- China

- /

- Electronic Equipment and Components

- /

- SZSE:300567

Top Chinese Growth Stocks With High Insider Ownership For September 2024

Reviewed by Simply Wall St

In September 2024, Chinese equities have shown resilience despite mixed economic data, with the Shanghai Composite Index and the blue-chip CSI 300 both posting gains. This positive momentum comes amid broader global market optimism following a significant interest rate cut by the U.S. Federal Reserve. For investors looking at growth opportunities in China, high insider ownership can be a strong indicator of confidence in a company's future prospects. Here are three top Chinese growth stocks with substantial insider stakes that merit attention this month.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 22.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 25.2% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Jinan Shengquan Group Share Holding (SHSE:605589)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jinan Shengquan Group Share Holding Co., Ltd. (SHSE:605589) operates in the manufacturing sector and has a market cap of CN¥15.80 billion.

Operations: Jinan Shengquan Group Share Holding Co., Ltd. (SHSE:605589) operates in the manufacturing sector and has a market cap of CN¥15.80 billion. The company's revenue segments include manufacturing, which generates significant income across various product lines.

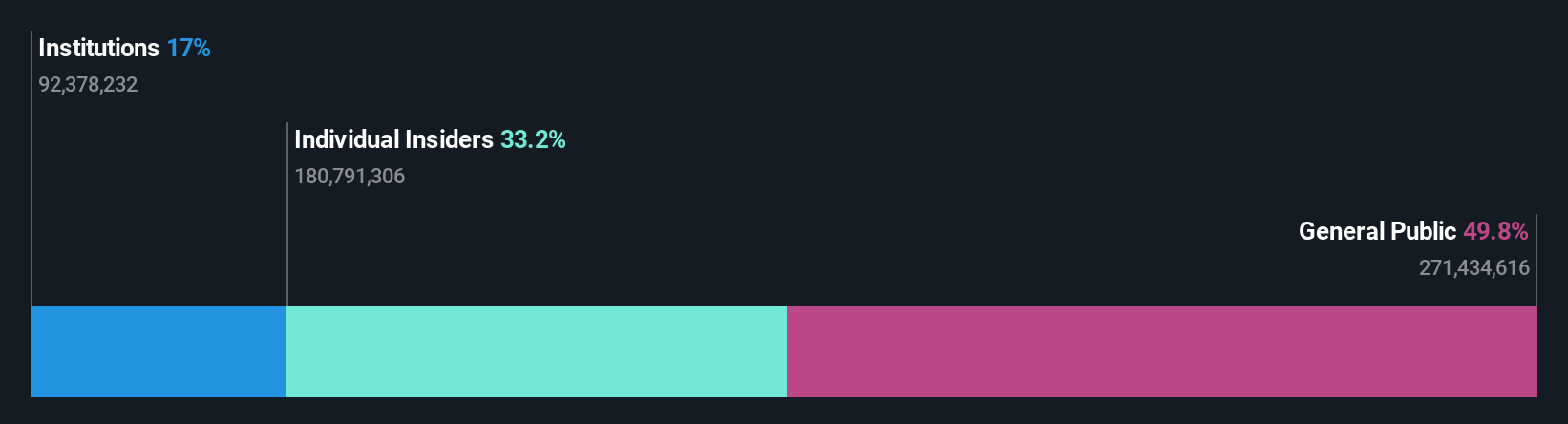

Insider Ownership: 28.5%

Earnings Growth Forecast: 23.2% p.a.

Jinan Shengquan Group Share Holding has demonstrated solid growth, with recent earnings showing a rise in revenue to CNY 4.63 billion and net income of CNY 331.32 million for the first half of 2024. The company announced a share repurchase program worth up to CNY 250 million, aimed at boosting investor confidence. Despite moderate revenue growth forecasts (15.2% annually), its earnings are expected to grow significantly at 23.2% per year, outpacing the Chinese market average.

- Dive into the specifics of Jinan Shengquan Group Share Holding here with our thorough growth forecast report.

- Our expertly prepared valuation report Jinan Shengquan Group Share Holding implies its share price may be lower than expected.

