- China

- /

- Electronic Equipment and Components

- /

- SZSE:300897

Unearthing November 2024's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have captured investor attention with the Russell 2000 Index leading gains, reflecting optimism over potential growth-friendly policies. Amidst this backdrop of economic shifts and rate adjustments, identifying promising small-cap stocks requires a keen eye for companies that can leverage these changing conditions to enhance their market position and financial performance.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bank MNC Internasional | 11.85% | 4.80% | 43.63% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Koal Software (SHSE:603232)

Simply Wall St Value Rating: ★★★★★★

Overview: Koal Software Co., Ltd. is a Chinese company that develops public key infrastructure platforms, with a market cap of CN¥3.27 billion.

Operations: Koal Software generates revenue through its development of public key infrastructure platforms in China. The company has a market capitalization of CN¥3.27 billion.

Koal Software, a smaller player in the software industry, shows intriguing potential despite recent challenges. With a price-to-earnings ratio of 94.3x, it sits below the industry average of 96.2x, suggesting some value appeal. The company's earnings skyrocketed by 705% over the past year, outpacing an industry decline of 11%. Despite this impressive growth and being debt-free for five years, Koal reported a net loss of CN¥38 million for the nine months ending September 2024. A significant one-off gain of CN¥27 million impacted its financial results recently, adding complexity to its performance narrative.

- Delve into the full analysis health report here for a deeper understanding of Koal Software.

Gain insights into Koal Software's historical performance by reviewing our past performance report.

L&K Engineering (Suzhou)Ltd (SHSE:603929)

Simply Wall St Value Rating: ★★★★★★

Overview: L&K Engineering (Suzhou) Co., Ltd. offers specialized engineering technical services in China and has a market cap of CN¥6 billion.

Operations: L&K Engineering (Suzhou) Co., Ltd. generates revenue through its specialized engineering technical services in China, contributing to a market capitalization of CN¥6 billion. The company focuses on optimizing its cost structure to enhance profitability, with particular attention to managing expenses related to service delivery. Notably, the gross profit margin has shown significant variation over recent periods.

L&K Engineering (Suzhou) Ltd. showcases impressive growth, with earnings surging by 59% over the past year, outpacing the construction industry's -4%. The company reported sales of CNY 4.42 billion for the first nine months of 2024, up from CNY 1.82 billion a year prior, and net income rose to CNY 439 million from CNY 229 million. Trading at nearly 40% below estimated fair value suggests potential upside. With no debt on its books and positive free cash flow, L&K seems well-positioned financially while maintaining high-quality earnings amidst industry challenges.

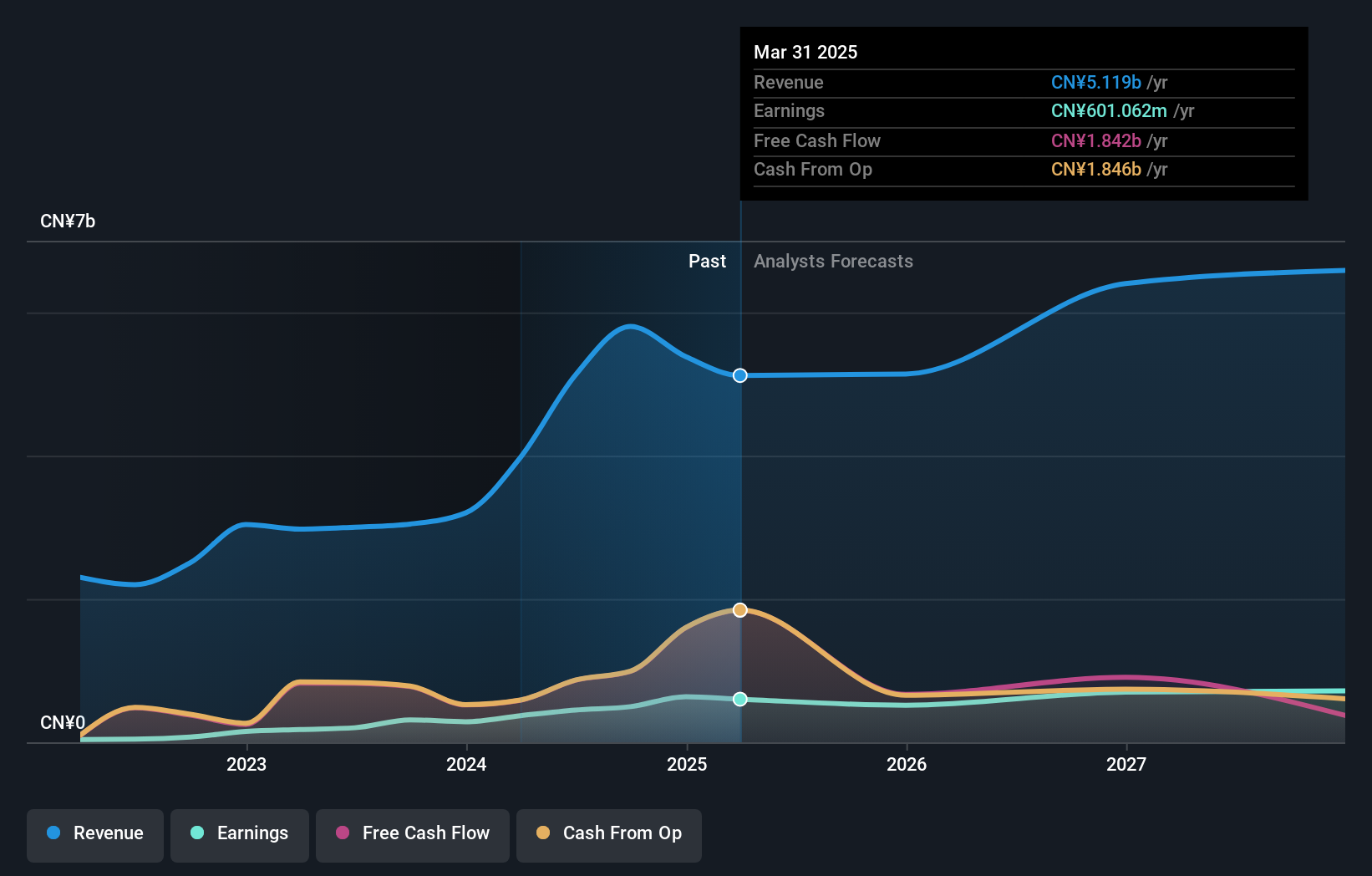

Hangzhou Seck Intelligent Technology (SZSE:300897)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou Seck Intelligent Technology Co., Ltd. specializes in the intelligent instrumentation manufacturing industry with a market cap of approximately CN¥2.34 billion.

Operations: Hangzhou Seck Intelligent Technology generates revenue primarily from the intelligent instrumentation manufacturing industry, amounting to CN¥678.10 million.

Hangzhou Seck Intelligent Technology, a smaller player in the electronics sector, has shown promising growth with earnings increasing by 10.6% over the past year, outpacing the industry average of 1.7%. The company is debt-free and boasts high-quality earnings, which is reflected in its price-to-earnings ratio of 26.2x—below the market average of 36.3x. Recent financials reveal sales for nine months reached CNY 490 million from CNY 455 million last year, while net income rose to CNY 64 million from CNY 61 million. Additionally, it repurchased over a million shares this year for approximately CNY 22 million.

Where To Now?

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4671 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Seck Intelligent Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300897

Hangzhou Seck Intelligent Technology

Hangzhou Seck Intelligent Technology Co., Ltd.

Flawless balance sheet with solid track record.