Shareholders in Kunming Yunnei PowerLtd (SZSE:000903) have lost 25%, as stock drops 11% this past week

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Kunming Yunnei Power Co.,Ltd. (SZSE:000903) shareholders, since the share price is down 26% in the last three years, falling well short of the market decline of around 9.6%. The last month has also been disappointing, with the stock slipping a further 30%.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Kunming Yunnei PowerLtd

Because Kunming Yunnei PowerLtd made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Kunming Yunnei PowerLtd's revenue dropped 19% per year. That's definitely a weaker result than most pre-profit companies report. With revenue in decline, the share price decline of 8% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

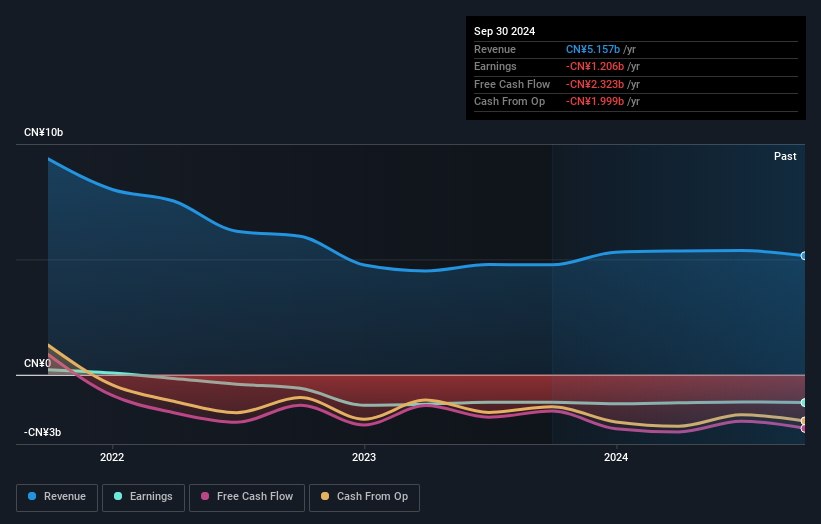

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Investors in Kunming Yunnei PowerLtd had a tough year, with a total loss of 2.3%, against a market gain of about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Kunming Yunnei PowerLtd better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Kunming Yunnei PowerLtd you should know about.

Of course Kunming Yunnei PowerLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kunming Yunnei PowerLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000903

Kunming Yunnei PowerLtd

Engages in the research and development, manufacture, and sale of diesel engines for commercial vehicles and passenger cars in the People’s Republic of China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives