- China

- /

- Electrical

- /

- SZSE:002487

Asian Market Insights: Chanjet Information Technology And Two Stocks That May Be Trading Below Fair Value

Reviewed by Simply Wall St

In the current global economic landscape, Asian markets have shown resilience despite ongoing challenges such as geopolitical tensions and fluctuating inflation rates. As investors navigate these complexities, identifying stocks that may be trading below their intrinsic value can present attractive opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.78 | CN¥165.09 | 49.3% |

| Takara Bio (TSE:4974) | ¥938.00 | ¥1829.46 | 48.7% |

| SRE Holdings (TSE:2980) | ¥3250.00 | ¥6471.62 | 49.8% |

| NexTone (TSE:7094) | ¥2274.00 | ¥4465.49 | 49.1% |

| Mobvista (SEHK:1860) | HK$19.03 | HK$37.83 | 49.7% |

| Kolmar Korea (KOSE:A161890) | ₩79300.00 | ₩155402.21 | 49% |

| HAESUNG DS (KOSE:A195870) | ₩30750.00 | ₩61294.35 | 49.8% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.60 | CN¥77.71 | 49% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥47.28 | CN¥94.11 | 49.8% |

| Chanjet Information Technology (SEHK:1588) | HK$11.03 | HK$21.58 | 48.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Chanjet Information Technology (SEHK:1588)

Overview: Chanjet Information Technology Company Limited operates in the cloud service and software sectors both in Mainland China and internationally, with a market cap of HK$3.59 billion.

Operations: Revenue segments for Chanjet Information Technology include the Cloud Service Business, which generated CN¥989.50 million.

Estimated Discount To Fair Value: 48.9%

Chanjet Information Technology is currently trading at HK$11.03, significantly below its estimated fair value of HK$21.58, indicating potential undervaluation based on cash flows. The company has recently turned profitable, with earnings forecasted to grow over 32% annually, outpacing the Hong Kong market's growth rate. Additionally, Chanjet's share repurchase program could enhance net asset and earnings per share values further supporting its investment appeal despite slower revenue growth forecasts of 14.1% annually.

- Our growth report here indicates Chanjet Information Technology may be poised for an improving outlook.

- Get an in-depth perspective on Chanjet Information Technology's balance sheet by reading our health report here.

Nanjing Vazyme Biotech (SHSE:688105)

Overview: Nanjing Vazyme Biotech Co., Ltd provides technology solutions in life science, biomedicine, and in vitro diagnostics, with a market cap of CN¥9.16 billion.

Operations: The company's revenue is derived from its offerings in life science, biomedicine, and in vitro diagnostics.

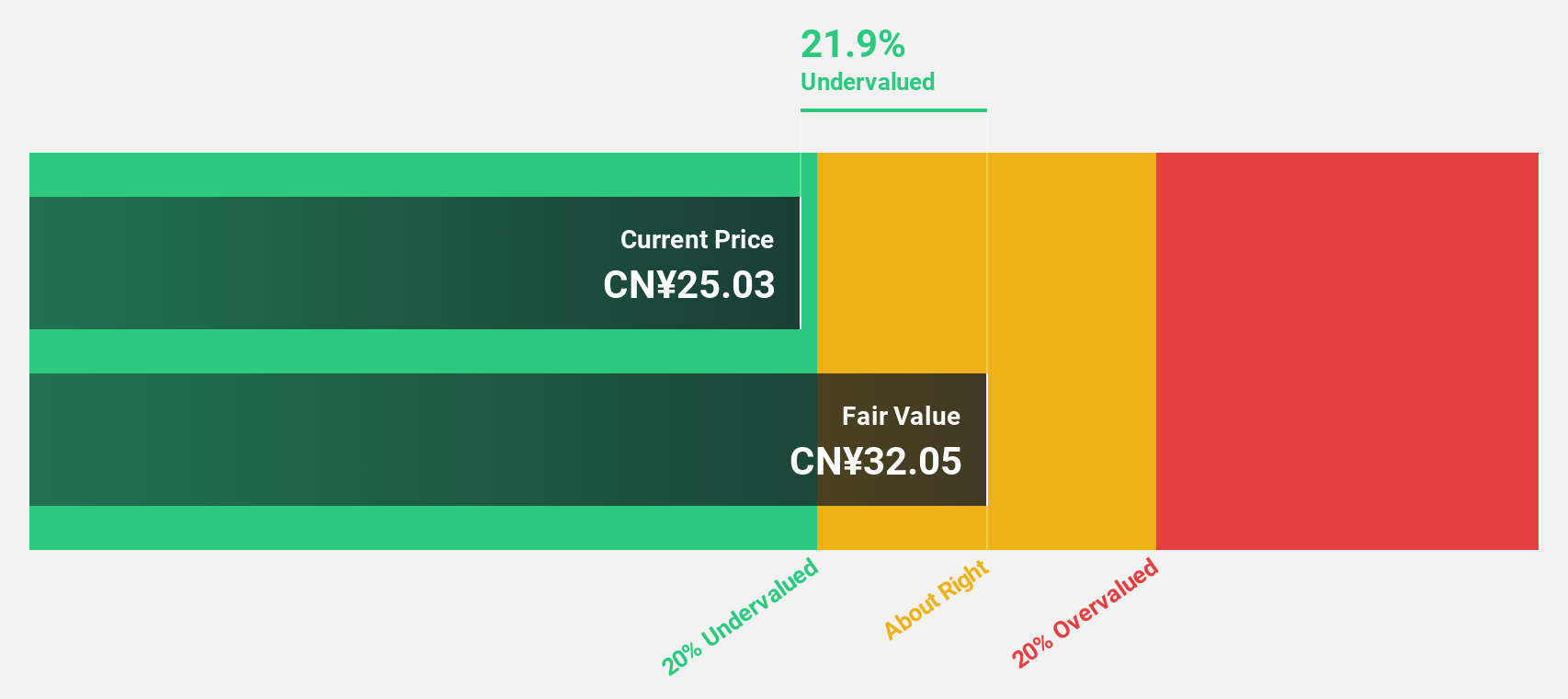

Estimated Discount To Fair Value: 25.8%

Nanjing Vazyme Biotech is trading at CN¥23.04, below its fair value estimate of CN¥31.05, suggesting undervaluation based on cash flows. Despite a recent dip in revenue and net income for H1 2025, the company is expected to become profitable within three years with above-market growth rates. While the dividend yield of 1.3% lacks coverage by earnings or cash flows, analysts anticipate a price increase of 22.1%.

- The analysis detailed in our Nanjing Vazyme Biotech growth report hints at robust future financial performance.

- Take a closer look at Nanjing Vazyme Biotech's balance sheet health here in our report.

Dajin Heavy IndustryLtd (SZSE:002487)

Overview: Dajin Heavy Industry Co., Ltd. develops, produces, and sells wind power equipment in China with a market cap of CN¥30.15 billion.

Operations: The company's revenue primarily comes from the Metal Products Industry, contributing CN¥5.04 billion, followed by New Energy Power Generation at CN¥222.35 million.

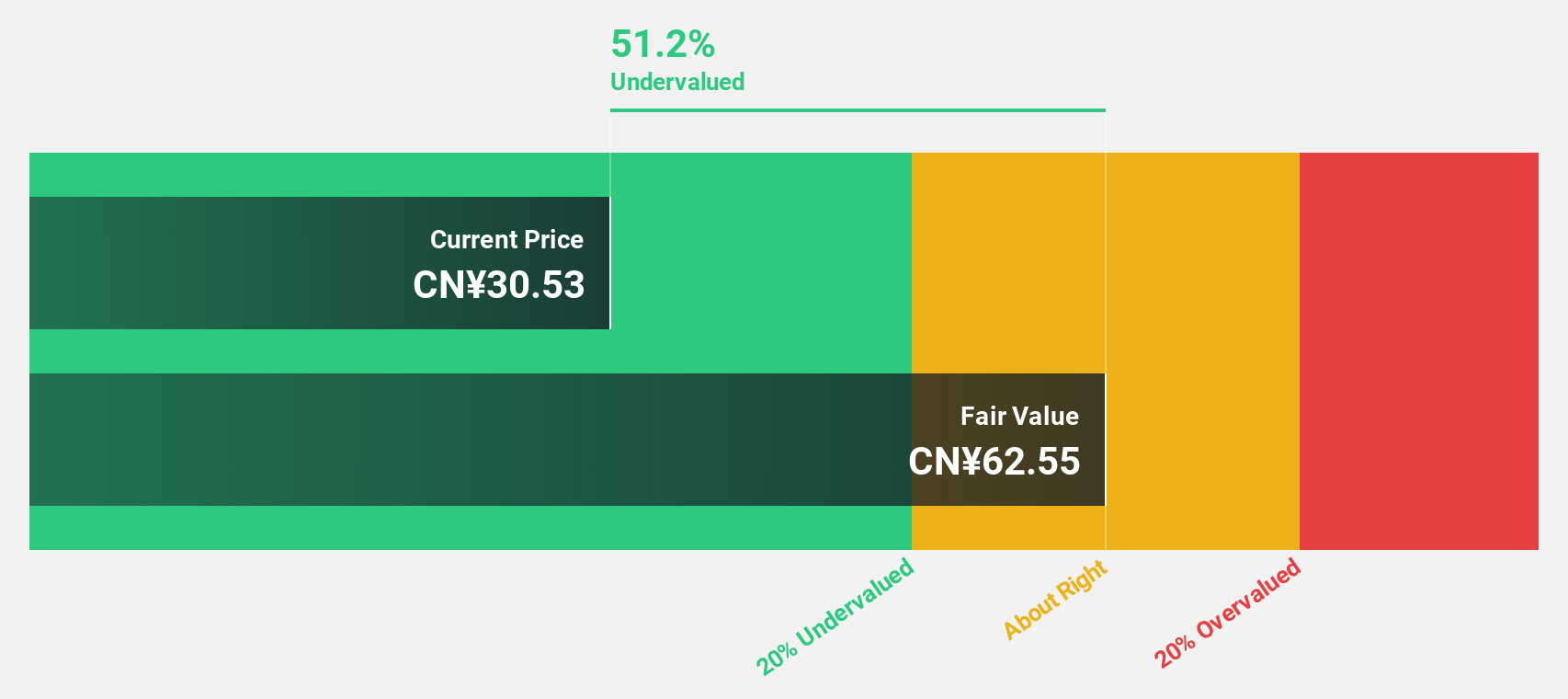

Estimated Discount To Fair Value: 49.8%

Dajin Heavy Industry Ltd. is trading at CN¥47.28, significantly undervalued compared to its estimated fair value of CN¥94.11, based on cash flows. The company reported impressive earnings growth of 159.4% over the past year and forecasts annual profit growth of 30.9%, outpacing the Chinese market average of 26.7%. Despite a forecasted low return on equity, Dajin's revenue growth prospects remain strong at 26.8% annually, supported by recent robust earnings results for H1 2025.

- Upon reviewing our latest growth report, Dajin Heavy IndustryLtd's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Dajin Heavy IndustryLtd's balance sheet health report.

Seize The Opportunity

- Dive into all 286 of the Undervalued Asian Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002487

Dajin Heavy IndustryLtd

Develops, produces, and sells wind power equipment in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives