- China

- /

- Electrical

- /

- SZSE:300484

Shenzhen V&T Technologies Co., Ltd.'s (SZSE:300484) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Most readers would already be aware that Shenzhen V&T Technologies' (SZSE:300484) stock increased significantly by 100% over the past three months. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. In this article, we decided to focus on Shenzhen V&T Technologies' ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Shenzhen V&T Technologies

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shenzhen V&T Technologies is:

3.4% = CN¥22m ÷ CN¥644m (Based on the trailing twelve months to September 2024).

The 'return' refers to a company's earnings over the last year. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.03 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Shenzhen V&T Technologies' Earnings Growth And 3.4% ROE

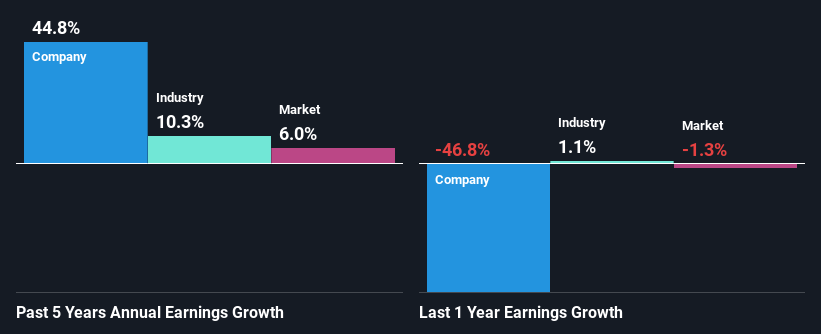

It is hard to argue that Shenzhen V&T Technologies' ROE is much good in and of itself. Not just that, even compared to the industry average of 6.4%, the company's ROE is entirely unremarkable. In spite of this, Shenzhen V&T Technologies was able to grow its net income considerably, at a rate of 45% in the last five years. We reckon that there could be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Shenzhen V&T Technologies' net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 10%.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Shenzhen V&T Technologies fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Shenzhen V&T Technologies Using Its Retained Earnings Effectively?

Shenzhen V&T Technologies' significant three-year median payout ratio of 93% (where it is retaining only 7.3% of its income) suggests that the company has been able to achieve a high growth in earnings despite returning most of its income to shareholders.

Moreover, Shenzhen V&T Technologies is determined to keep sharing its profits with shareholders which we infer from its long history of nine years of paying a dividend.

Summary

Overall, we have mixed feelings about Shenzhen V&T Technologies. Although the company has shown a pretty impressive growth in earnings, yet the low ROE and the low rate of reinvestment makes us skeptical about the continuity of that growth, especially when or if the business comes to face any threats. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. To gain further insights into Shenzhen V&T Technologies' past profit growth, check out this visualization of past earnings, revenue and cash flows.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300484

Shenzhen V&T Technologies

Engages in the research and development, manufacture, and sale of medium and low voltage inverters, electric vehicle motor controllers, servo drives, inverters, and other power electronic products in China and internationally.

Flawless balance sheet slight.