- Japan

- /

- Capital Markets

- /

- TSE:7342

High Growth Companies With Significant Insider Stakes

Reviewed by Simply Wall St

In the wake of recent global market developments, U.S. stocks have surged to record highs, buoyed by investor optimism surrounding potential economic growth and tax reforms following a significant political shift. The S&P 500 and Nasdaq Composite saw substantial gains as expectations for deregulation and lower corporate taxes fueled market enthusiasm, while the Federal Reserve's rate cut further supported positive sentiment. In this context of heightened market activity, identifying growth companies with high insider ownership can offer investors unique insights into potential opportunities. High insider stakes often signal confidence in a company's future prospects, aligning management's interests with those of shareholders amidst evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 36.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Guangdong Greenway TechnologyLtd (SHSE:688345)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Greenway Technology Co., Ltd specializes in the R&D, production, sale, and servicing of lithium-ion battery packs and batteries globally, with a market cap of CN¥2.23 billion.

Operations: The company generates revenue of CN¥1.74 billion from the production and sales of lithium battery-related products across various regions, including China, Europe, Asia, and North America.

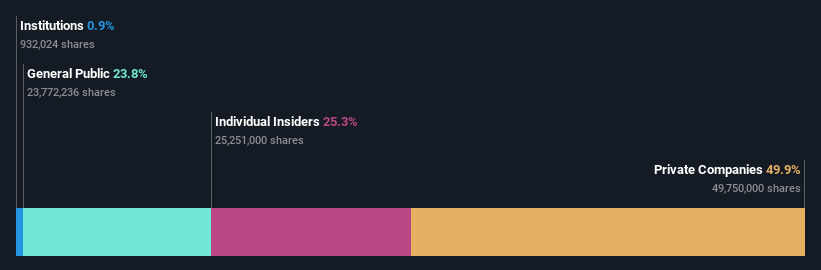

Insider Ownership: 25.3%

Earnings Growth Forecast: 115.5% p.a.

Guangdong Greenway Technology Ltd. is forecasted to achieve above-average market growth with expected revenue growth of 21.3% per year and earnings projected to increase by 115.47% annually, despite recent net losses reported for the nine months ending September 2024. The company completed a share buyback program, repurchasing shares worth CNY 6 million, which may indicate confidence in future performance despite current volatility and low forecasted return on equity at 9.4%.

- Dive into the specifics of Guangdong Greenway TechnologyLtd here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Guangdong Greenway TechnologyLtd is priced higher than what may be justified by its financials.

Bichamp Cutting Technology (Hunan) (SZSE:002843)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bichamp Cutting Technology (Hunan) Co., Ltd. (SZSE:002843) operates in the cutting tools industry and has a market cap of CN¥4.81 billion.

Operations: Unfortunately, the provided text for revenue segments does not contain specific information on the company's revenue breakdown. If you can provide more details, I would be happy to help summarize it for you.

Insider Ownership: 31.8%

Earnings Growth Forecast: 28.7% p.a.

Bichamp Cutting Technology (Hunan) is poised for strong growth, with earnings expected to rise by 28.7% annually, outpacing the Chinese market. Despite a decline in recent net income to CNY 66.02 million for the nine months ending September 2024, revenue is forecasted to grow at 24.1% per year. However, its return on equity is projected to remain relatively low at 13.5%, and its share price has been highly volatile recently without significant insider trading activity reported.

- Delve into the full analysis future growth report here for a deeper understanding of Bichamp Cutting Technology (Hunan).

- Our valuation report unveils the possibility Bichamp Cutting Technology (Hunan)'s shares may be trading at a premium.

WealthNavi (TSE:7342)

Simply Wall St Growth Rating: ★★★★★☆

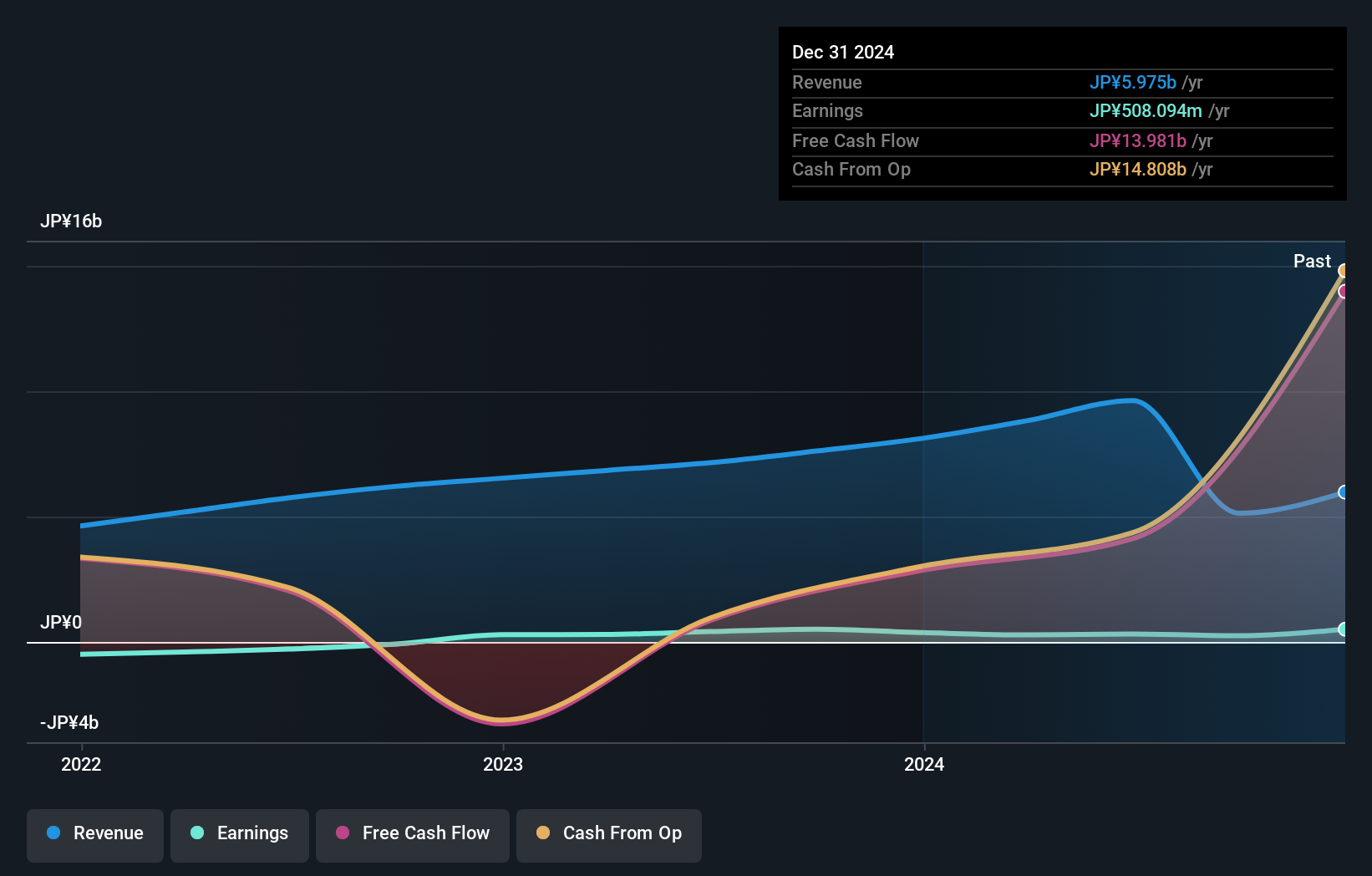

Overview: WealthNavi Inc. develops and delivers an online asset management and risk management platform, with a market cap of ¥67.73 billion.

Operations: WealthNavi Inc.'s revenue is primarily generated from its online asset management and risk management platform.

