In recent weeks, global markets have experienced notable gains, with U.S. small-cap indices like the Russell 2000 reaching record highs despite geopolitical tensions and tariff concerns. This positive momentum highlights the resilience of smaller companies in navigating complex economic landscapes, making it an opportune time to explore stocks that may be undervalued or overlooked by mainstream investors. Identifying such gems often involves looking for companies with strong fundamentals and growth potential that can thrive even amid broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Zhejiang Xidamen New MaterialLtd (SHSE:605155)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Xidamen New Material Co., Ltd. specializes in the R&D, design, production, and sale of indoor and outdoor light and heat block products as well as anti-dust, anti-UV, and energy-saving solutions in China with a market cap of approximately CN¥2.14 billion.

Operations: Zhejiang Xidamen New Material Co., Ltd. generates revenue through the sale of light and heat block, anti-dust, anti-UV, and energy-saving products. The company's market cap is approximately CN¥2.14 billion.

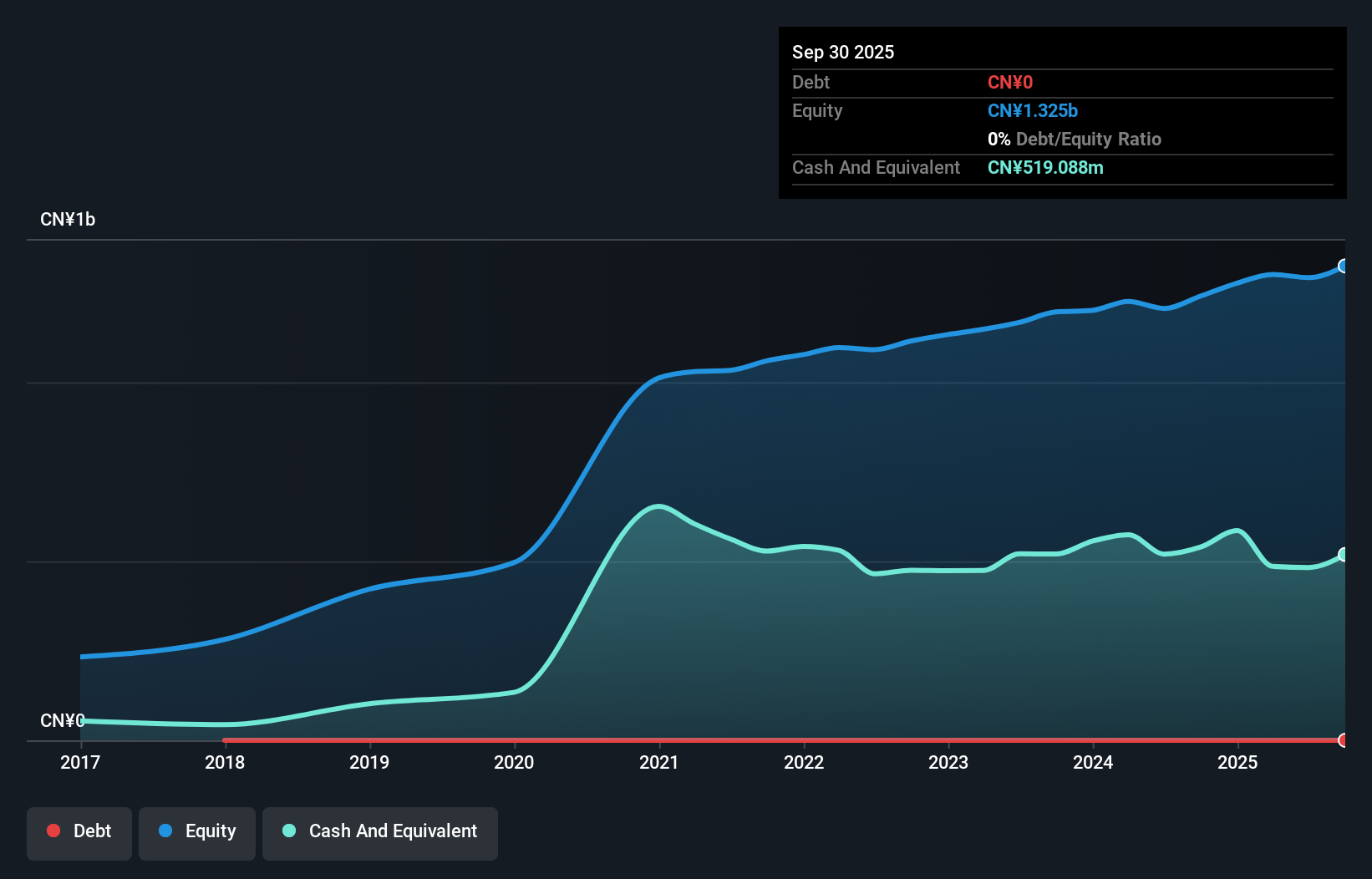

Zhejiang Xidamen, a small player in the new materials sector, has shown robust performance with sales climbing to CNY 589.65 million for the first nine months of 2024 from CNY 451.42 million last year. Net income rose to CNY 86.92 million from CNY 75.85 million, indicating strong earnings quality and profitability without debt concerns over the past five years. The company's Price-To-Earnings ratio of 21x is notably below the Chinese market average of 36x, suggesting it might be undervalued relative to peers. Earnings growth outpaced industry averages by hitting a commendable rise of 10.6% recently, reflecting its competitive edge in an industry that saw an -8% change overall.

Shenzhen Laibao Hi-Tech (SZSE:002106)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Laibao Hi-Tech Co., Ltd. focuses on the R&D, production, and sale of flat panel display upstream materials and touch devices in China, with a market cap of CN¥7.94 billion.

Operations: Shenzhen Laibao Hi-Tech generates revenue primarily from the sale of flat panel display upstream materials and touch devices. The company's financial performance is highlighted by its gross profit margin, which has shown notable fluctuations in recent periods.

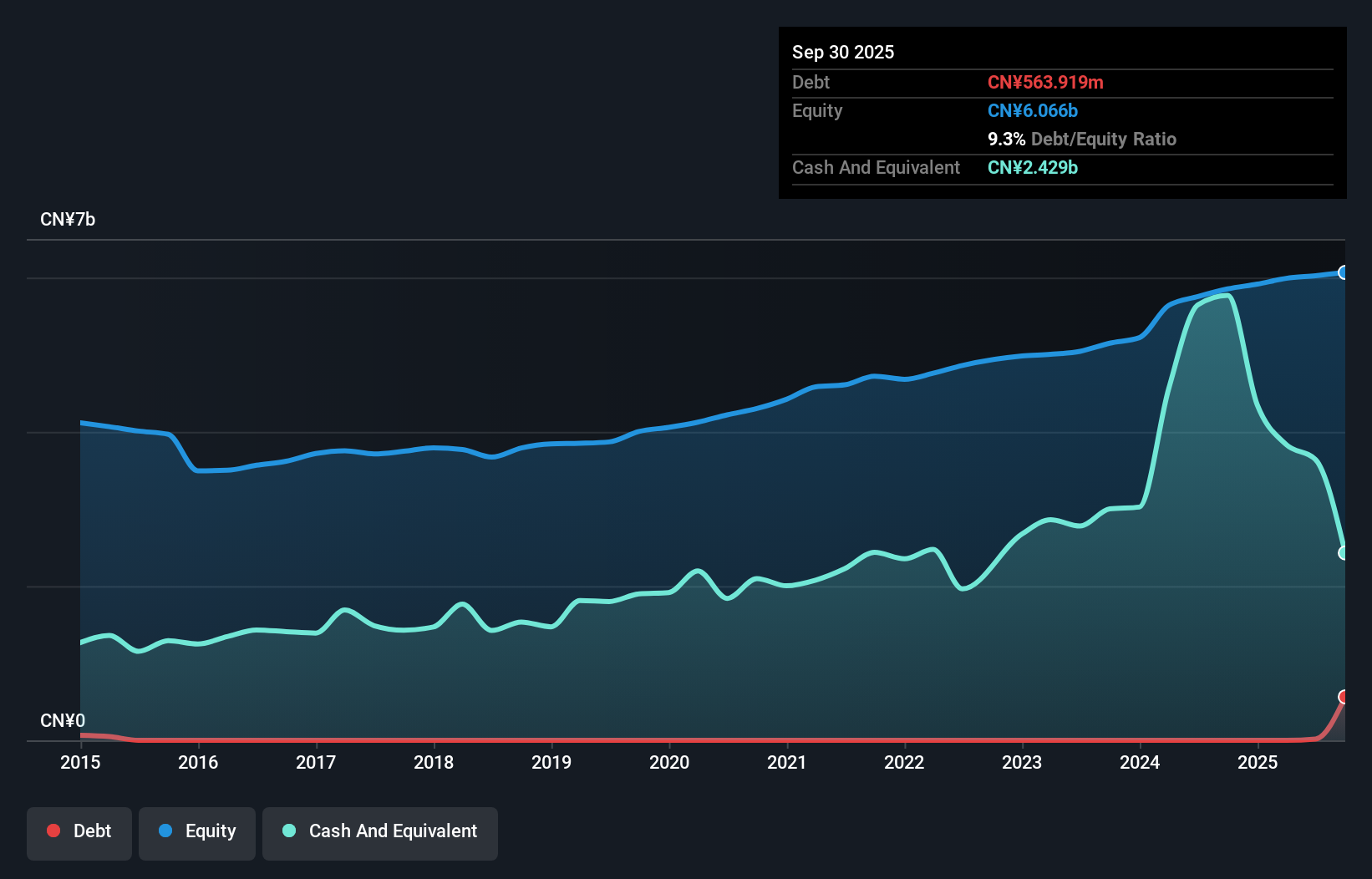

Shenzhen Laibao Hi-Tech, a nimble player in the electronics sector, has shown promising financial health with earnings growth of 21.9% over the past year, outpacing the industry average of 1.8%. The company's debt-free status enhances its appeal, ensuring no interest coverage concerns and suggesting robust financial management. Recent earnings reports highlight sales reaching CNY 4.41 billion for nine months ending September 2024, up from CNY 4.23 billion a year prior, with net income slightly rising to CNY 309 million from CNY 303 million. Trading at a price-to-earnings ratio of 20.8x below the market average signals potential value for investors seeking growth opportunities in this space.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Laibao Hi-Tech.

Understand Shenzhen Laibao Hi-Tech's track record by examining our Past report.

Nohmi Bosai (TSE:6744)

Simply Wall St Value Rating: ★★★★★★

Overview: Nohmi Bosai Ltd. specializes in the development, marketing, installation, and maintenance of fire protection systems across Japan, China, other parts of Asia, and the United States with a market capitalization of ¥174.33 billion.

Operations: The company's primary revenue streams include the development, marketing, installation, and maintenance of fire protection systems across various regions. It operates with a market capitalization of ¥174.33 billion.

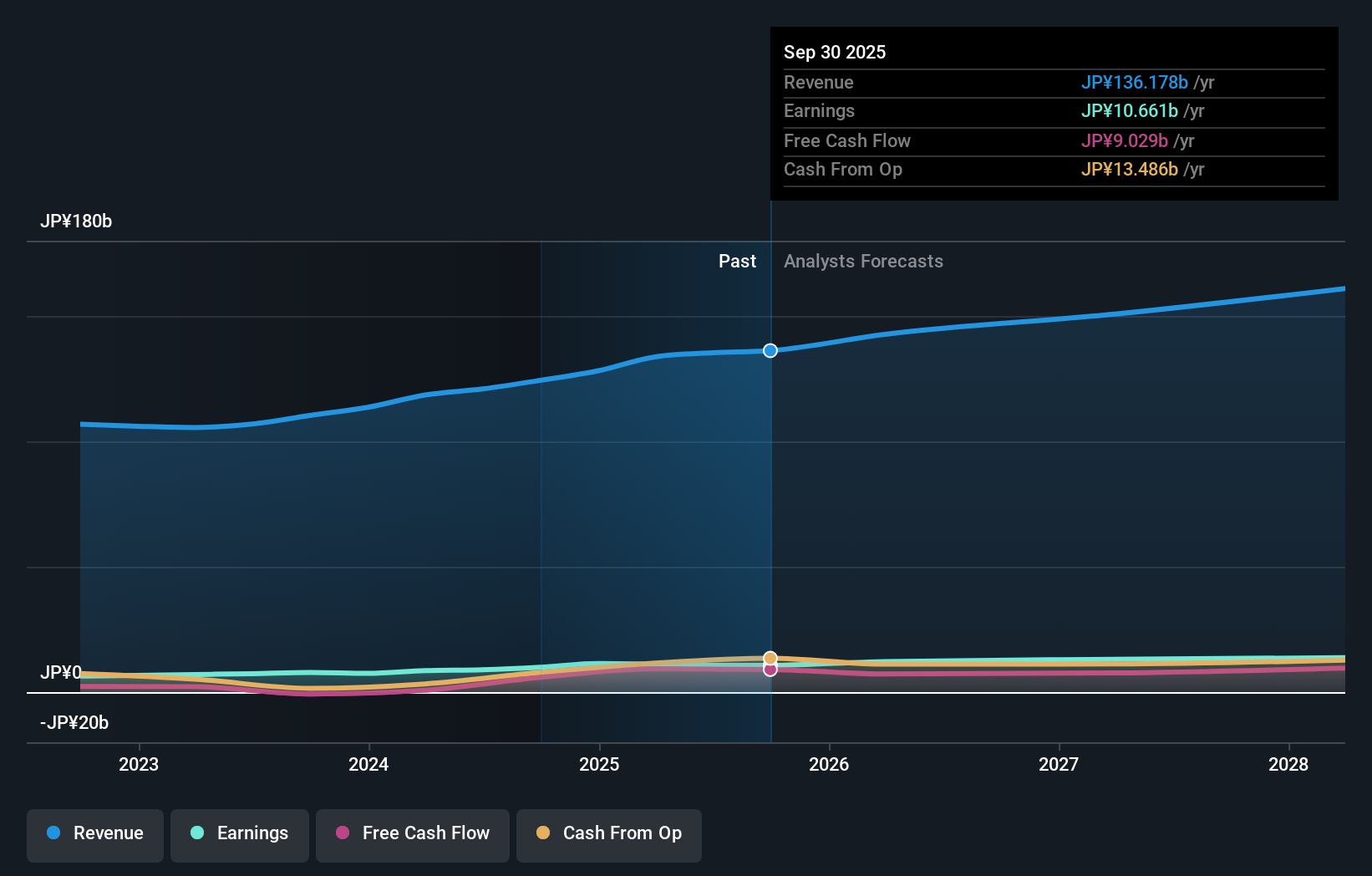

Nohmi Bosai, a nimble player in its industry, has shown robust financial health with no debt currently compared to a 0.2% debt to equity ratio five years ago. The company's earnings surged by 27% over the past year, outpacing the electronic industry's -2.3%, highlighting its competitive edge. Despite recent share price volatility, Nohmi Bosai's high-quality earnings and profitability ensure that cash runway is not a concern. Looking ahead, their guidance for fiscal year ending March 2025 anticipates net sales of ¥130 billion and operating income of ¥14 billion, suggesting steady growth potential in the near term.

- Click to explore a detailed breakdown of our findings in Nohmi Bosai's health report.

Evaluate Nohmi Bosai's historical performance by accessing our past performance report.

Where To Now?

- Investigate our full lineup of 4637 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Xidamen New MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605155

Zhejiang Xidamen New MaterialLtd

Engages in the research and development, design, production, and sale of indoor and outdoor light and heat block, anti-dust, anti-UV, and energy saving products in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives