- Taiwan

- /

- Tech Hardware

- /

- TWSE:3515

Undiscovered Gems On None Exchange To Explore In November 2024

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets experienced mixed results, with small-cap stocks holding up better than their large-cap counterparts amid cautious sentiment. As the S&P MidCap 400 Index reached record highs before retreating, investors are increasingly attentive to economic indicators that impact smaller companies, such as job market fluctuations and manufacturing activity. In this environment of uncertainty and opportunity, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and growth potential despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Techno Smart | NA | 6.07% | -0.57% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Compañía Electro Metalúrgica | 72.83% | 12.17% | 19.18% | ★★★★☆☆ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al Wathba National Insurance Company PJSC | 14.56% | 13.48% | 31.31% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Roshow Technology (SZSE:002617)

Simply Wall St Value Rating: ★★★★★☆

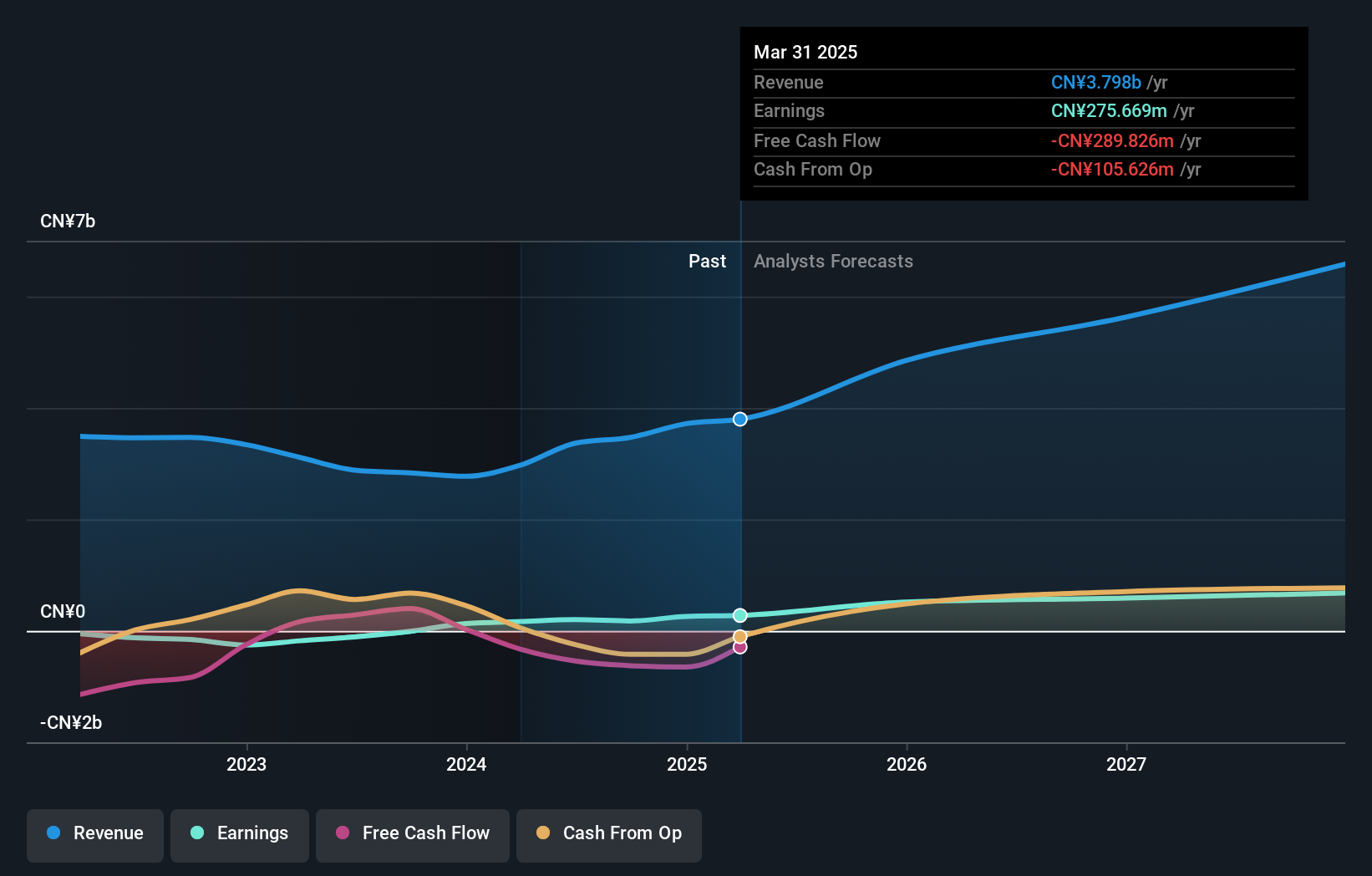

Overview: Roshow Technology Co., Ltd. focuses on the research, development, manufacture, and sale of electromagnetic products in China with a market cap of CN¥12.41 billion.

Operations: Roshow Technology generates revenue primarily through the sale of electromagnetic products. The company has a market capitalization of CN¥12.41 billion, reflecting its scale in the industry.

Roshow Technology, a promising player in the electrical industry, has shown impressive growth with sales reaching CNY 2.78 billion for the first nine months of 2024, up from CNY 2.08 billion last year. The company turned profitable recently and boasts high-quality earnings, alongside a robust net income of CNY 234.06 million compared to last year's CNY 188.68 million. Its financial health is underscored by a reduced debt-to-equity ratio from 81% to 31% over five years and satisfactory interest coverage at 10x EBIT, though free cash flow remains negative despite these gains.

Kinpo Electronics (TWSE:2312)

Simply Wall St Value Rating: ★★★★☆☆

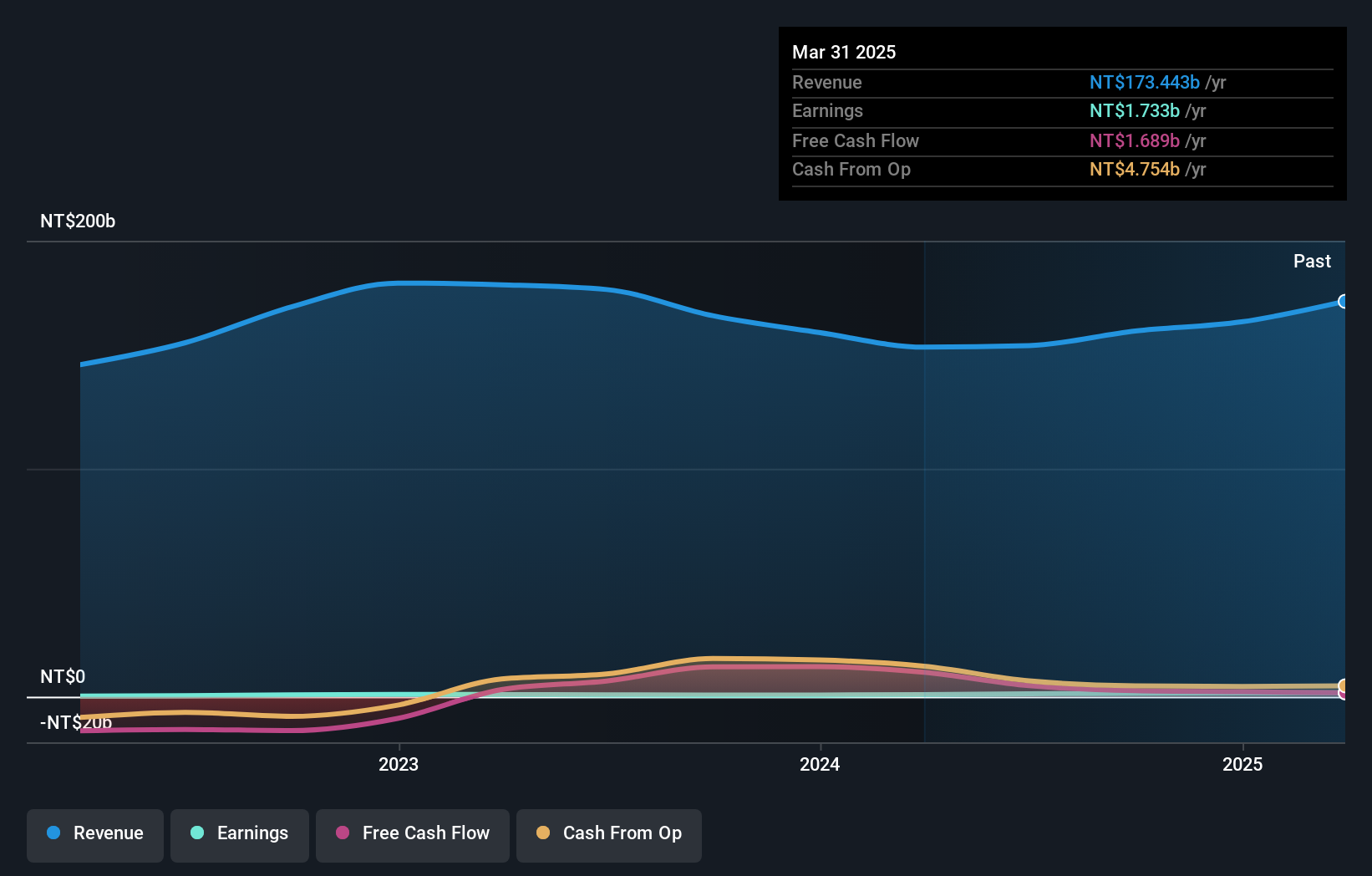

Overview: Kinpo Electronics, Inc. is involved in the design, manufacture, and sale of consumer electronics, web-based communications, computer peripherals, and storage products across Taiwan and international markets with a market cap of NT$38.17 billion.

Operations: Kinpo Electronics generates revenue primarily from its Consumer Electronics Manufacturing Sector, which accounts for NT$152.20 billion.

Kinpo Electronics, a vibrant player in the tech sector, has shown impressive earnings growth of 57.7% over the past year, outpacing the industry average of 11.3%. With a net debt to equity ratio at 72.7%, it appears high but manageable as interest payments are well covered by EBIT at 3.7 times coverage. Recent financials reveal sales for Q2 stood at TWD 40 billion compared to TWD 39 billion last year, while net income surged from TWD 128 million to TWD 452 million, reflecting strong performance and high-quality earnings amidst executive changes and strategic presentations.

- Navigate through the intricacies of Kinpo Electronics with our comprehensive health report here.

Examine Kinpo Electronics' past performance report to understand how it has performed in the past.

ASROCK Incorporation (TWSE:3515)

Simply Wall St Value Rating: ★★★★★★

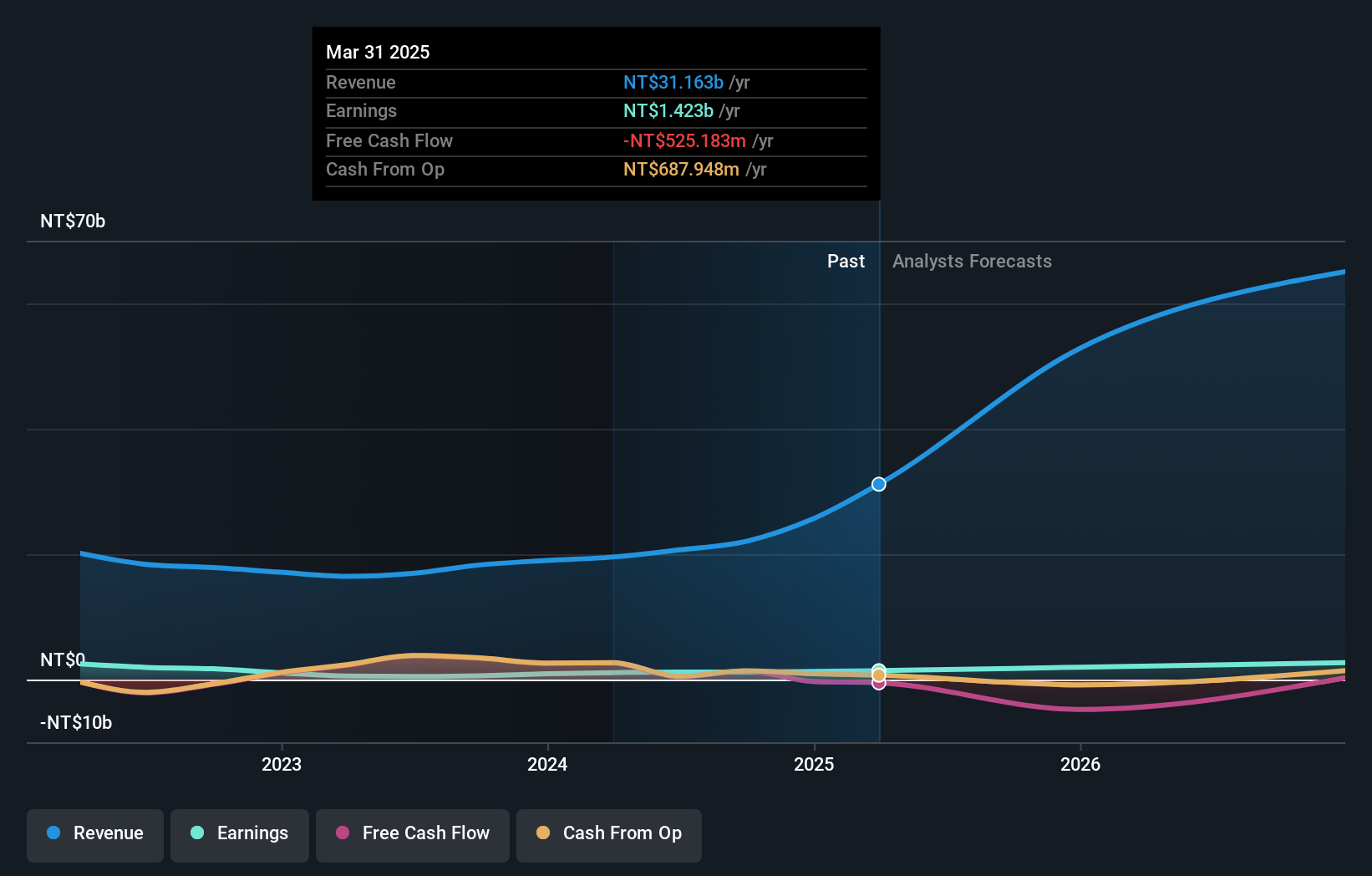

Overview: ASROCK Incorporation designs, develops, and sells motherboards in Taiwan with a market cap of NT$26.21 billion.

Operations: The company generates revenue primarily from the sale of motherboards.

ASROCK, a nimble player in the tech sector, has shown impressive earnings growth of 95.8% over the past year, outpacing the industry's 11.3%. With no debt on its books for five years, interest payments are not a concern for this company. Their recent financials highlight sales of TWD 6.27 billion in Q3 2024 compared to TWD 4.90 billion last year and net income at TWD 305 million versus TWD 309 million previously. Despite a slight dip in quarterly net income, ASROCK's robust free cash flow of approximately US$1352 million suggests strong operational efficiency and potential for future growth.

- Get an in-depth perspective on ASROCK Incorporation's performance by reading our health report here.

Make It Happen

- Unlock our comprehensive list of 4726 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3515

ASROCK Incorporation

Designs, develops, and sells motherboards in Taiwan.

Flawless balance sheet with reasonable growth potential.