- China

- /

- Commercial Services

- /

- SHSE:603568

May 2024 Insight Into Three Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets exhibit a mix of trends with the Dow Jones experiencing significant losses and the Nasdaq reaching new heights, investors are navigating through a landscape marked by mixed economic signals and varying sector performances. In this context, focusing on growth companies with high insider ownership might offer valuable insights, as these firms often demonstrate alignment between management’s interests and shareholder values, potentially fostering resilience amidst market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

| Plenti Group (ASX:PLT) | 12.6% | 106.4% |

| Elliptic Laboratories (OB:ELABS) | 31.3% | 124.6% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| Vow (OB:VOW) | 31.8% | 97.5% |

Let's take a closer look at a couple of our picks from the screened companies.

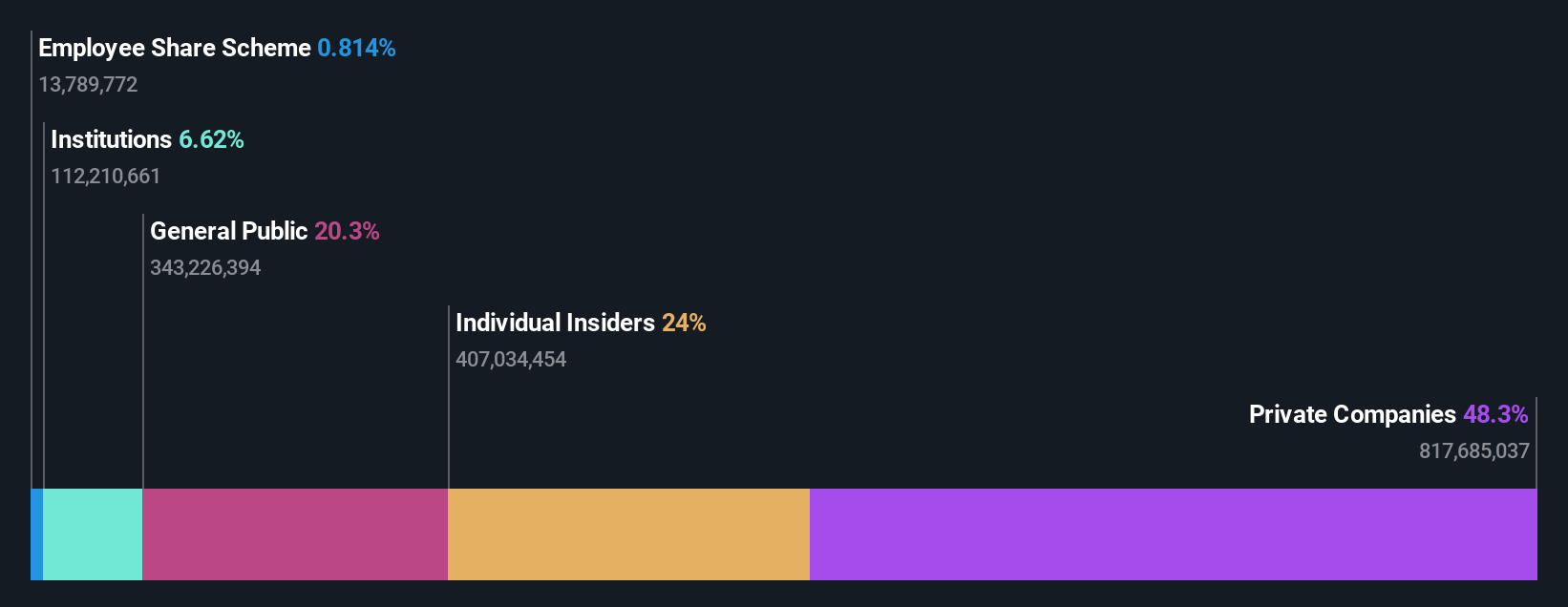

Zhejiang Weiming Environment Protection (SHSE:603568)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhejiang Weiming Environment Protection Co., Ltd. is a company engaged in environmental protection services, with a market capitalization of approximately CN¥35.998 billion.

Operations: The company generates revenue primarily from its industrial segment, totaling approximately CN¥6.69 billion.

Insider Ownership: 24%

Revenue Growth Forecast: 30.9% p.a.

Zhejiang Weiming Environment Protection has demonstrated robust financial performance with a significant increase in sales and net income as reported in their recent quarterly and annual earnings. Specifically, their Q1 2024 results showed a substantial rise in revenue to CNY 2.01 billion, up from CNY 1.34 billion the previous year, with net income also increasing to CNY 712.42 million. The company is expected to continue this growth trajectory with forecasted annual profit growth outpacing the Chinese market average, alongside a projected high return on equity. However, its dividend coverage by cash flows remains weak despite these strong earnings figures.

- Delve into the full analysis future growth report here for a deeper understanding of Zhejiang Weiming Environment Protection.

- In light of our recent valuation report, it seems possible that Zhejiang Weiming Environment Protection is trading behind its estimated value.

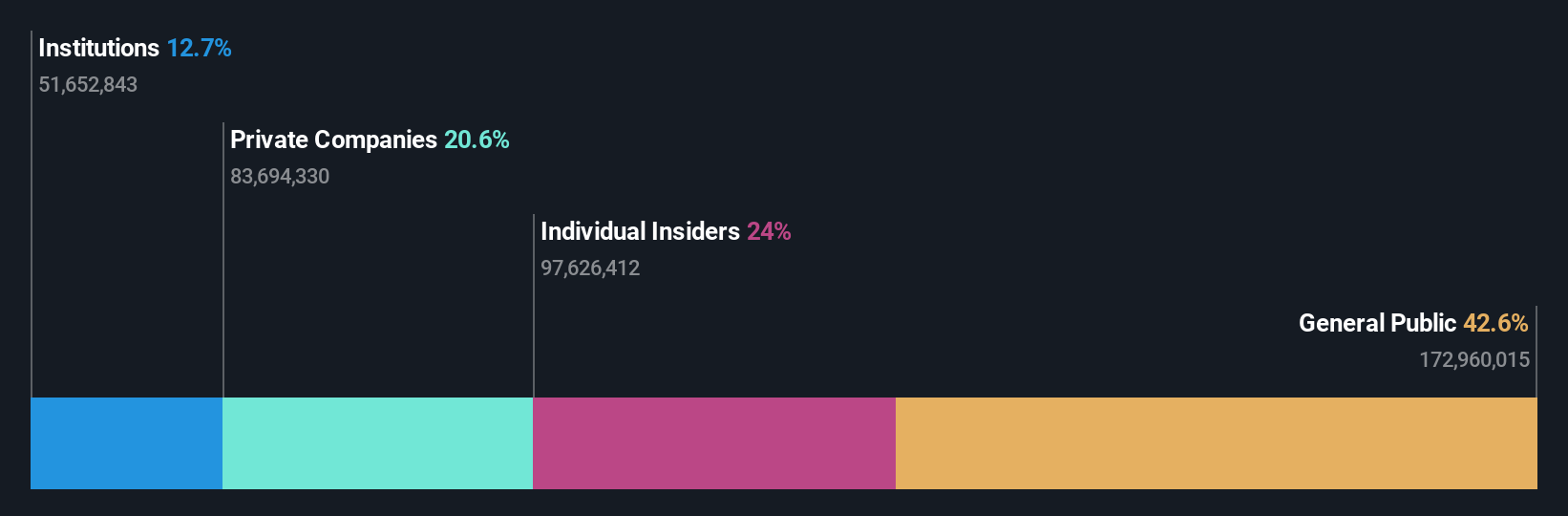

Chengdu Olymvax Biopharmaceuticals (SHSE:688319)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Olymvax Biopharmaceuticals Inc. specializes in the research, development, production, and sale of human vaccines with a market capitalization of approximately CN¥3.87 billion.

Operations: The company generates revenue primarily from medicine manufacturing, totaling CN¥500.05 million.

Insider Ownership: 26.2%

Revenue Growth Forecast: 31.6% p.a.

Chengdu Olymvax Biopharmaceuticals, despite a challenging Q1 in 2024 with a shift from net income to a loss of CNY 26 million, is poised for recovery. Expected to turn profitable within three years, the company's revenue growth forecast at 31.6% annually outstrips the Chinese market average. However, its projected return on equity remains modest at 13.4%. Insider ownership remains stable with no significant buying or selling reported in the past three months, underscoring steady confidence from within.

- Dive into the specifics of Chengdu Olymvax Biopharmaceuticals here with our thorough growth forecast report.

- According our valuation report, there's an indication that Chengdu Olymvax Biopharmaceuticals' share price might be on the cheaper side.

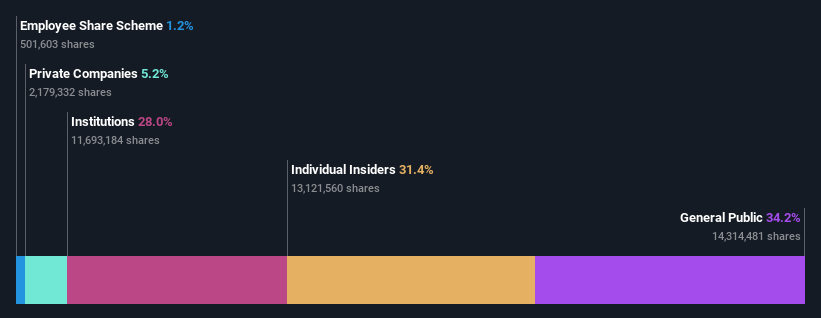

M31 Technology (TPEX:6643)

Simply Wall St Growth Rating: ★★★★★★

Overview: M31 Technology Corporation specializes in providing silicon intellectual property (IP) design services for the integrated circuit industry, with a market capitalization of approximately NT$39.37 billion.

Operations: The company generates its revenue primarily from the provision of design services for silicon intellectual property in the integrated circuit sector.

Insider Ownership: 31.4%

Revenue Growth Forecast: 25.8% p.a.

M31 Technology is projected to experience robust growth, with revenue and earnings expected to increase by 25.8% and 36.52% per year, respectively, outpacing the Taiwan market averages. Despite a volatile share price in recent months and a decrease in net income as reported in Q1 2024, the company's high forecasted Return on Equity of 34.8% signals strong potential returns on shareholder equity. Additionally, recent advancements in their MIPI C/D-PHY technology underscore M31's commitment to innovation and market competitiveness.

- Unlock comprehensive insights into our analysis of M31 Technology stock in this growth report.

- In light of our recent valuation report, it seems possible that M31 Technology is trading beyond its estimated value.

Where To Now?

- Access the full spectrum of 1493 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Weiming Environment Protection might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603568

Zhejiang Weiming Environment Protection

Zhejiang Weiming Environment Protection Co., Ltd.

Exceptional growth potential with proven track record.