- China

- /

- Consumer Durables

- /

- SZSE:000651

The five-year underlying earnings growth at Gree Electric Appliances of Zhuhai (SZSE:000651) is promising, but the shareholders are still in the red over that time

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Gree Electric Appliances, Inc. of Zhuhai (SZSE:000651) shareholders for doubting their decision to hold, with the stock down 28% over a half decade. Unfortunately the share price momentum is still quite negative, with prices down 14% in thirty days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Since Gree Electric Appliances of Zhuhai has shed CN¥10.0b from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Gree Electric Appliances of Zhuhai

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

While the share price declined over five years, Gree Electric Appliances of Zhuhai actually managed to increase EPS by an average of 4.4% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, five years ago. Having said that, we might get a better idea of what's going on with the stock by looking at other metrics.

The most recent dividend was actually lower than it was in the past, so that may have sent the share price lower.

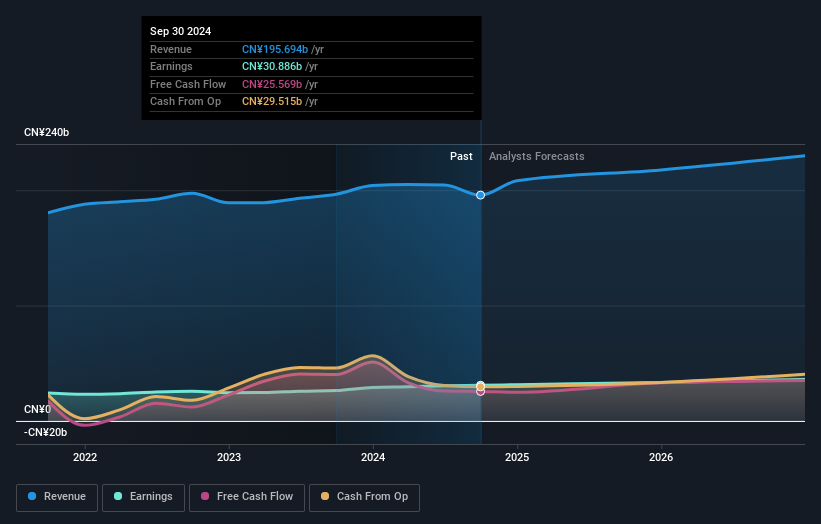

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Gree Electric Appliances of Zhuhai is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Gree Electric Appliances of Zhuhai stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Gree Electric Appliances of Zhuhai the TSR over the last 5 years was -2.4%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Gree Electric Appliances of Zhuhai shareholders have received a total shareholder return of 33% over the last year. And that does include the dividend. Notably the five-year annualised TSR loss of 0.5% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Gree Electric Appliances of Zhuhai that you should be aware of before investing here.

Of course Gree Electric Appliances of Zhuhai may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000651

Gree Electric Appliances of Zhuhai

Produces and sells air-conditioners, home appliances, and accessories in China.

Very undervalued with outstanding track record and pays a dividend.