- China

- /

- Electrical

- /

- SZSE:300786

October 2024's Leading Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and sector-specific rallies, investors are observing notable performances across various indices, with the S&P 500 and Nasdaq Composite showing significant year-to-date gains. In this context of evolving economic indicators and market dynamics, growth companies with strong insider ownership stand out as potentially resilient options due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

China Transinfo Technology (SZSE:002373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Transinfo Technology Co., Ltd. operates in the transportation and IoT sectors with a market cap of CN¥16.23 billion.

Operations: The company's revenue is primarily derived from its Intelligent Transportation segment, generating CN¥3.12 billion, and its Intelligent Internet of Things segment, contributing CN¥4.88 billion.

Insider Ownership: 17.2%

Revenue Growth Forecast: 14.9% p.a.

China Transinfo Technology has shown a mixed financial performance recently, with revenue increasing to CNY 3.57 billion but net income dropping significantly to CNY 12.24 million for the half-year ended June 30, 2024. Despite this, the company's earnings are expected to grow at a robust rate of 45.71% annually over the next three years, outpacing the Chinese market's average growth rate. The company completed a share buyback program worth CNY 79.77 million, enhancing shareholder value amidst substantial insider ownership levels.

- Click here to discover the nuances of China Transinfo Technology with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of China Transinfo Technology shares in the market.

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thunder Software Technology Co., Ltd. offers operating-system products across China, Europe, the United States, Japan, and other international markets with a market cap of CN¥30.13 billion.

Operations: Thunder Software Technology Co., Ltd. generates its revenue from providing operating-system products across various regions including China, Europe, the United States, Japan, and other international markets.

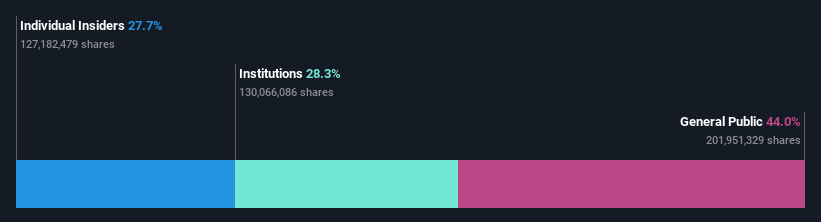

Insider Ownership: 27.6%

Revenue Growth Forecast: 17% p.a.

Thunder Software Technology's earnings are projected to grow significantly at 34.4% annually, surpassing the Chinese market average. Despite this, recent financial results show a decline in net income from CNY 387.96 million to CNY 104.37 million year-over-year for the half-year ending June 30, 2024. The company's share price has been highly volatile recently and its profit margins have decreased substantially from last year, although it trades below its estimated fair value by a considerable margin.

- Get an in-depth perspective on Thunder Software TechnologyLtd's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Thunder Software TechnologyLtd's share price might be too pessimistic.

Qingdao Guolin Technology GroupLtd (SZSE:300786)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qingdao Guolin Technology Group Co., Ltd. specializes in the design, manufacture, installation, commissioning, operation, and maintenance of ozone equipment and has a market cap of CN¥3.52 billion.

Operations: The company generates revenue through its activities in designing, manufacturing, installing, commissioning, operating, and maintaining ozone equipment.

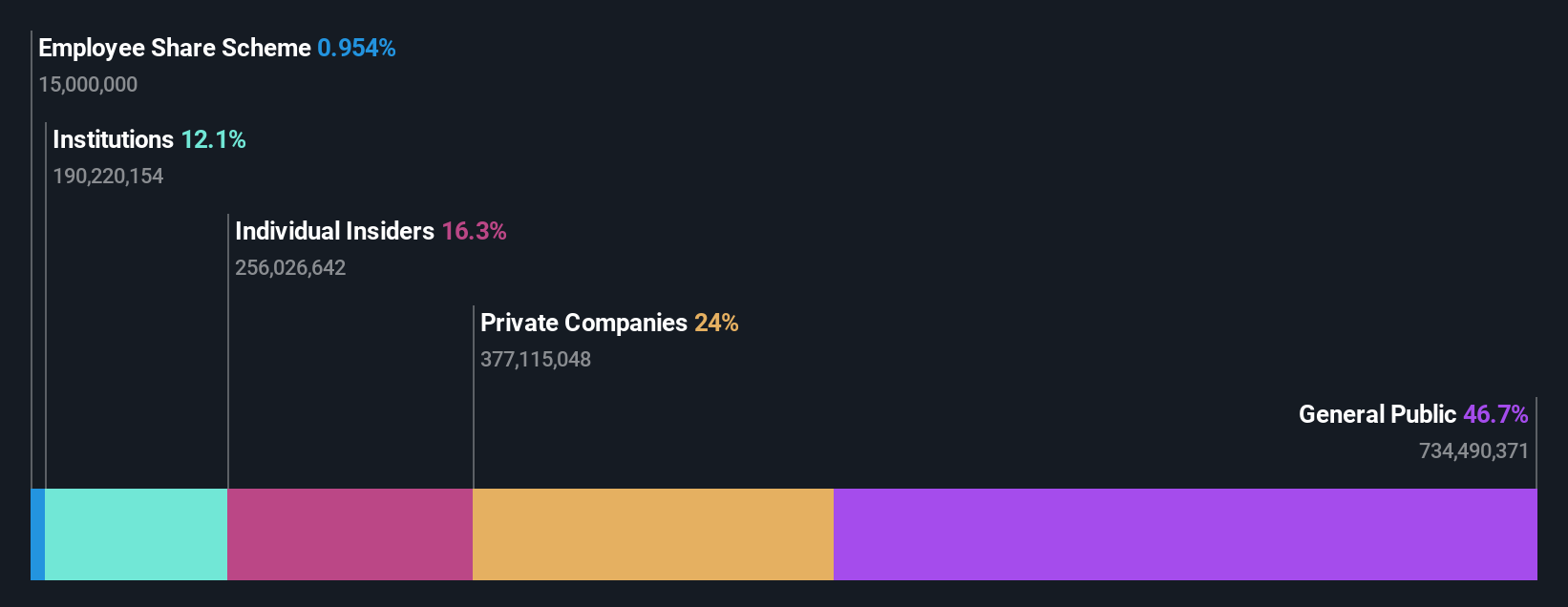

Insider Ownership: 29.8%

Revenue Growth Forecast: 27.9% p.a.

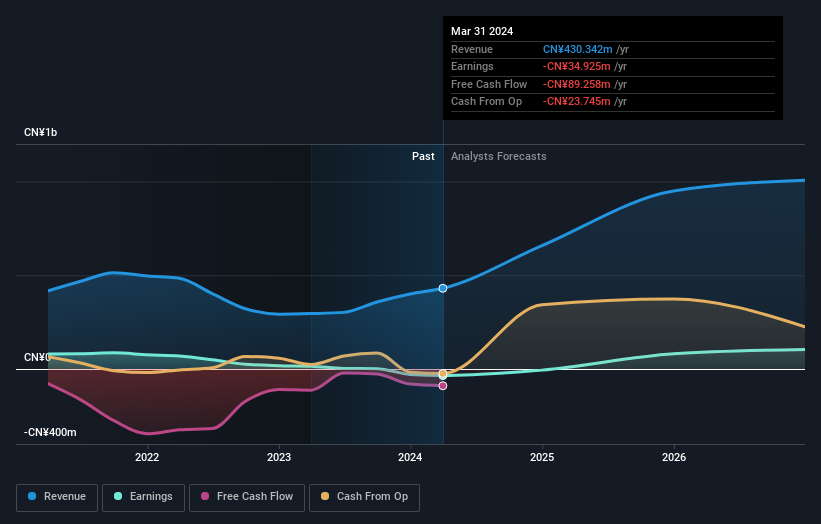

Qingdao Guolin Technology Group is poised for significant growth, with revenue expected to increase by 27.9% annually, outpacing the Chinese market average. Despite recent financials showing a widened net loss of CNY 24.68 million for the half-year ending June 30, 2024, the company is forecast to become profitable within three years. Its share price has been highly volatile recently, and its return on equity is projected to remain low at 6.7% in three years.

- Take a closer look at Qingdao Guolin Technology GroupLtd's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Qingdao Guolin Technology GroupLtd is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1483 Fast Growing Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Guolin Technology GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300786

Qingdao Guolin Technology GroupLtd

Engages in the design and manufacture, installation, commissioning, operation, and maintenance of ozone equipment.

High growth potential with mediocre balance sheet.