As global markets continue to navigate a complex landscape marked by fluctuating oil prices, shifting interest rates, and varied economic indicators across major regions, investors are increasingly seeking opportunities that promise resilience and potential growth. In this environment, companies with significant insider ownership often stand out as they typically signal strong confidence from those closest to the business's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

Hoshine Silicon Industry (SHSE:603260)

Simply Wall St Growth Rating: ★★★★☆☆

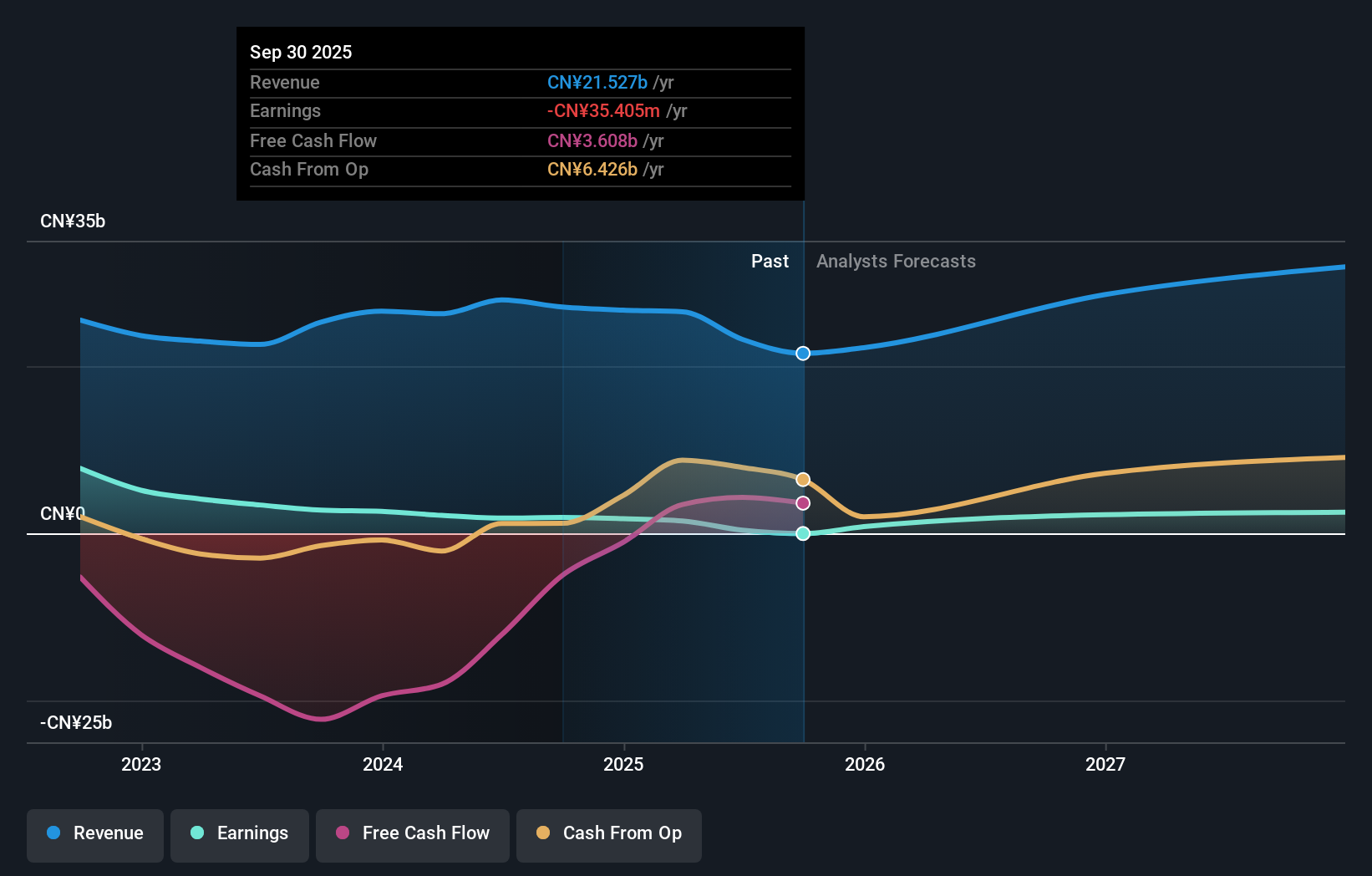

Overview: Hoshine Silicon Industry Co., Ltd. produces and sells silicon-based materials both in China and internationally, with a market cap of CN¥69.63 billion.

Operations: Hoshine Silicon Industry Co., Ltd. generates revenue through the production and sale of silicon-based materials across domestic and international markets.

Insider Ownership: 32.6%

Hoshine Silicon Industry anticipates significant earnings growth at 34.41% annually, surpassing the CN market's 23.8%. However, profit margins have declined to 6.5% from last year's 15%, and debt coverage by operating cash flow is inadequate. The company recently completed a share buyback of CNY 407.65 million, reflecting confidence in its growth trajectory despite lower profit margins and a dividend yield inadequately covered by free cash flows at 1.15%.

- Unlock comprehensive insights into our analysis of Hoshine Silicon Industry stock in this growth report.

- Upon reviewing our latest valuation report, Hoshine Silicon Industry's share price might be too optimistic.

Shenzhen Megmeet Electrical (SZSE:002851)

Simply Wall St Growth Rating: ★★★★★☆

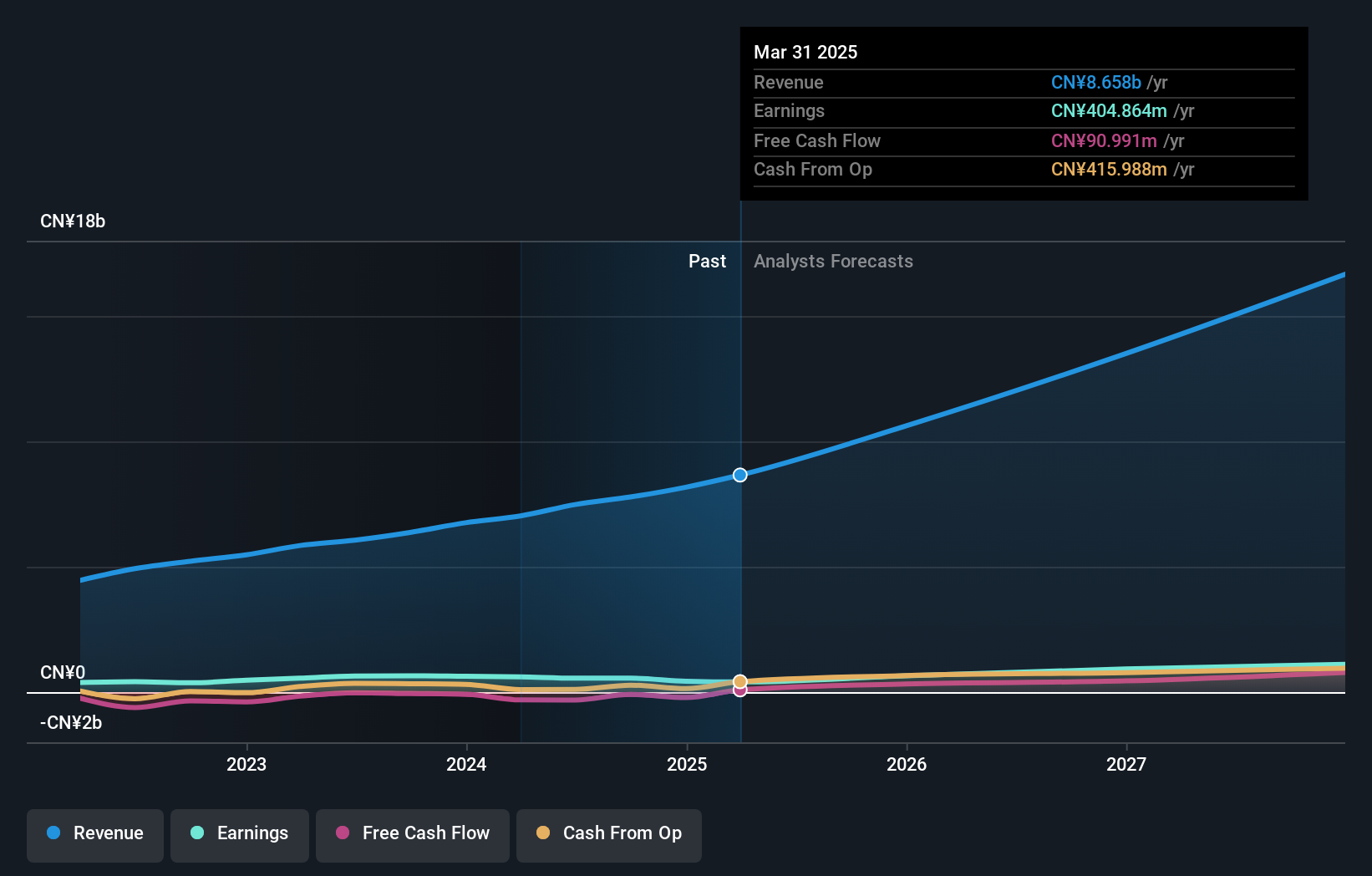

Overview: Shenzhen Megmeet Electrical Co., LTD focuses on the research, development, production, sales, and services of hardware, software, and system solutions for electrical automation in China with a market cap of CN¥23.47 billion.

Operations: The company's revenue segments include Smart Equipment (CN¥390.08 million), Precision Connection (CN¥357.48 million), Industrial Automation (CN¥605.29 million), Industrial Power Products (CN¥2.25 billion), New Energy and Rail Transit (CN¥597.02 million), and Smart Home Appliances Electronic Control Products (CN¥3.23 billion).

Insider Ownership: 28.9%

Shenzhen Megmeet Electrical is poised for substantial growth, with earnings expected to rise 28.3% annually, outpacing the CN market's 23.8%. Revenue is also forecast to grow at 21.9% per year. Despite a recent decline in net income and earnings per share compared to last year, the company has initiated a share buyback program worth up to CNY 40 million, signaling confidence in its valuation and future prospects amidst high insider ownership.

- Click here to discover the nuances of Shenzhen Megmeet Electrical with our detailed analytical future growth report.

- Our expertly prepared valuation report Shenzhen Megmeet Electrical implies its share price may be too high.

SG Micro (SZSE:300661)

