Zhejiang Yingfeng Technology Co., Ltd. (SHSE:605055) Doing What It Can To Lift Shares

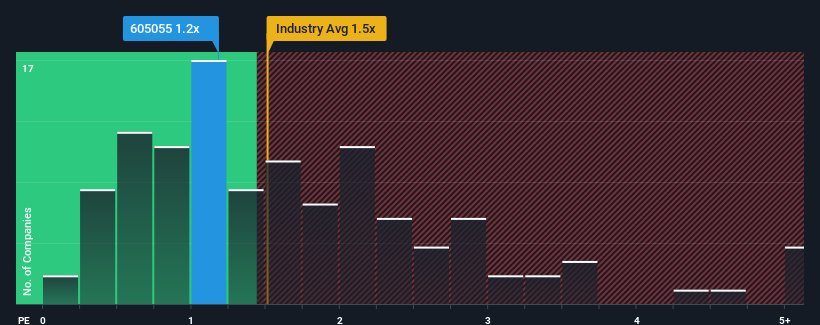

It's not a stretch to say that Zhejiang Yingfeng Technology Co., Ltd.'s (SHSE:605055) price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" for companies in the Luxury industry in China, where the median P/S ratio is around 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Zhejiang Yingfeng Technology

What Does Zhejiang Yingfeng Technology's Recent Performance Look Like?

The revenue growth achieved at Zhejiang Yingfeng Technology over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zhejiang Yingfeng Technology will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Zhejiang Yingfeng Technology's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. The latest three year period has also seen an excellent 86% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 17% shows it's noticeably more attractive.

With this information, we find it interesting that Zhejiang Yingfeng Technology is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Zhejiang Yingfeng Technology's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Zhejiang Yingfeng Technology currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You need to take note of risks, for example - Zhejiang Yingfeng Technology has 3 warning signs (and 1 which is concerning) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Yingfeng Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605055

Zhejiang Yingfeng Technology

Engages in the textiles printing and dyeing processing business in China.

Slight risk and fair value.

Market Insights

Community Narratives