Shenzhen Megmeet Electrical (SZSE:002851)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Megmeet Electrical Co., LTD specializes in the research, development, production, sales, and services of hardware, software, and system solutions for electrical automation in China and has a market cap of CN¥12.43 billion.

Operations: The company's revenue segments include Smart Equipment (CN¥390.08 million), Precision Connection (CN¥357.48 million), Industrial Automation (CN¥605.29 million), Industrial Power Products (CN¥2.25 billion), New Energy and Rail Transit (CN¥597.02 million), and Smart Home Appliances Electronic Control Products (CN¥3.23 billion).

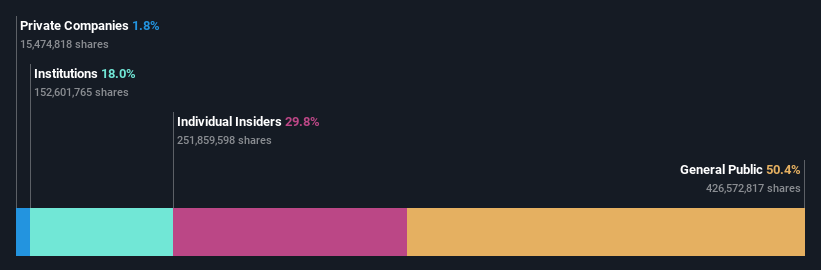

Insider Ownership: 28.9%

Earnings Growth Forecast: 26.9% p.a.

Shenzhen Megmeet Electrical has shown robust growth, with earnings projected to rise 26.89% annually over the next three years, surpassing the Chinese market average. Recent financials reveal a revenue increase to CNY 4.01 billion for H1 2024 despite a dip in net income to CNY 314.58 million. The company announced a share repurchase program worth up to CNY 40 million, which is expected to enhance shareholder value and reduce registered capital upon completion.

- Get an in-depth perspective on Shenzhen Megmeet Electrical's performance by reading our analyst estimates report here.

- The analysis detailed in our Shenzhen Megmeet Electrical valuation report hints at an deflated share price compared to its estimated value.

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Jingce Electronic Group Co., Ltd researches, develops, produces, and sells display, semiconductor, and new energy detection systems with a market cap of CN¥13.59 billion.

Operations: The company's revenue segments include Electron Product, generating CN¥2.44 billion.

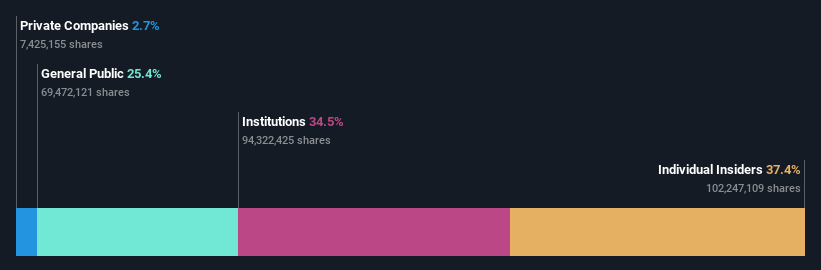

Insider Ownership: 37.4%

Earnings Growth Forecast: 36.4% p.a.

Wuhan Jingce Electronic Group Ltd. is poised for significant growth, with earnings expected to increase 36.4% annually over the next three years, outpacing the Chinese market average. Recent financials show a modest revenue rise to CNY 1.12 billion for H1 2024 and a substantial jump in net income to CNY 49.83 million from CNY 12.09 million a year ago, despite high volatility in its share price and low forecasted return on equity at 9.5%.

- Take a closer look at Wuhan Jingce Electronic GroupLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Wuhan Jingce Electronic GroupLtd is trading beyond its estimated value.

Key Takeaways

- Take a closer look at our Fast Growing Chinese Companies With High Insider Ownership list of 385 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Jingce Electronic GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300567

Wuhan Jingce Electronic GroupLtd

Researches, develops, produces, and sells display, semiconductor, and new energy detection systems.

High growth potential low.