- China

- /

- Professional Services

- /

- SZSE:002620

3 Promising Penny Stocks With At Least US$100M Market Cap

Reviewed by Simply Wall St

Global markets have recently been influenced by rising U.S. Treasury yields, leading to mixed performances across major indices, with large-cap and growth stocks showing relative resilience. For investors interested in exploring opportunities beyond the mainstream, penny stocks—despite their somewhat antiquated name—remain a noteworthy area of interest. These stocks often represent smaller or newer companies that can offer potential growth at lower price points, especially when they are backed by strong financial health and fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.71 | MYR122.98M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$495.14M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.32 | THB1.88B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.915 | £473.73M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.61 | A$72.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.14 | £806.26M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.29 | £426.67M | ★★★★☆☆ |

Click here to see the full list of 5,797 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Hunan Mendale HometextileLtd (SZSE:002397)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hunan Mendale Hometextile Co., Ltd operates in the home textile industry both in China and internationally, with a market cap of CN¥1.90 billion.

Operations: Hunan Mendale Hometextile Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥1.9B

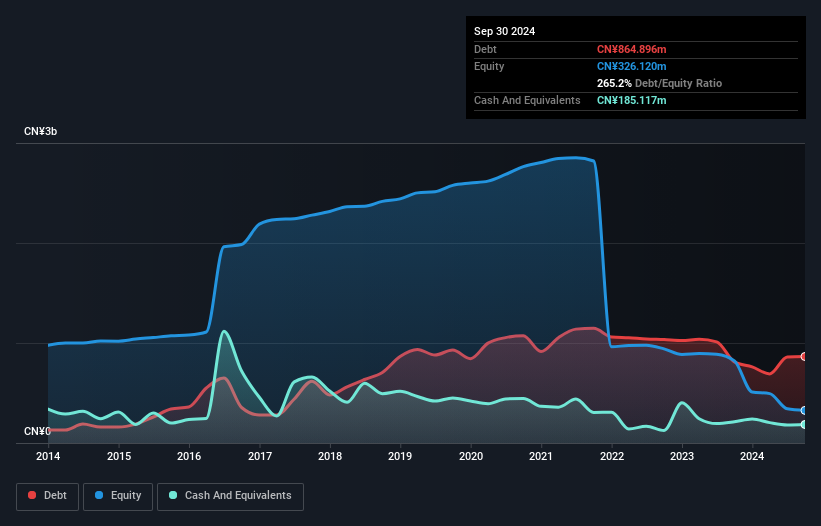

Hunan Mendale Hometextile Co., Ltd, with a market cap of CN¥1.90 billion, reported declining sales and net income for the first nine months of 2024 compared to the previous year. Despite becoming profitable recently, earnings have declined significantly over five years. The company faces challenges with short-term liabilities exceeding short-term assets but maintains a satisfactory net debt to equity ratio and well-covered interest payments. Recent shareholder activism led to changes in board nominations, indicating potential strategic shifts. While management is experienced, the board's lack of tenure might impact governance stability amidst financial fluctuations.

- Dive into the specifics of Hunan Mendale HometextileLtd here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Hunan Mendale HometextileLtd's track record.

Fujian Minfa Aluminium (SZSE:002578)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fujian Minfa Aluminium Inc. develops, processes, and sells aluminum alloy extruded profiles for architecture, general engineering, and industry fields in China with a market cap of CN¥2.87 billion.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥2.87B

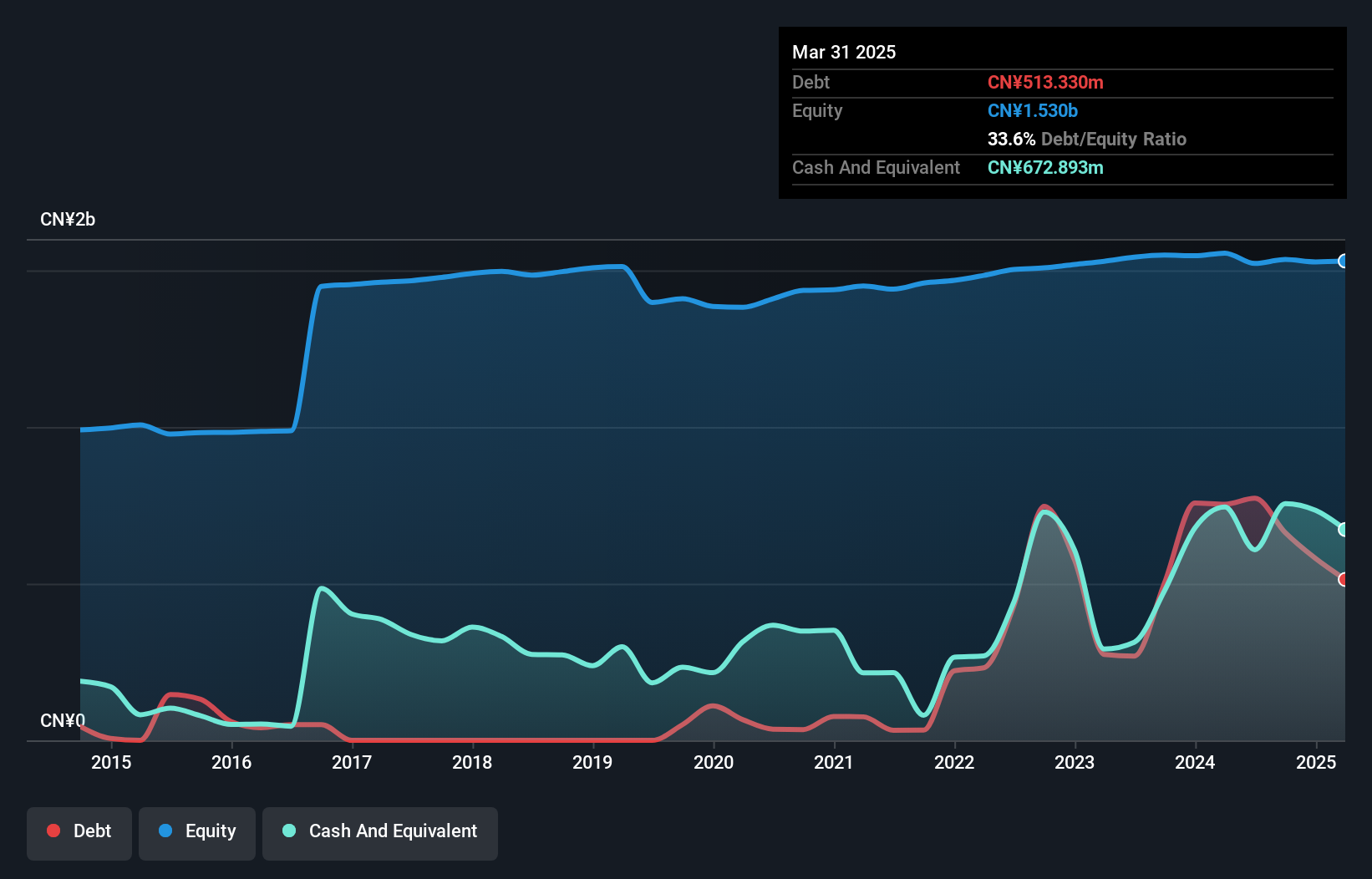

Fujian Minfa Aluminium Inc., with a market cap of CN¥2.87 billion, has faced declining revenue and net income in 2024 compared to the previous year, highlighting ongoing challenges. Despite having more cash than debt and manageable interest payments, the company's financial health is strained by increased debt levels and negative earnings growth over recent years. The board's average tenure suggests limited experience, potentially affecting strategic decisions during volatile periods. While shareholder dilution hasn't been significant recently, low return on equity and unsustainable dividends raise concerns about future profitability amidst industry pressures.

- Click to explore a detailed breakdown of our findings in Fujian Minfa Aluminium's financial health report.

- Gain insights into Fujian Minfa Aluminium's historical outcomes by reviewing our past performance report.

Shenzhen Ruihe Construction Decoration (SZSE:002620)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Ruihe Construction Decoration Co., Ltd. operates in the construction and decoration industry, focusing on interior design and building projects, with a market cap of approximately CN¥1.30 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: CN¥1.3B

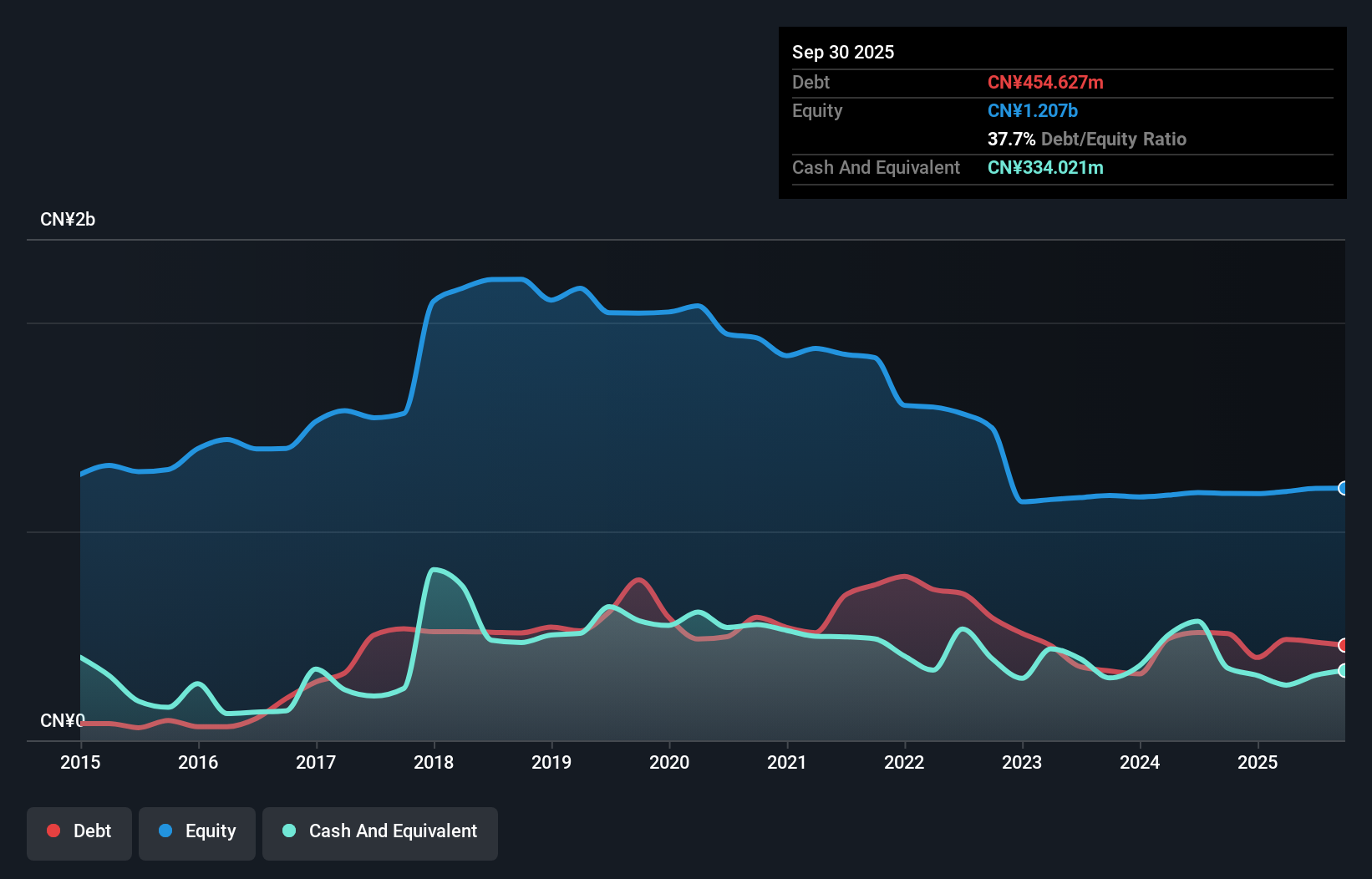

Shenzhen Ruihe Construction Decoration Co., Ltd. has experienced a significant decline in revenue from CN¥1.19 billion to CN¥588.22 million over the past year, with net losses widening to CN¥108.34 million for the nine months ending September 2024. Despite being unprofitable, the company maintains a positive free cash flow and has a cash runway exceeding three years, suggesting short-term financial stability amidst increased debt levels and negative return on equity of -115.34%. The board's average tenure is relatively low at 2.8 years, indicating limited experience which could impact strategic decision-making in challenging times.

- Click here and access our complete financial health analysis report to understand the dynamics of Shenzhen Ruihe Construction Decoration.

- Learn about Shenzhen Ruihe Construction Decoration's historical performance here.

Next Steps

- Take a closer look at our Penny Stocks list of 5,797 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002620

Shenzhen Ruihe Construction Decoration

Shenzhen Ruihe Construction Decoration Co., Ltd.

Adequate balance sheet and slightly overvalued.