- China

- /

- Electrical

- /

- SZSE:300438

3 Chinese Growth Companies With High Insider Ownership And 20% Revenue Growth

Reviewed by Simply Wall St

As Chinese equities rise amid a holiday-shortened week and the Fed's decision to cut interest rates, investors are closely watching for growth opportunities in this evolving market. In such an environment, companies with high insider ownership and robust revenue growth stand out as particularly attractive investments.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 22.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 25.2% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's dive into some prime choices out of the screener.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing SuperMap Software Co., Ltd. provides geographic information system (GIS) and geospatial intelligence software products and services both in China and internationally, with a market cap of CN¥6.65 billion.

Operations: The company's revenue segments include geographic information system (GIS) and geospatial intelligence software products and services provided both domestically and internationally.

Insider Ownership: 18%

Revenue Growth Forecast: 19.6% p.a.

Beijing SuperMap Software, a growth company with high insider ownership in China, recently reported half-year earnings showing a decline in sales to CNY 627.03 million and net income to CNY 33.9 million. Despite this, the company has forecasted revenue growth of 19.6% per year and earnings growth of 27.4% per year, outpacing the Chinese market average. Additionally, it completed a share buyback worth CNY 114.96 million, indicating strong internal confidence.

- Navigate through the intricacies of Beijing SuperMap Software with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Beijing SuperMap Software shares in the market.

Guangzhou Great Power Energy and Technology (SZSE:300438)

Simply Wall St Growth Rating: ★★★★★☆

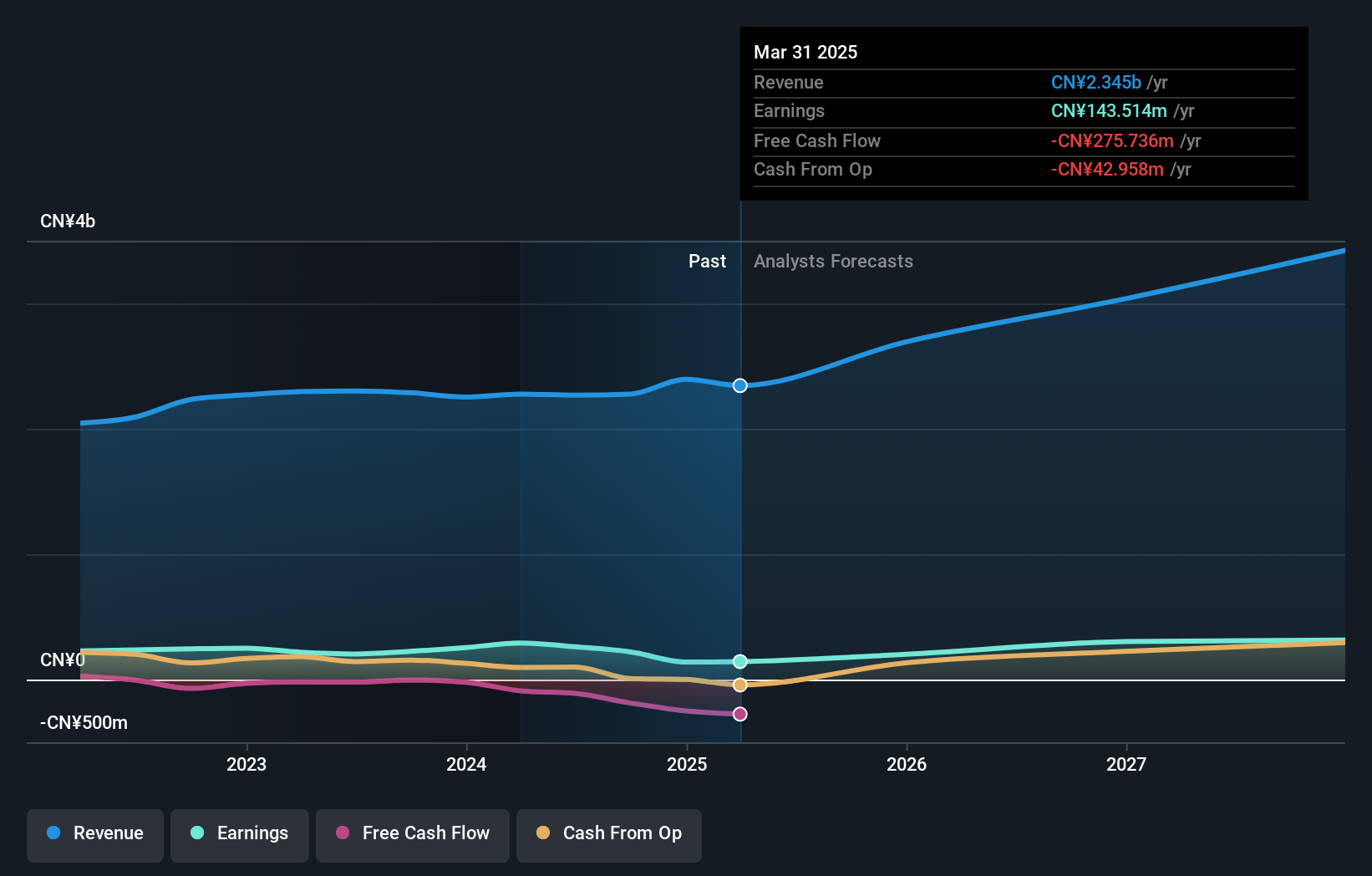

Overview: Guangzhou Great Power Energy and Technology Co., Ltd researches, develops, produces, and sells various batteries in China with a market cap of CN¥11.56 billion.

Operations: The company's revenue primarily comes from its Batteries / Battery Systems segment, which generated CN¥6.33 billion.

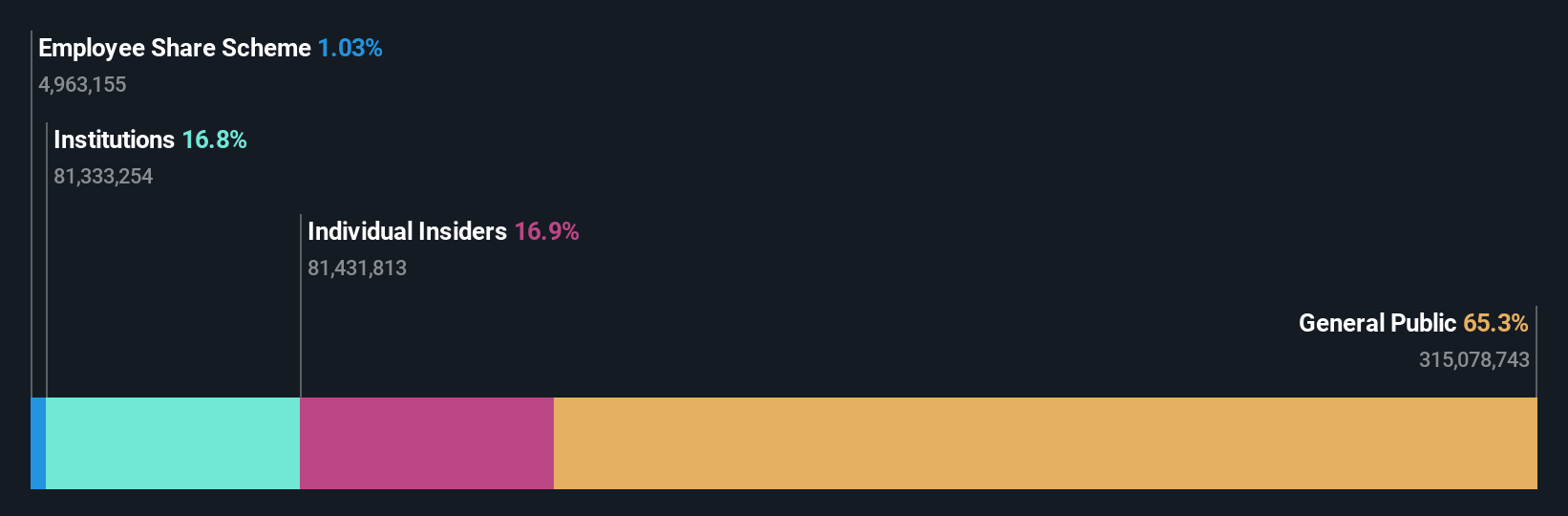

Insider Ownership: 34.5%

Revenue Growth Forecast: 20.6% p.a.

Guangzhou Great Power Energy and Technology reported a significant decline in half-year earnings, with sales dropping to CNY 3.71 billion and net income plummeting to CNY 41.68 million. Despite this, the company is forecasted to achieve robust revenue growth of 20.6% per year, well above the market average, and is expected to become profitable within three years. However, its return on equity is projected to remain low at 8.6%, indicating potential profitability challenges ahead.

- Click here and access our complete growth analysis report to understand the dynamics of Guangzhou Great Power Energy and Technology.

- The analysis detailed in our Guangzhou Great Power Energy and Technology valuation report hints at an inflated share price compared to its estimated value.

Guangzhou Sie Consulting (SZSE:300687)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Sie Consulting Co., Ltd. is a solution provider in industrial Internet, intelligent manufacturing, core ERP, and business operation centers in China with a market cap of CN¥5.43 billion.

Operations: The company's revenue segments include Software Services, which generated CN¥2.27 billion.

Insider Ownership: 28.8%

Revenue Growth Forecast: 20.1% p.a.

Guangzhou Sie Consulting's revenue is forecast to grow at 20.1% per year, outpacing the market average of 13.1%, with earnings expected to rise by 24.4% annually over the next three years. Recent half-year results showed a modest increase in sales to CNY 1,069.11 million and net income rising to CNY 29.71 million from CNY 22.14 million a year ago. Despite these positive growth indicators, its return on equity is projected at a relatively low 13%.

- Delve into the full analysis future growth report here for a deeper understanding of Guangzhou Sie Consulting.

- The analysis detailed in our Guangzhou Sie Consulting valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Discover the full array of 385 Fast Growing Chinese Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300438

Guangzhou Great Power Energy and Technology

Researches, develops, produces, and sells various batteries in China.

Reasonable growth potential with mediocre balance sheet.