As global markets react to rising U.S. Treasury yields and tepid economic growth, investors are closely monitoring the performance of growth stocks, which have recently outperformed value stocks amid these shifting conditions. In such a landscape, companies with high insider ownership often attract attention as their leadership's vested interest can signal confidence in the business's long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 25.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Do-Fluoride New Materials (SZSE:002407)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Do-Fluoride New Materials Co., Ltd. is involved in the development, production, and sale of inorganic fluorides, electronic chemicals, lithium-ion batteries, and related materials both in China and internationally, with a market cap of approximately CN¥14.10 billion.

Operations: The company generates revenue from its activities in inorganic fluorides, electronic chemicals, and lithium-ion batteries along with related materials on a global scale.

Insider Ownership: 13.9%

Revenue Growth Forecast: 21.9% p.a.

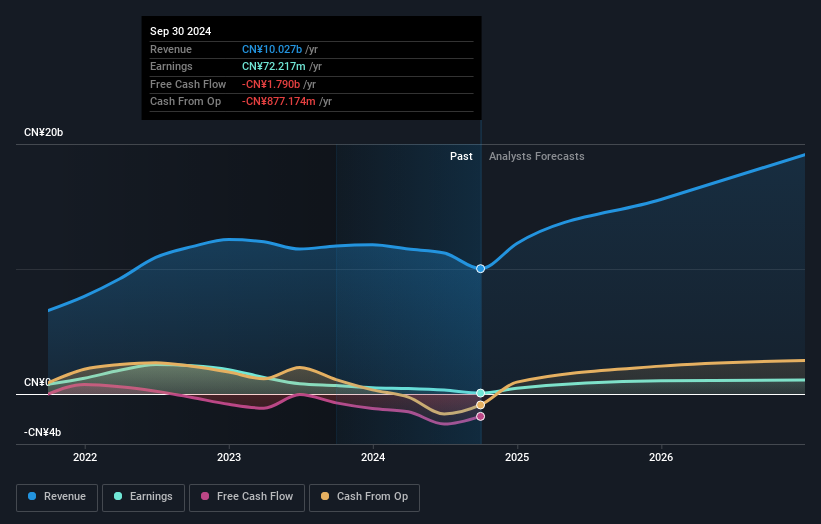

Do-Fluoride New Materials demonstrates potential as a growth company with high insider ownership, despite recent financial challenges. The company's revenue and net income have declined significantly over the past year, with sales at CNY 6.88 billion and net income at CNY 24.96 million for the nine months ended September 2024. However, analysts forecast robust annual earnings growth of over 49% and revenue growth of approximately 21.9%, outpacing the broader Chinese market expectations.

- Take a closer look at Do-Fluoride New Materials' potential here in our earnings growth report.

- The valuation report we've compiled suggests that Do-Fluoride New Materials' current price could be inflated.

Guangdong Create Century Intelligent Equipment Group (SZSE:300083)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Create Century Intelligent Equipment Group Corporation Limited, with a market cap of CN¥13.04 billion, operates in China focusing on the research, development, production, and sale of high-end intelligent equipment.

Operations: Revenue Segments (in millions of CN¥): Guangdong Create Century Intelligent Equipment Group Corporation Limited, along with its subsidiaries, does not provide specific revenue segment details in the given text.

Insider Ownership: 17.9%

Revenue Growth Forecast: 21.2% p.a.

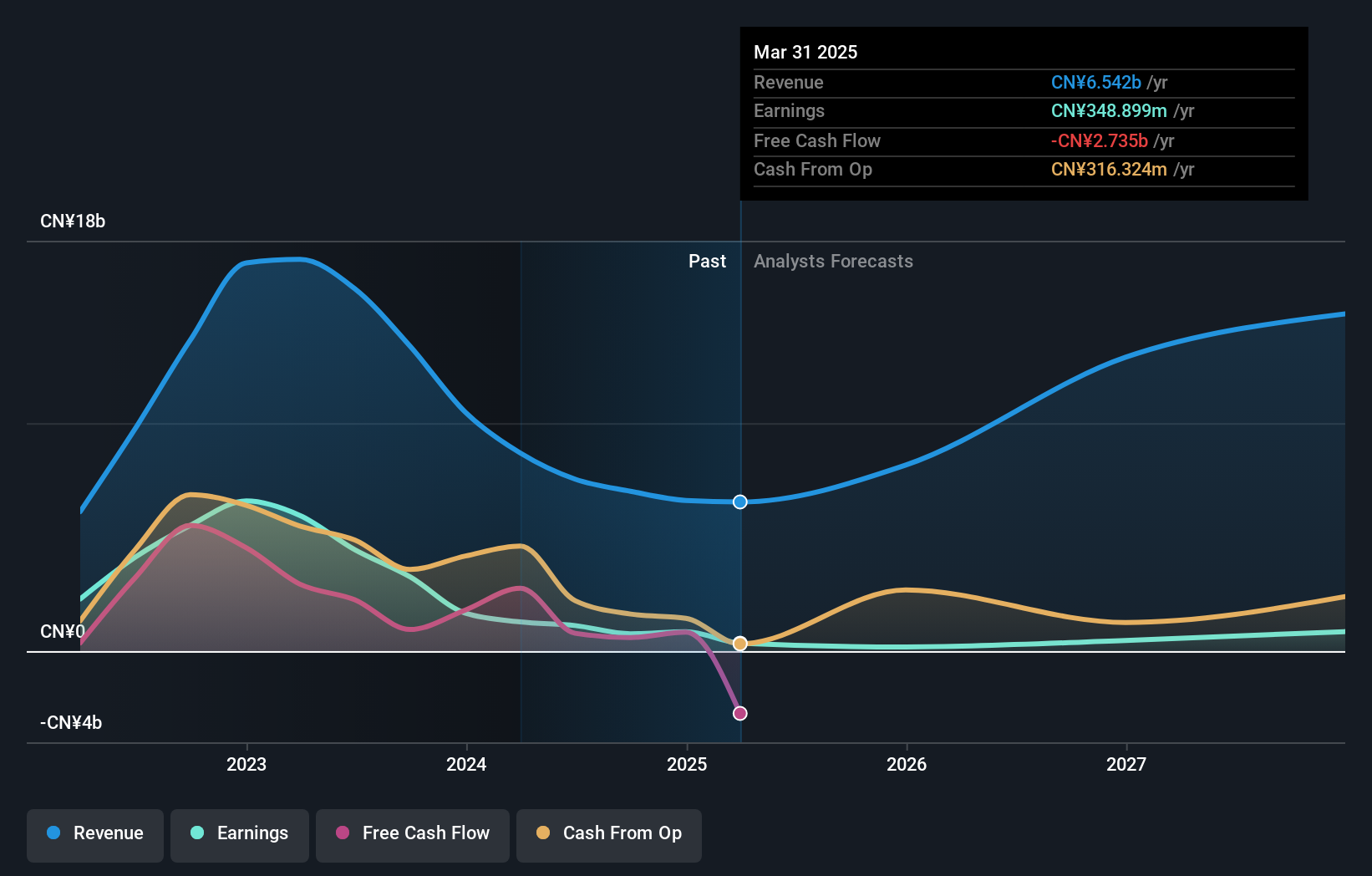

Guangdong Create Century Intelligent Equipment Group shows promise in the growth sector, with earnings forecasted to grow 36.2% annually, surpassing market expectations. Recent earnings for the nine months ended September 2024 reported sales of CNY 3.28 billion and net income of CNY 201.63 million, reflecting year-over-year growth. The company has initiated a share repurchase program worth up to CNY 200 million, aimed at supporting equity incentive plans, indicating confidence in its future prospects.

- Click to explore a detailed breakdown of our findings in Guangdong Create Century Intelligent Equipment Group's earnings growth report.

- Our valuation report unveils the possibility Guangdong Create Century Intelligent Equipment Group's shares may be trading at a premium.

Canmax Technologies (SZSE:300390)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Canmax Technologies Co., Ltd. is involved in the provision of new energy lithium battery materials and has a market cap of CN¥19.14 billion.

Operations: Canmax Technologies generates its revenue from the provision of new energy lithium battery materials.

Insider Ownership: 34%

Revenue Growth Forecast: 42.2% p.a.

Canmax Technologies demonstrates potential in the growth sector, with revenue expected to grow 42.2% annually, outpacing the Chinese market's forecast. Despite a significant drop in net income to CNY 923.32 million for the nine months ended September 2024, its earnings are projected to rise significantly at 35.9% annually over three years. The company's recent share buyback of CNY 249.97 million underscores management's confidence despite current volatility and reduced profit margins from last year’s figures.

- Unlock comprehensive insights into our analysis of Canmax Technologies stock in this growth report.

- The analysis detailed in our Canmax Technologies valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1524 more companies for you to explore.Click here to unveil our expertly curated list of 1527 Fast Growing Companies With High Insider Ownership.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300083

Guangdong Create Century Intelligent Equipment Group

Engages in the research, development, production, and sale of high-end intelligent equipment business in China.

High growth potential with excellent balance sheet.