- China

- /

- Water Utilities

- /

- SHSE:600187

Sunshine Insurance Group And 2 Other Asian Penny Stocks To Watch

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, Asian equities have shown resilience, with particular attention on smaller stocks that may offer unique opportunities. Penny stocks, though an older term, continue to attract interest for their potential to provide value and growth where larger firms might not. This article will explore three such penny stocks in Asia, each demonstrating financial strength and offering intriguing prospects for investors seeking under-the-radar opportunities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.86 | HK$2.33B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.50 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.05 | SGD425.55M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.72 | THB2.83B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.04 | HK$2.8B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.48 | THB9.05B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 943 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sunshine Insurance Group (SEHK:6963)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sunshine Insurance Group Company Limited offers a range of insurance products and related services in the People’s Republic of China, with a market cap of HK$43.36 billion.

Operations: The company's revenue is primarily derived from its life insurance segment, generating CN¥24.46 billion, and property and casualty insurance through Sunshine P&C at CN¥51.36 billion, with a smaller contribution from Sunshine Surety at CN¥111 million.

Market Cap: HK$43.36B

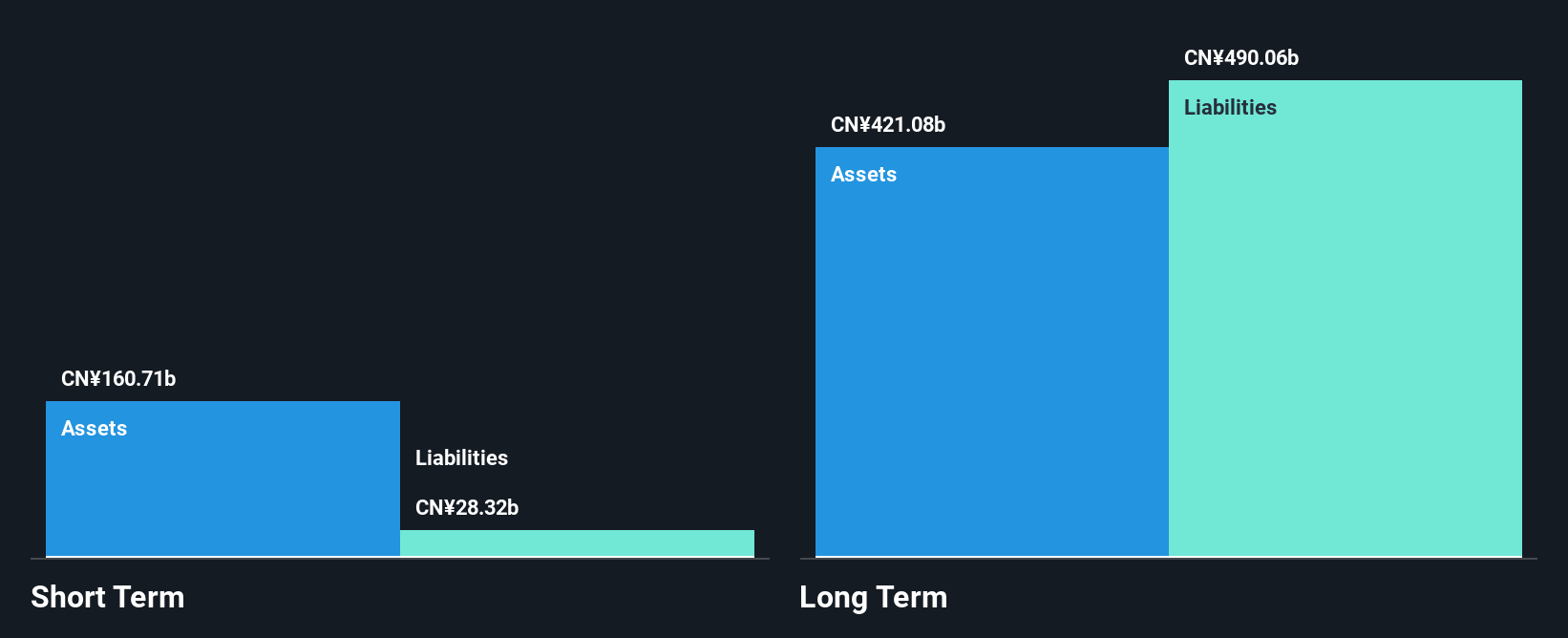

Sunshine Insurance Group, with a market cap of HK$43.36 billion, has demonstrated robust financial health and growth potential in the Asian penny stock landscape. The company has shown strong earnings growth of 42.9% over the past year, surpassing its five-year average decline and outperforming the industry benchmark. Its debt is well-managed, covered by operating cash flow at 122.2%, and interest payments are adequately covered by EBIT at 7.3 times coverage. Recent inclusion in the FTSE All-World Index highlights its growing recognition among investors, while stable profit margins and an experienced board further bolster its investment appeal.

- Get an in-depth perspective on Sunshine Insurance Group's performance by reading our balance sheet health report here.

- Assess Sunshine Insurance Group's future earnings estimates with our detailed growth reports.

Heilongjiang Interchina Water TreatmentLtd (SHSE:600187)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Heilongjiang Interchina Water Treatment Co., Ltd focuses on constructing and operating water treatment and environmental protection projects, as well as energy-saving and clean energy transformation initiatives in China, with a market cap of CN¥4.63 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥4.63B

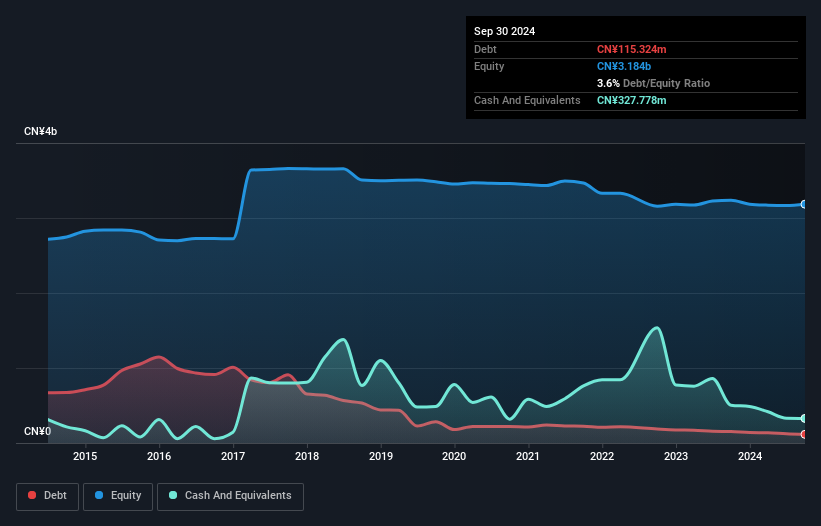

Heilongjiang Interchina Water Treatment Co., Ltd, with a market cap of CN¥4.63 billion, has experienced significant financial fluctuations. Despite reporting sales of CN¥132.38 million for the nine months ending September 2025, the company recorded a net loss of CN¥16.14 million due to large one-off losses impacting its earnings quality. However, it maintains strong short-term financial health with assets exceeding liabilities and reduced debt levels over five years. Its recent addition to the S&P Global BMI Index reflects growing investor interest despite low return on equity and challenges in profitability consistency compared to industry standards.

- Click here to discover the nuances of Heilongjiang Interchina Water TreatmentLtd with our detailed analytical financial health report.

- Gain insights into Heilongjiang Interchina Water TreatmentLtd's historical outcomes by reviewing our past performance report.

Kingland TechnologyLtd (SZSE:000711)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kingland Technology Co., Ltd. offers ecological environment solutions in China and has a market cap of CN¥5.09 billion.

Operations: The company generates revenue of CN¥628.70 million from its operations within China.

Market Cap: CN¥5.09B

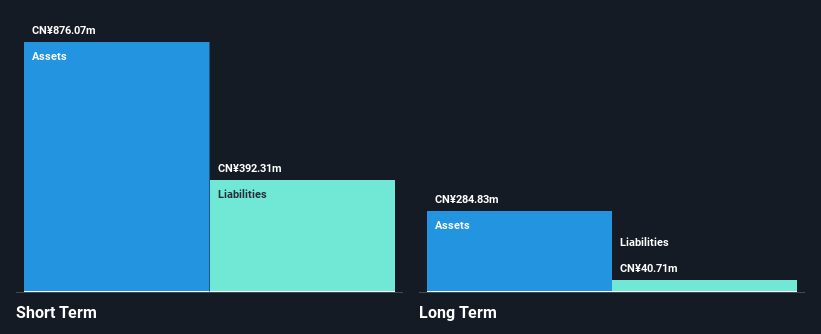

Kingland Technology Co., Ltd. has shown substantial revenue growth, reporting CN¥331.54 million for the first nine months of 2025 compared to CN¥80.7 million the previous year, yet remains unprofitable with a net loss of CN¥104.88 million. The company's financial position is stable with short-term assets exceeding liabilities and a satisfactory net debt to equity ratio of 6.8%. However, it faces challenges with less than a year of cash runway and an inexperienced management team averaging 1.8 years in tenure, which may impact strategic direction and operational efficiency moving forward.

- Navigate through the intricacies of Kingland TechnologyLtd with our comprehensive balance sheet health report here.

- Assess Kingland TechnologyLtd's previous results with our detailed historical performance reports.

Where To Now?

- Discover the full array of 943 Asian Penny Stocks right here.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heilongjiang Interchina Water TreatmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600187

Heilongjiang Interchina Water TreatmentLtd

Engages in the construction and operation of water treatment, environmental protection projects, energy saving and clean energy transformation and other related project and other related projects in China.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives