Zhongshan Broad-Ocean Motor And 2 Other Undiscovered Gems With Promising Fundamentals

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, small-cap stocks have faced increased pressure, with indices like the Russell 2000 reflecting these headwinds. In such an environment, identifying stocks with strong fundamentals becomes crucial for investors seeking opportunities amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.07% | 32.89% | -17.68% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhongshan Broad-Ocean Motor (SZSE:002249)

Simply Wall St Value Rating: ★★★★★★

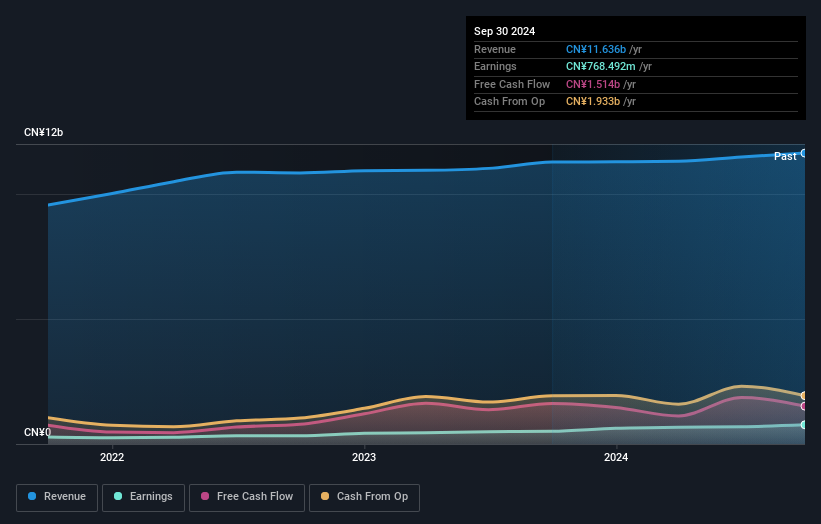

Overview: Zhongshan Broad-Ocean Motor Co., Ltd. operates in the motor systems business in China, with a market capitalization of CN¥13.63 billion.

Operations: Broad-Ocean Motor generates revenue primarily from its motor systems business in China. The company's financial performance is highlighted by a net profit margin trend worth noting.

Zhongshan Broad-Ocean Motor, a nimble player in the market, has shown impressive financial health with its debt to equity ratio plummeting from 24.8% to just 0.6% over five years. The company reported earnings growth of 50%, outpacing the Electrical industry's modest 2%. Trading at a notable discount of over half its estimated fair value, it offers potential upside for investors. Despite not repurchasing shares recently, it completed a buyback earlier in the year worth CNY 50 million. With net income rising to CNY 671 million for nine months ending September, profitability remains robust.

Shenzhen Genvict Technologies (SZSE:002869)

Simply Wall St Value Rating: ★★★★★★

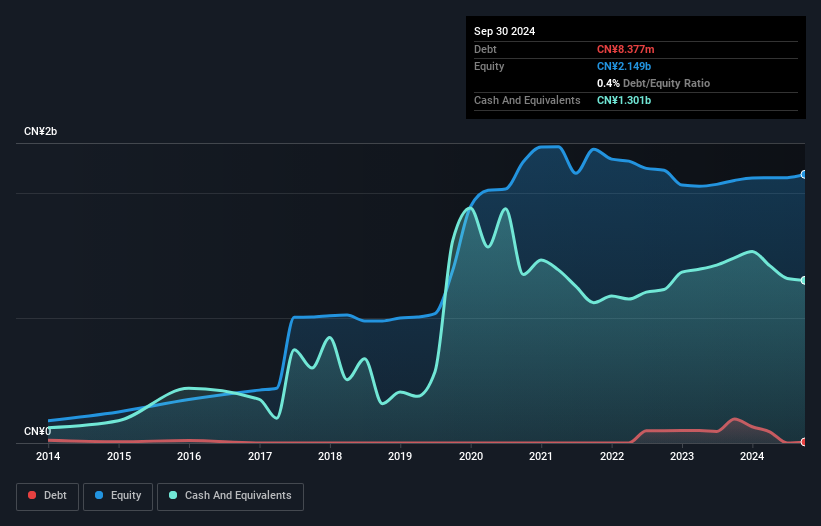

Overview: Shenzhen Genvict Technologies Co., Ltd. and its subsidiaries focus on the research, development, and industrialization of smart transportation technology in China with a market cap of CN¥5.98 billion.

Operations: Genvict Technologies derives its revenue primarily from the Intelligent Traffic Industry, amounting to CN¥518.02 million.

Genvict Technologies, a notable player in the electronics sector, has shown impressive financial resilience. With no debt on its books for the past five years, it boasts a high level of non-cash earnings and has achieved a remarkable 142% earnings growth over the past year, outpacing industry averages. Despite this success, its share price remains highly volatile. Recent reports indicate sales of CNY 352 million for nine months ending September 2024, with net income rising to CNY 31 million from CNY 26 million last year. This performance suggests strong potential as earnings are forecasted to grow by over 36% annually.

Ningbo CixingLtd (SZSE:300307)

Simply Wall St Value Rating: ★★★★☆☆

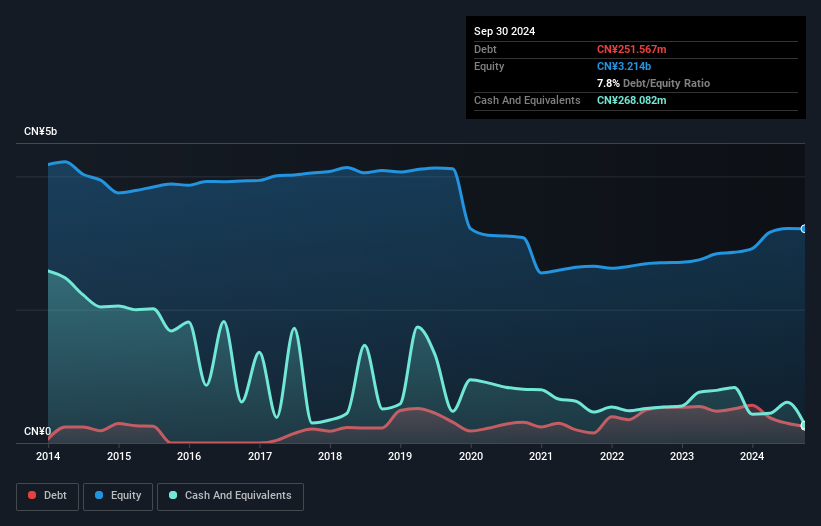

Overview: Ningbo Cixing Co., Ltd. is a company that manufactures and sells knitting machinery both in China and internationally, with a market cap of CN¥6.41 billion.

Operations: Ningbo Cixing Co., Ltd. generates revenue primarily from the sale of knitting machinery in domestic and international markets. The company's net profit margin has shown variability, reflecting changes in cost structures and market conditions.

Ningbo Cixing, a player in the machinery sector, has shown significant earnings growth of 142% over the past year, outpacing its industry. The company's price-to-earnings ratio stands at 20.9x, which is attractive compared to the broader CN market average of 34.3x. Despite a slight increase in its debt-to-equity ratio from 7.6% to 7.8% over five years, Ningbo Cixing's interest coverage remains strong and not concerning. Recent financial results highlight substantial net income growth for the nine months ending September 2024 at CNY 309 million from last year's CNY 117 million, reflecting robust operational performance and profitability improvements.

- Click here and access our complete health analysis report to understand the dynamics of Ningbo CixingLtd.

Gain insights into Ningbo CixingLtd's past trends and performance with our Past report.

Where To Now?

- Discover the full array of 4743 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo CixingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300307

Ningbo CixingLtd

Manufactures and sells knitting machinery in China and internationally.

Solid track record with adequate balance sheet and pays a dividend.