Three Undiscovered Gems With Strong Fundamentals November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have captured investor attention with the Russell 2000 Index leading gains, despite not reaching record highs. In this environment of anticipated economic growth and regulatory changes, identifying stocks with strong fundamentals becomes crucial for investors seeking opportunities in the evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bank MNC Internasional | 11.85% | 4.80% | 43.63% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shanghai Laimu ElectronicsLtd (SHSE:603633)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Laimu Electronics Co., Ltd. is engaged in the research, development, production, and sale of precision electronic components in China with a market cap of CN¥3.14 billion.

Operations: Laimu Electronics generates revenue primarily from the sale of precision electronic components. The company has a market cap of CN¥3.14 billion, indicating its scale within the industry.

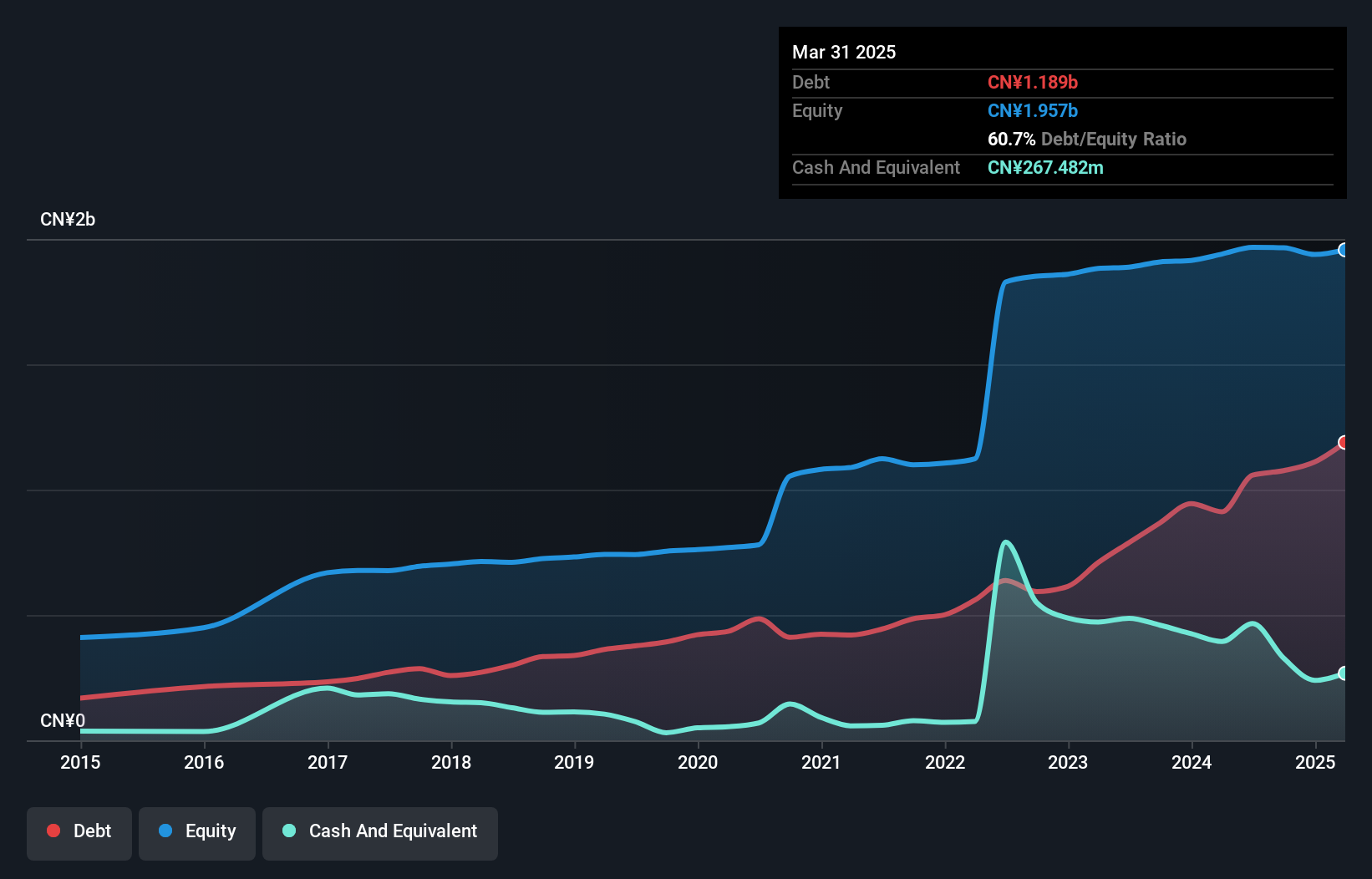

Shanghai Laimu Electronics, a smaller player in the electronics sector, reported sales of CNY 1.05 billion for the nine months ending September 2024, up from CNY 777.64 million a year prior. Net income also saw an uptick to CNY 70.09 million compared to last year's CNY 65.74 million, reflecting steady growth with basic earnings per share rising slightly to CNY 0.16 from CNY 0.15 previously. The company boasts high-quality earnings and its net debt to equity ratio sits at a satisfactory level of 38%, indicating prudent financial management despite an increase over five years from 52% to nearly 55%.

Jiangsu Tongli Risheng Machinery (SHSE:605286)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Tongli Risheng Machinery Co., Ltd. operates in the machinery manufacturing industry and has a market cap of CN¥4.73 billion.

Operations: The company generates revenue primarily from machinery manufacturing. It has a market cap of CN¥4.73 billion, indicating its scale in the industry.

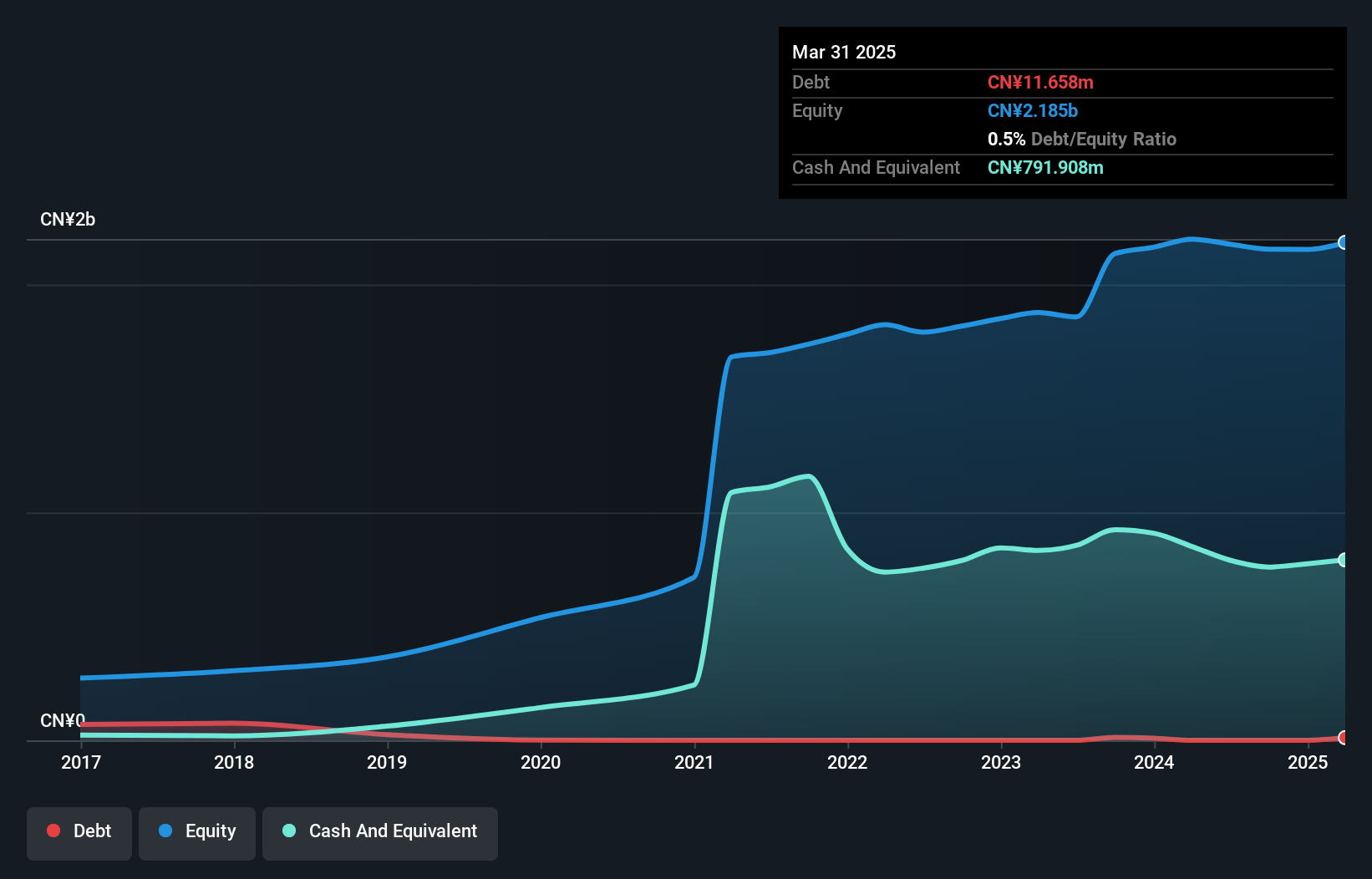

Jiangsu Tongli Risheng Machinery, a promising smaller player in the machinery sector, has shown impressive financial resilience. Over the past five years, its debt to equity ratio significantly reduced from 34.9% to 5.9%, indicating a solid balance sheet position. The company's earnings surged by 64% last year, outpacing the industry average of -0.4%. Furthermore, it trades at nearly 90% below estimated fair value, suggesting potential undervaluation. Recent reports highlight revenue growth from CNY 1,789 million to CNY 2,271 million over nine months and net income rising from CNY 144 million to CNY 219 million compared to last year.

JiangSu Changling HydraulicLtd (SHSE:605389)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Changling Hydraulic Co., Ltd specializes in the research, development, production, and sale of hydraulic components both in China and internationally, with a market capitalization of CN¥3.12 billion.

Operations: JiangSu Changling Hydraulic Ltd generates revenue through the production and sale of hydraulic components, with a market capitalization of CN¥3.12 billion.

JiangSu Changling Hydraulic, a nimble player in the machinery sector, showcases an appealing Price-To-Earnings ratio of 29.4x, undercutting the broader CN market's 36.3x. Over the past year, its earnings growth of 6.2% outpaced the industry average of -0.4%, reflecting strong performance against peers. The company has no debt now compared to five years ago when its debt-to-equity ratio was at 1.4%, indicating improved financial health and flexibility for future endeavors. Recent results for nine months ending September show sales hit CNY 678 million with net income rising to CNY 91 million from last year's figures, highlighting solid operational progress this year.

Make It Happen

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4671 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605389

JiangSu Changling HydraulicLtd

Jiangsu Changling Hydraulic Co.,Ltd researches and develops, produces, and sells hydraulic components in China and internationally.

Flawless balance sheet with acceptable track record.