- China

- /

- Consumer Durables

- /

- SHSE:603657

A Piece Of The Puzzle Missing From Jinhua Chunguang Technology Co.,Ltd's (SHSE:603657) 27% Share Price Climb

Jinhua Chunguang Technology Co.,Ltd (SHSE:603657) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 70%.

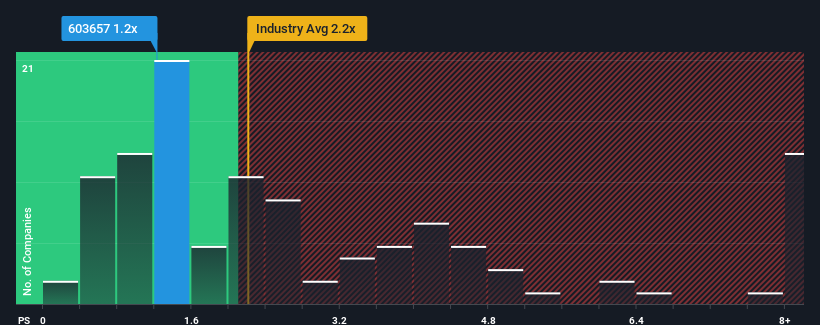

In spite of the firm bounce in price, Jinhua Chunguang TechnologyLtd's price-to-sales (or "P/S") ratio of 1.2x might still make it look like a buy right now compared to the Consumer Durables industry in China, where around half of the companies have P/S ratios above 2.2x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Jinhua Chunguang TechnologyLtd

How Has Jinhua Chunguang TechnologyLtd Performed Recently?

While the industry has experienced revenue growth lately, Jinhua Chunguang TechnologyLtd's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Jinhua Chunguang TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Jinhua Chunguang TechnologyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Jinhua Chunguang TechnologyLtd would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 4.3% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 69% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 24% over the next year. That's shaping up to be materially higher than the 10% growth forecast for the broader industry.

With this information, we find it odd that Jinhua Chunguang TechnologyLtd is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Jinhua Chunguang TechnologyLtd's P/S?

The latest share price surge wasn't enough to lift Jinhua Chunguang TechnologyLtd's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Jinhua Chunguang TechnologyLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Jinhua Chunguang TechnologyLtd (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

If you're unsure about the strength of Jinhua Chunguang TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603657

Jinhua Chunguang TechnologyLtd

Engages in the research and development, production, and sales of cleaning appliance hoses accessories and complete machine ODM/OEM products in China and internationally.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives