Why We're Not Concerned Yet About Guangdong Create Century Intelligent Equipment Group Corporation Limited's (SZSE:300083) 25% Share Price Plunge

Guangdong Create Century Intelligent Equipment Group Corporation Limited (SZSE:300083) shares have had a horrible month, losing 25% after a relatively good period beforehand. The last month has meant the stock is now only up 5.8% during the last year.

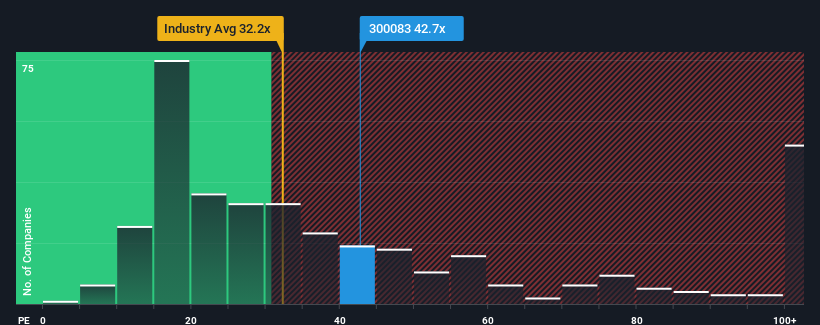

Even after such a large drop in price, Guangdong Create Century Intelligent Equipment Group may still be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 42.7x, since almost half of all companies in China have P/E ratios under 32x and even P/E's lower than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been pleasing for Guangdong Create Century Intelligent Equipment Group as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Guangdong Create Century Intelligent Equipment Group

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Guangdong Create Century Intelligent Equipment Group's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 245%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 132% during the coming year according to the five analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

With this information, we can see why Guangdong Create Century Intelligent Equipment Group is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Guangdong Create Century Intelligent Equipment Group's P/E?

There's still some solid strength behind Guangdong Create Century Intelligent Equipment Group's P/E, if not its share price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Guangdong Create Century Intelligent Equipment Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Guangdong Create Century Intelligent Equipment Group you should be aware of.

If you're unsure about the strength of Guangdong Create Century Intelligent Equipment Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300083

Guangdong Create Century Intelligent Equipment Group

Engages in the research, development, production, and sale of high-end intelligent equipment business in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives