The three-year underlying earnings growth at Zhangjiagang Furui Special Equipment (SZSE:300228) is promising, but the shareholders are still in the red over that time

One of the frustrations of investing is when a stock goes down. But it's hard to avoid some disappointing investments when the overall market is down. The Zhangjiagang Furui Special Equipment Co., Ltd. (SZSE:300228) is down 20% over three years, but the total shareholder return is -20% once you include the dividend. And that total return actually beats the market decline of 22%. The share price has dropped 29% in three months.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Zhangjiagang Furui Special Equipment

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Zhangjiagang Furui Special Equipment became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

With a rather small yield of just 0.7% we doubt that the stock's share price is based on its dividend. Revenue is actually up 22% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Zhangjiagang Furui Special Equipment further; while we may be missing something on this analysis, there might also be an opportunity.

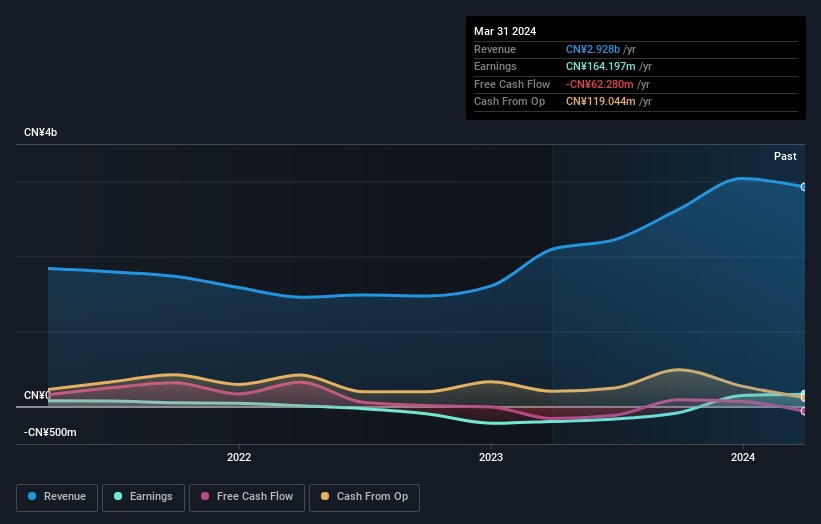

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Zhangjiagang Furui Special Equipment's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's certainly disappointing to see that Zhangjiagang Furui Special Equipment shares lost 2.0% throughout the year, that wasn't as bad as the market loss of 10%. Given the total loss of 1.8% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Zhangjiagang Furui Special Equipment you should be aware of.

Of course Zhangjiagang Furui Special Equipment may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhangjiagang Furui Special Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300228

Zhangjiagang Furui Special Equipment

Zhangjiagang Furui Special Equipment Co., Ltd.

Flawless balance sheet with acceptable track record.