- China

- /

- Electrical

- /

- SHSE:688191

Exploring High Insider Ownership Growth Companies On The Chinese Exchange

Reviewed by Simply Wall St

Amid fluctuating global markets, Chinese stocks have recently faced headwinds, notably due to persistent concerns over U.S. interest rates overshadowing Beijing's proactive measures to support its housing sector. In such an environment, exploring growth companies with high insider ownership on the Chinese exchange could offer intriguing insights into firms potentially poised for resilience and informed strategic direction.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

| Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 58.6% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's uncover some gems from our specialized screener.

Zhiyang Innovation Technology (SHSE:688191)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhiyang Innovation Technology Co., Ltd. is a company based in China that specializes in manufacturing and selling power equipment, with a market capitalization of approximately CN¥2.88 billion.

Operations: The firm operates primarily in the power equipment sector in China.

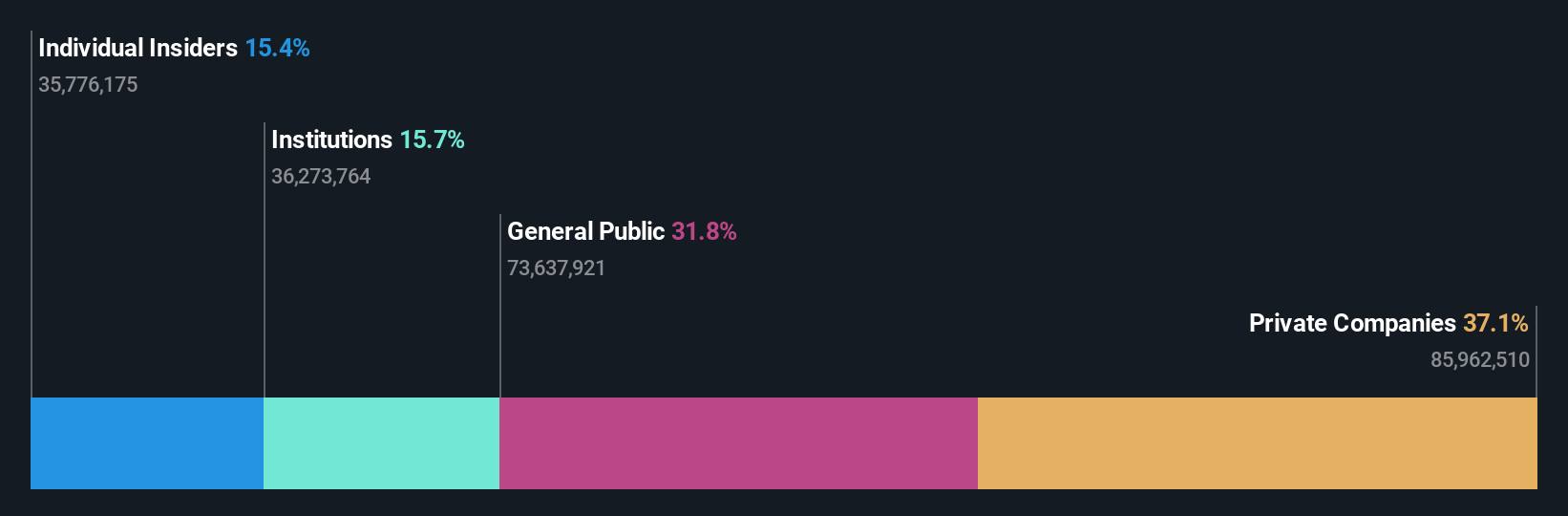

Insider Ownership: 15.1%

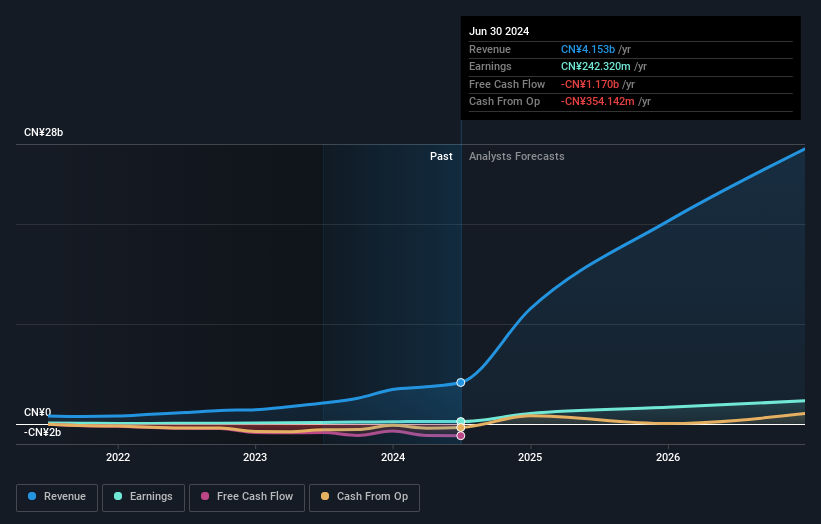

Zhiyang Innovation Technology, while trading at 56.3% below its estimated fair value, shows a promising growth trajectory with earnings expected to surge significantly over the next three years. Despite a highly volatile share price and unstable dividend track record, the company's revenue and earnings growth outpace market forecasts significantly. Recent buybacks indicate management’s confidence in the company's value, although recent financials show a net loss reduction from last year's figures.

- Get an in-depth perspective on Zhiyang Innovation Technology's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Zhiyang Innovation Technology shares in the market.

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030)

Simply Wall St Growth Rating: ★★★★★★

Overview: Suzhou Shijing Environmental Technology Ltd, operating under the ticker SZSE:301030, is an environmental technology company with a market capitalization of approximately CN¥7.04 billion.

Operations: The company generates revenue primarily from its pollution and treatment control products segment, totaling approximately CN¥3.73 billion.

Insider Ownership: 15.7%

Suzhou Shijing Environmental Technology Ltd. is poised for robust growth with its earnings and revenue projected to expand by 54.93% and 54.7% annually, outperforming the broader Chinese market significantly. Despite a promising P/E ratio of 27x, which is below the market average, concerns remain about its debt levels not being well covered by operating cash flow and dividends that are poorly supported by cash flows. Recent financials reveal a substantial increase in both sales and net income, reflecting strong operational performance.

- Navigate through the intricacies of Suzhou Shijing Environmental TechnologyLtd with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Suzhou Shijing Environmental TechnologyLtd's share price might be on the expensive side.

Zhejiang Fengmao Technology (SZSE:301459)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Fengmao Technology Co., Ltd. specializes in the research, development, manufacturing, and sales of belt-driven, fluid pipeline, and rubber sealing systems in China, with a market capitalization of approximately CN¥3.66 billion.

Operations: The company generates CN¥820.64 million in revenue from its machinery and industrial equipment segment.

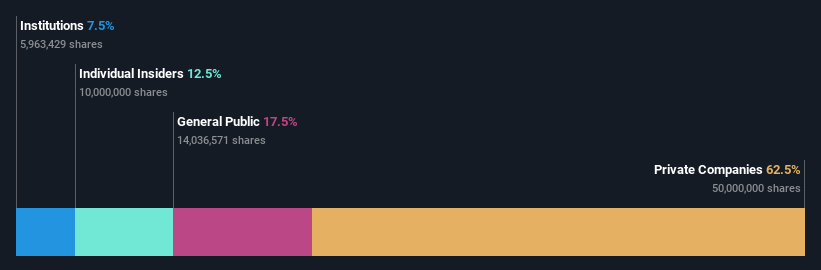

Insider Ownership: 12.5%

Zhejiang Fengmao Technology Co., Ltd. demonstrates promising growth with earnings and revenue forecasted to increase by 25.37% and 25.2% annually, respectively, surpassing the Chinese market averages. Despite a lower-than-average P/E ratio of 25.8x compared to the CN market's 31.1x, concerns arise from its low projected return on equity of 10.7% in three years and an unstable dividend track record. Recent financials show a year-over-year earnings growth of 26.4%, with dividends recently affirmed at CNY 4 per ten shares for 2023.

- Delve into the full analysis future growth report here for a deeper understanding of Zhejiang Fengmao Technology.

- Our valuation report here indicates Zhejiang Fengmao Technology may be overvalued.

Where To Now?

- Click through to start exploring the rest of the 405 Fast Growing Chinese Companies With High Insider Ownership now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhiyang Innovation Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688191

Zhiyang Innovation Technology

Manufactures and sells power equipment in China.

High growth potential with excellent balance sheet.