- China

- /

- Electrical

- /

- SZSE:300820

November 2024's Select Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a busy earnings season with mixed signals from economic data, major indices like the Nasdaq Composite and S&P MidCap 400 have experienced volatility, highlighting investor caution amid fluctuating growth expectations. In this environment, where value stocks have shown resilience against their growth counterparts, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer potential upside when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | US$22.50 | US$44.83 | 49.8% |

| Harmony Gold Mining (JSE:HAR) | ZAR180.36 | ZAR359.54 | 49.8% |

| Anhui Huaheng Biotechnology (SHSE:688639) | CN¥36.00 | CN¥71.71 | 49.8% |

| IMAGICA GROUP (TSE:6879) | ¥480.00 | ¥956.03 | 49.8% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2153.00 | ¥4304.26 | 50% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.49 | US$46.79 | 49.8% |

| Redcentric (AIM:RCN) | £1.1775 | £2.35 | 50% |

| DoubleVerify Holdings (NYSE:DV) | US$19.72 | US$39.40 | 49.9% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$272.22 | US$544.40 | 50% |

| Royal Plus (SET:PLUS) | THB5.45 | THB10.88 | 49.9% |

Let's explore several standout options from the results in the screener.

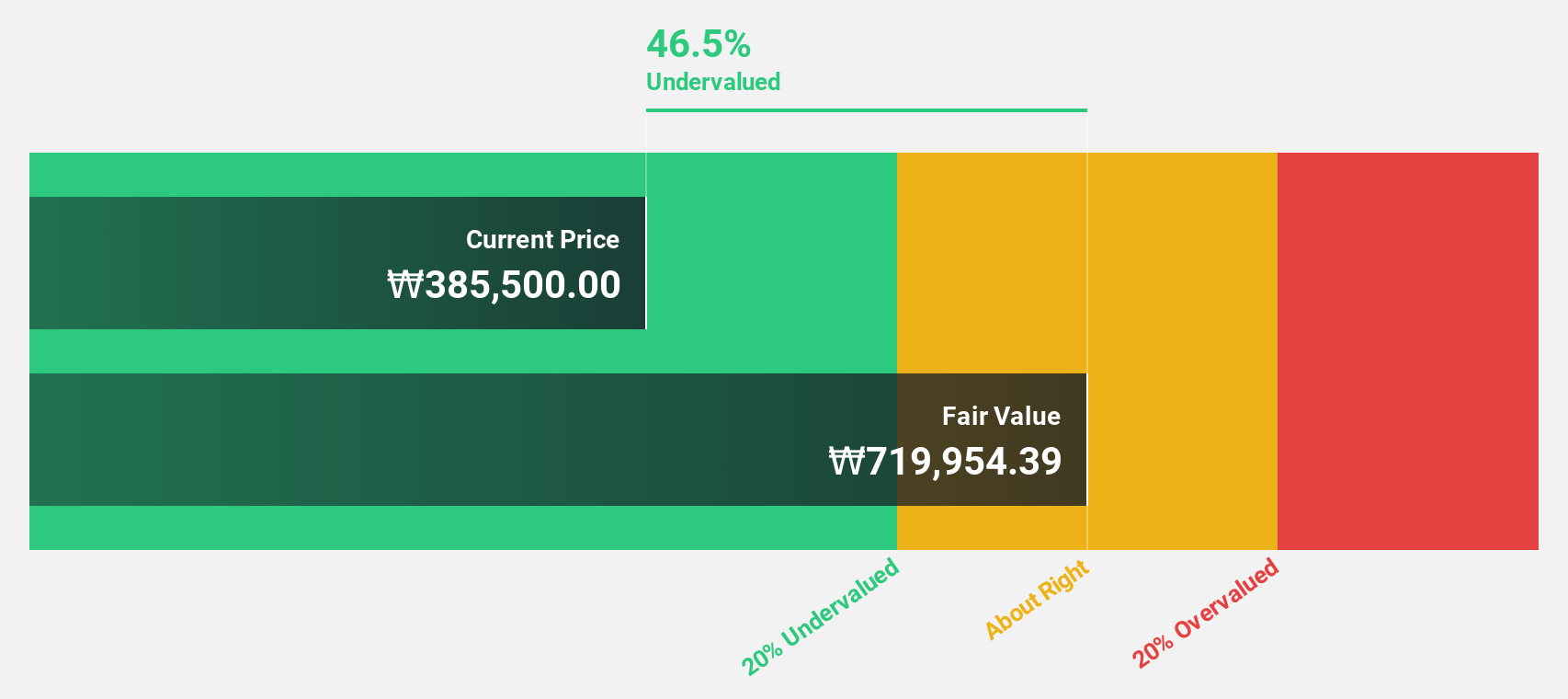

ALTEOGEN (KOSDAQ:A196170)

Overview: ALTEOGEN Inc., a biotechnology company, specializes in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars with a market cap of ₩20.25 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 billion.

Estimated Discount To Fair Value: 49.5%

ALTEOGEN is trading at ₩437,000, significantly below its estimated fair value of ₩865.48 million, suggesting it may be undervalued based on cash flows. Despite recent shareholder dilution, the company's earnings and revenue are forecast to grow rapidly at 99.46% and 64.2% per year respectively over the next three years, outpacing market averages. Additionally, its Return on Equity is projected to reach a very high level in three years' time.

- Our growth report here indicates ALTEOGEN may be poised for an improving outlook.

- Click here to discover the nuances of ALTEOGEN with our detailed financial health report.

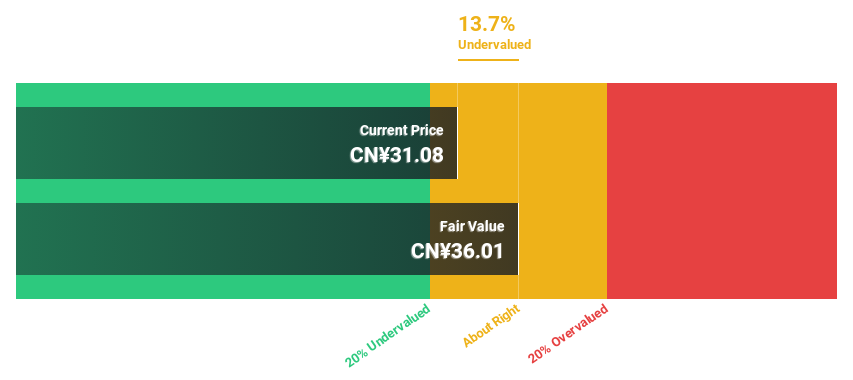

Servyou Software Group (SHSE:603171)

Overview: Servyou Software Group Co., Ltd. offers financial and tax information services in China and has a market cap of CN¥11.99 billion.

Operations: Revenue Segments (in millions of CN¥): Servyou Software Group Co., Ltd. generates revenue through its financial and tax information services in China.

Estimated Discount To Fair Value: 18.1%

Servyou Software Group, priced at CN¥29.91, trades below its estimated fair value of CN¥36.52, offering potential undervaluation based on cash flows. The company's earnings are expected to grow significantly at 50.9% annually, surpassing the market average in China. Despite a decline in profit margins from 8.6% to 5%, revenue growth remains robust with recent nine-month sales rising to CN¥1.28 billion from CN¥1.20 billion year-over-year, reflecting solid performance momentum.

- In light of our recent growth report, it seems possible that Servyou Software Group's financial performance will exceed current levels.

- Dive into the specifics of Servyou Software Group here with our thorough financial health report.

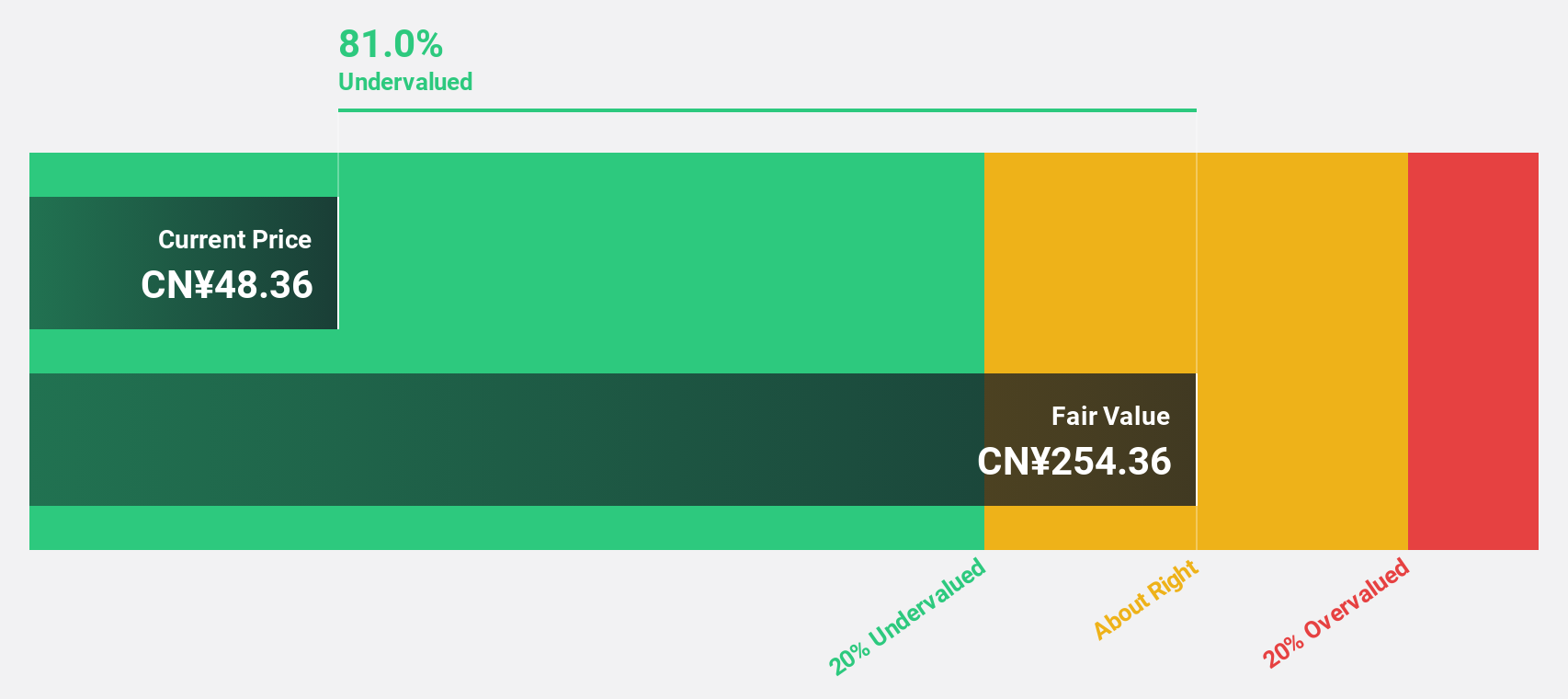

Sichuan Injet Electric (SZSE:300820)

Overview: Sichuan Injet Electric Co., Ltd. focuses on the research, design, and manufacturing of industrial power equipment in China with a market cap of CN¥11.11 billion.

Operations: Sichuan Injet Electric Co., Ltd. generates revenue primarily from its industrial power equipment operations in China.

Estimated Discount To Fair Value: 47.1%

Sichuan Injet Electric, trading at CN¥54.94, is significantly undervalued compared to its fair value estimate of CN¥103.77, with strong cash flow potential. The company's earnings are forecast to grow substantially at 28.3% annually, outpacing the broader Chinese market. Recent financials show nine-month sales increased from CN¥1.13 billion to CN¥1.33 billion year-over-year, alongside a net income rise from CN¥279.89 million to CN¥303.02 million, underscoring robust growth dynamics despite share price volatility.

- Our earnings growth report unveils the potential for significant increases in Sichuan Injet Electric's future results.

- Click to explore a detailed breakdown of our findings in Sichuan Injet Electric's balance sheet health report.

Seize The Opportunity

- Click this link to deep-dive into the 932 companies within our Undervalued Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300820

Sichuan Injet Electric

Engages in the research and development, design, and manufacturing of industrial power equipment in China.

Exceptional growth potential and undervalued.