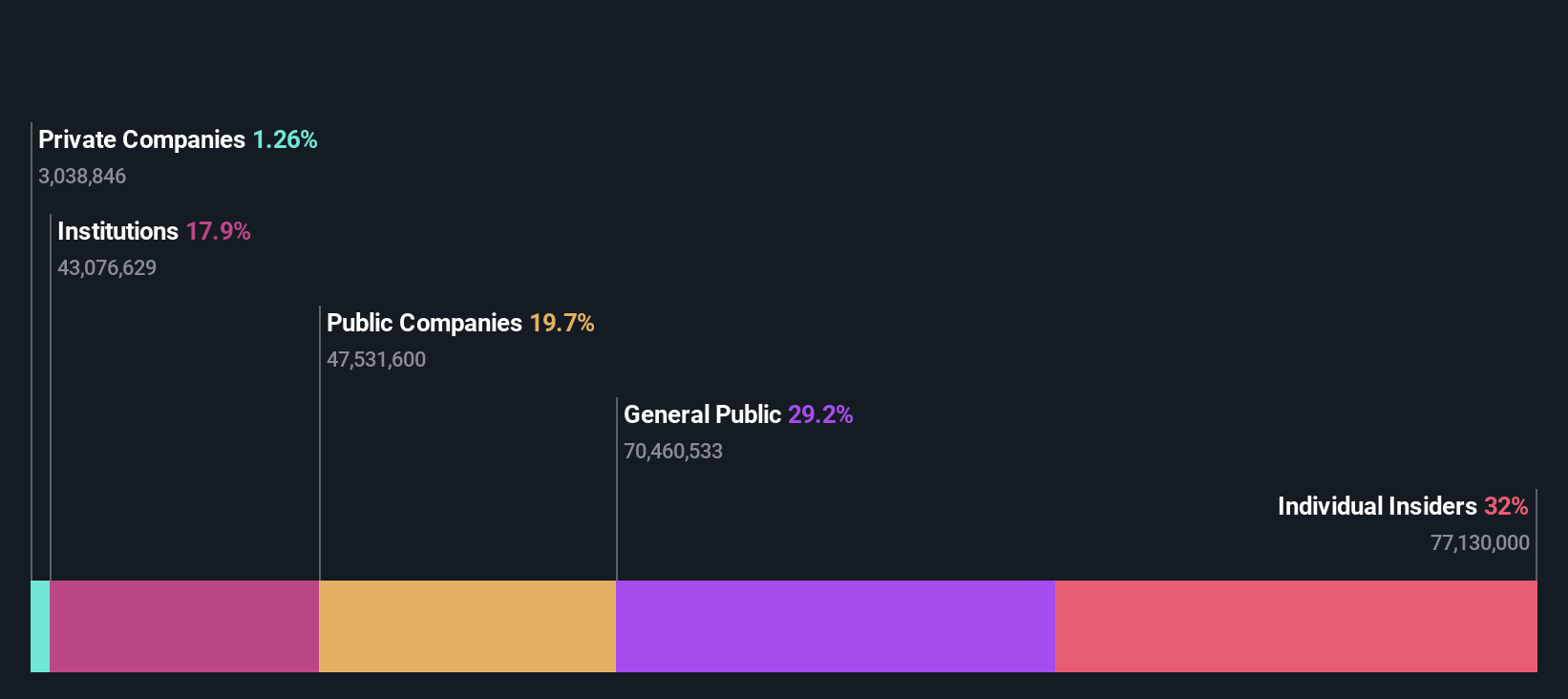

Insider Ownership: 17.6%

Earnings Growth Forecast: 76.5% p.a.

WealthNavi is positioned for rapid growth, with earnings projected to increase by 76.54% annually, surpassing the Japanese market's growth rate. Revenue is expected to grow at 20.4% per year, outpacing the broader market as well. Despite recent shareholder dilution and volatile share prices, the company is expanding its operations by relocating its headquarters to accommodate business growth. However, profit margins have decreased compared to last year due to significant one-off items impacting results.

- Click here and access our complete growth analysis report to understand the dynamics of WealthNavi.

- According our valuation report, there's an indication that WealthNavi's share price might be on the expensive side.

Summing It All Up

- Gain an insight into the universe of 1525 Fast Growing Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if WealthNavi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7342

WealthNavi

Develops and delivers an online asset management and risk management platform.

High growth potential with excellent balance sheet.