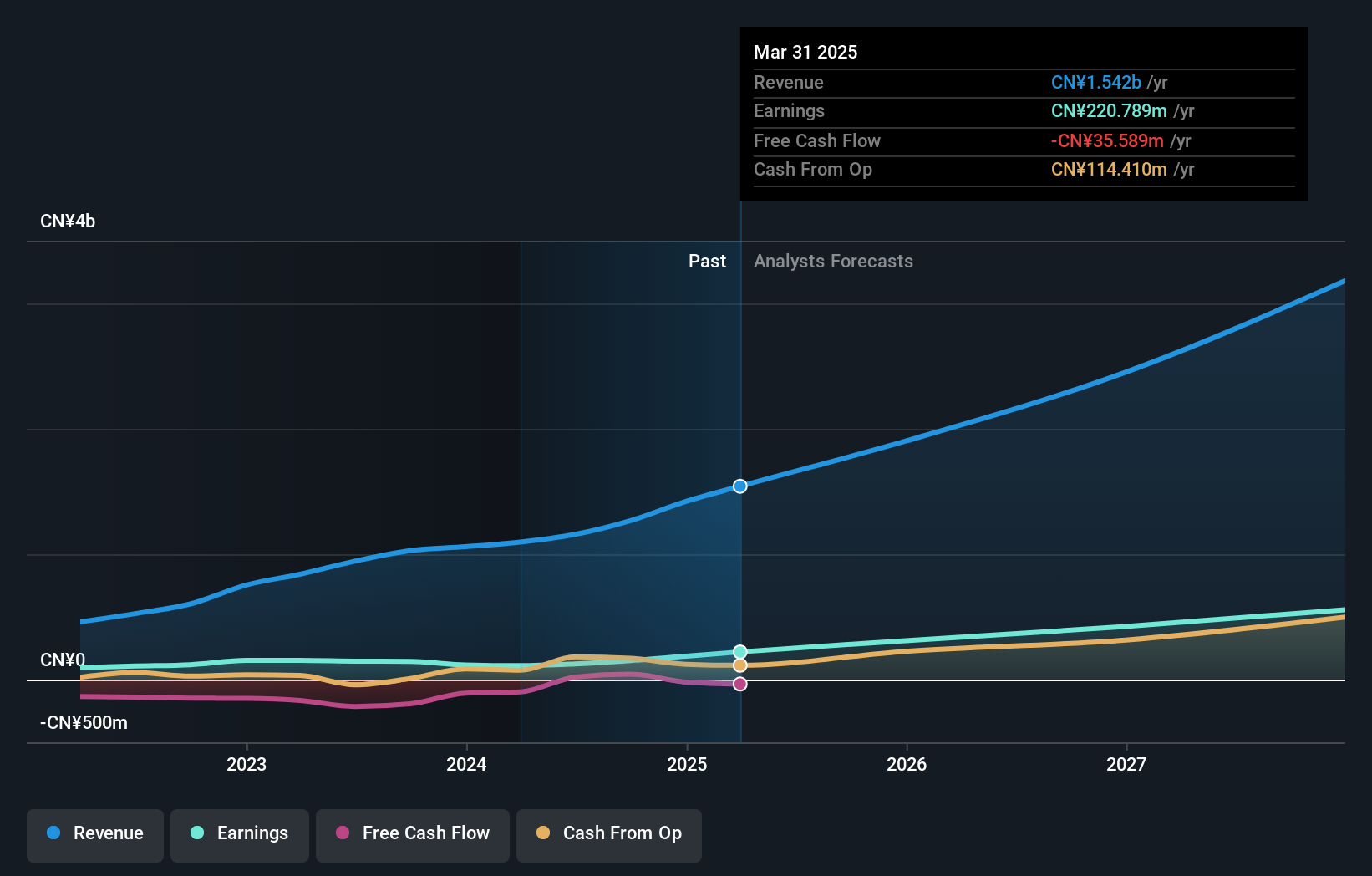

Overview: Cubic Sensor and Instrument Co., Ltd. manufactures gas sensors and sensor solutions in China, with a market cap of approximately CN¥2.41 billion.

Operations: Cubic Sensor and Instrument Ltd. generates revenue from the manufacturing of gas sensors and sensor solutions in China.

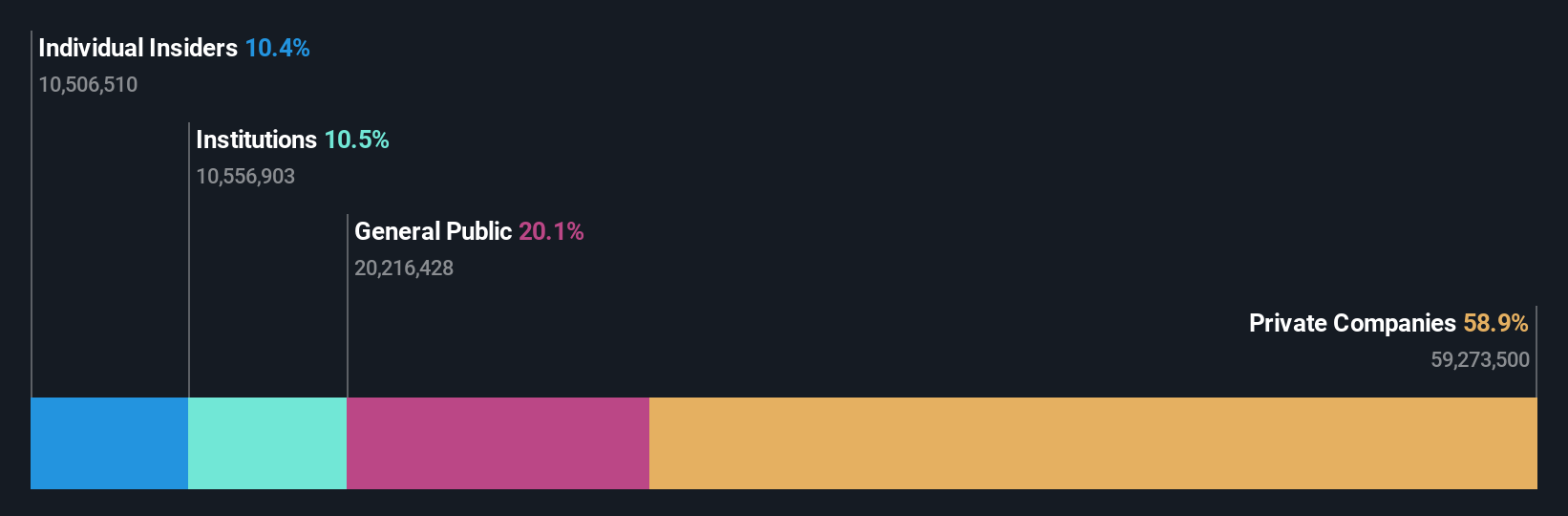

Insider Ownership: 10.1%

Earnings Growth Forecast: 34.5% p.a.

Cubic Sensor and Instrument Ltd. stands out for its strong growth prospects, with earnings expected to grow 34.49% annually, significantly outpacing the Chinese market's 23.1%. Despite being dropped from the S&P Global BMI Index in June 2024, its revenue is forecast to grow at 24.5% per year, faster than the market average of 13.2%. However, its current dividend yield of 2.49% is not well covered by free cash flows, indicating potential sustainability issues.

- Delve into the full analysis future growth report here for a deeper understanding of Cubic Sensor and InstrumentLtd.

- The analysis detailed in our Cubic Sensor and InstrumentLtd valuation report hints at an inflated share price compared to its estimated value.

China Railway Prefabricated Construction (SZSE:300374)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Railway Prefabricated Construction Co., Ltd. (SZSE:300374) specializes in the manufacturing and supply of prefabricated construction materials with a market cap of CN¥3.34 billion.

Operations: China Railway Prefabricated Construction Co., Ltd. (SZSE:300374) specializes in the manufacturing and supply of prefabricated construction materials with a market cap of CN¥3.34 billion. Revenue Segments (in millions of CN¥):

Insider Ownership: 25.2%

Earnings Growth Forecast: 160.8% p.a.

China Railway Prefabricated Construction Co., Ltd. is forecast to achieve revenue growth of 18.9% annually, outpacing the broader Chinese market's 13.2%. Earnings are expected to grow at a substantial rate of 160.76% per year, with profitability anticipated within three years. Recent earnings for the first half of 2024 showed significant improvement, with sales reaching CNY 818.05 million and net loss narrowing to CNY 48.87 million from CNY 68.48 million a year ago, reflecting positive momentum despite ongoing losses.

- Click to explore a detailed breakdown of our findings in China Railway Prefabricated Construction's earnings growth report.

- In light of our recent valuation report, it seems possible that China Railway Prefabricated Construction is trading beyond its estimated value.

Xi'an Sinofuse Electric (SZSE:301031)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an Sinofuse Electric Co., Ltd. specializes in the research, development, production, and sale of circuit protection devices, fuses, and related accessories with a market cap of CN¥4.79 billion.

Operations: Revenue Segments (in millions of CN¥): Circuit protection devices: 1,200.45; Fuses: 850.30; Related accessories: 450.15. The company's revenue is primarily generated from circuit protection devices (CN¥1.20 billion), fuses (CN¥850.30 million), and related accessories (CN¥450.15 million).

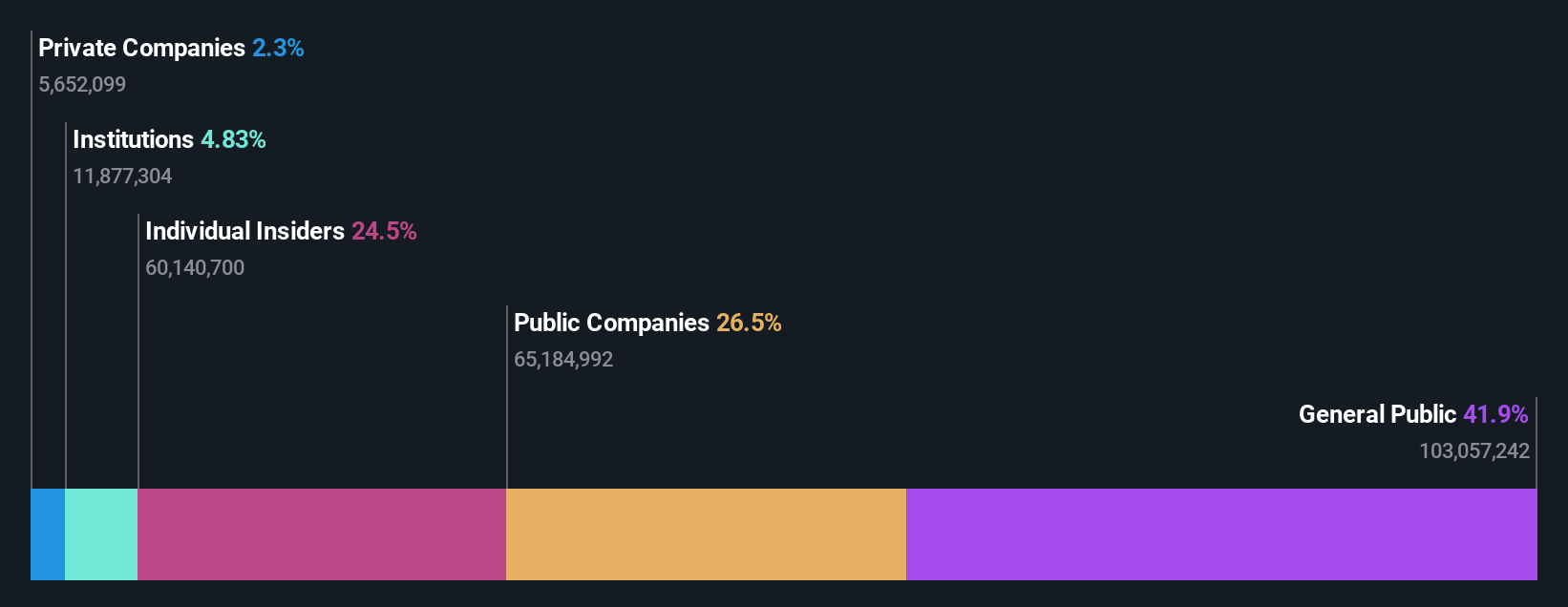

Insider Ownership: 36.8%

Earnings Growth Forecast: 45.3% p.a.

Xi'an Sinofuse Electric is projected to see revenue growth of 29.7% annually, surpassing the Chinese market's 13.2%, and earnings growth of 45.3% per year, significantly higher than the market's 23.1%. Despite a decline in profit margins from last year, insider ownership remains high with no substantial insider trading recently reported. Recent earnings for H1 2024 showed sales of CNY 577 million and net income improvement to CNY 65.4 million from CNY 56.87 million a year ago, indicating strong performance momentum.

- Unlock comprehensive insights into our analysis of Xi'an Sinofuse Electric stock in this growth report.

- According our valuation report, there's an indication that Xi'an Sinofuse Electric's share price might be on the expensive side.

Taking Advantage

- Investigate our full lineup of 383 Fast Growing Chinese Companies With High Insider Ownership right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688665

Cubic Sensor and InstrumentLtd

Manufactures gas sensors and sensor solutions in China.

Flawless balance sheet with high growth potential.