While shareholders of Guangzhou Haozhi IndustrialLtd (SZSE:300503) are in the black over 5 years, those who bought a week ago aren't so fortunate

While Guangzhou Haozhi Industrial Co.,Ltd. (SZSE:300503) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 23% in the last quarter. Looking further back, the stock has generated good profits over five years. It has returned a market beating 46% in that time.

Although Guangzhou Haozhi IndustrialLtd has shed CN¥453m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for Guangzhou Haozhi IndustrialLtd

Because Guangzhou Haozhi IndustrialLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, Guangzhou Haozhi IndustrialLtd can boast revenue growth at a rate of 16% per year. Even measured against other revenue-focussed companies, that's a good result. It's good to see that the stock has 8%, but not entirely surprising given revenue shows strong growth. If you think there could be more growth to come, now might be the time to take a close look at Guangzhou Haozhi IndustrialLtd. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

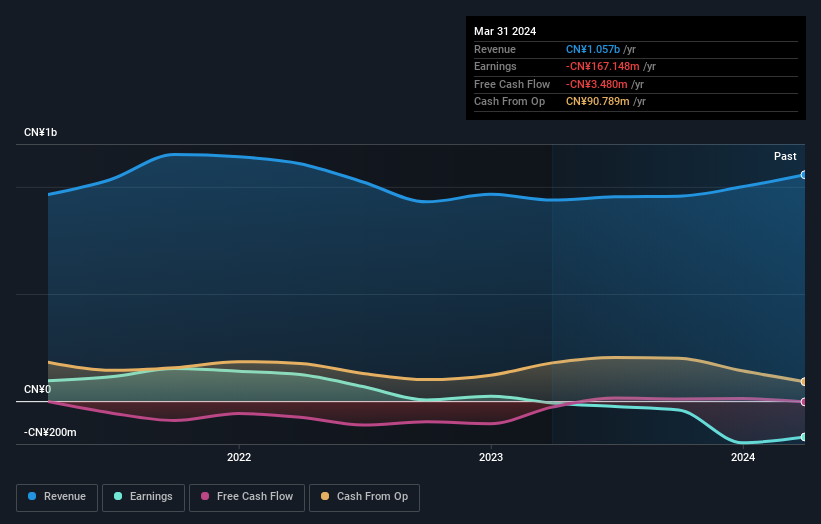

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Guangzhou Haozhi IndustrialLtd's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Guangzhou Haozhi IndustrialLtd shareholders have received a total shareholder return of 24% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 8% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Guangzhou Haozhi IndustrialLtd better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Guangzhou Haozhi IndustrialLtd you should be aware of, and 2 of them are a bit concerning.

Of course Guangzhou Haozhi IndustrialLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300503

Guangzhou Haozhi IndustrialLtd

Researches and develops, designs, manufactures, sells, and repairs precision electro-spindles and related spare parts in China and internationally.

Imperfect balance sheet very low.