Simply Wall St Growth Rating: ★★★★★☆

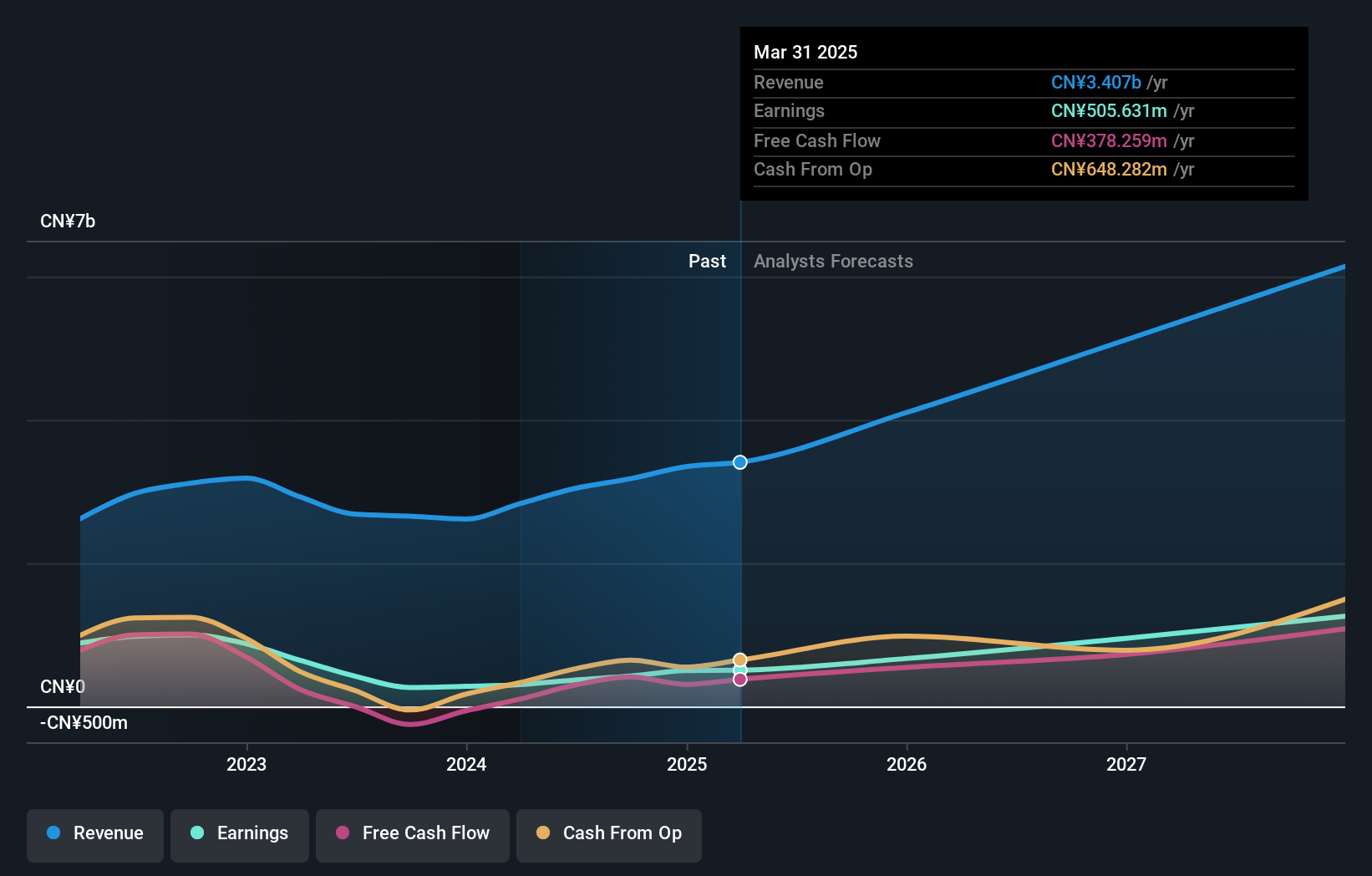

Overview: SG Micro Corp designs, markets, and sells analog ICs primarily in China with a market cap of CN¥44.79 billion.

Operations: The company generates revenue of CN¥3.04 billion from the Integrated Circuit Industry segment.

Insider Ownership: 32.9%

SG Micro is positioned for significant growth, with earnings expected to increase 42% annually, surpassing the CN market's 23.8%. Revenue growth is also projected at a robust 20.8% per year. Despite recent volatility in share price and low future return on equity forecasts, SG Micro's financial results show strong performance with net income doubling to CNY 178.65 million for H1 2024, reflecting its potential amidst high insider ownership and strategic board changes.

- Click to explore a detailed breakdown of our findings in SG Micro's earnings growth report.

- The analysis detailed in our SG Micro valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 1489 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hoshine Silicon Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603260

Hoshine Silicon Industry

Engages in the production and sale of silicon-based materials in China and internationally.

Reasonable growth potential slight.