The three-year loss for Suzhou Hailu Heavy IndustryLtd (SZSE:002255) shareholders likely driven by its shrinking earnings

This week we saw the Suzhou Hailu Heavy Industry Co.,Ltd (SZSE:002255) share price climb by 12%. Unfortunately the return over three years isn't so good. To be specific, the share price is a full 25% lower, while the market is down , with a return of (-21%)..

On a more encouraging note the company has added CN¥430m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

View our latest analysis for Suzhou Hailu Heavy IndustryLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

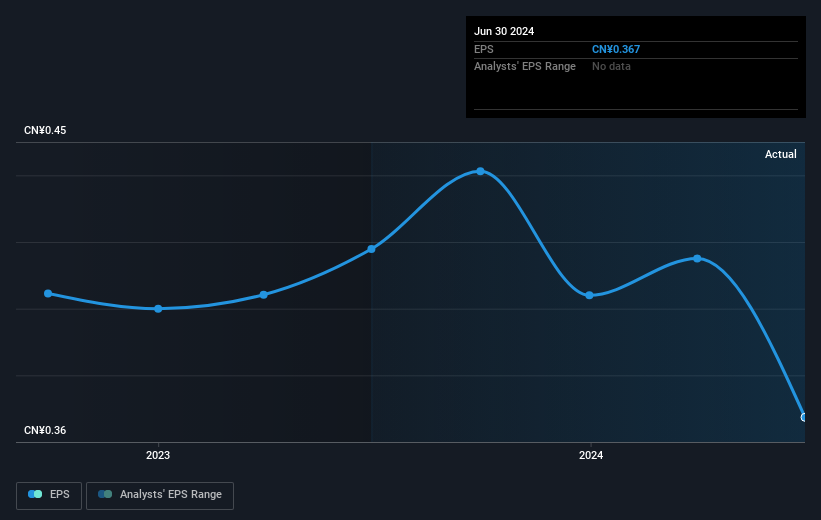

During the three years that the share price fell, Suzhou Hailu Heavy IndustryLtd's earnings per share (EPS) dropped by 1.2% each year. The share price decline of 9% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We regret to report that Suzhou Hailu Heavy IndustryLtd shareholders are down 11% for the year. Unfortunately, that's worse than the broader market decline of 6.0%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Is Suzhou Hailu Heavy IndustryLtd cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002255

Suzhou Hailu Heavy IndustryLtd

Designs, manufactures, and sells industrial waste heat boilers, large and special material pressure vessels, and nuclear safety equipment.

Flawless balance sheet and good value.