- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2480

Undiscovered Gems To Explore In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with the Russell 2000 Index hitting an intraday peak, small-cap stocks are gaining attention amidst a backdrop of geopolitical developments and economic indicators. The recent nomination of Scott Bessent as Treasury secretary has further influenced market sentiment, emphasizing a focus on economic stability. In this dynamic environment, identifying promising stocks often involves looking for companies with strong fundamentals that can thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saha-Union | 0.48% | -1.12% | 8.28% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Thai Steel Cable | NA | 2.46% | 16.55% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Gem-Year IndustrialLtd (SHSE:601002)

Simply Wall St Value Rating: ★★★★★★

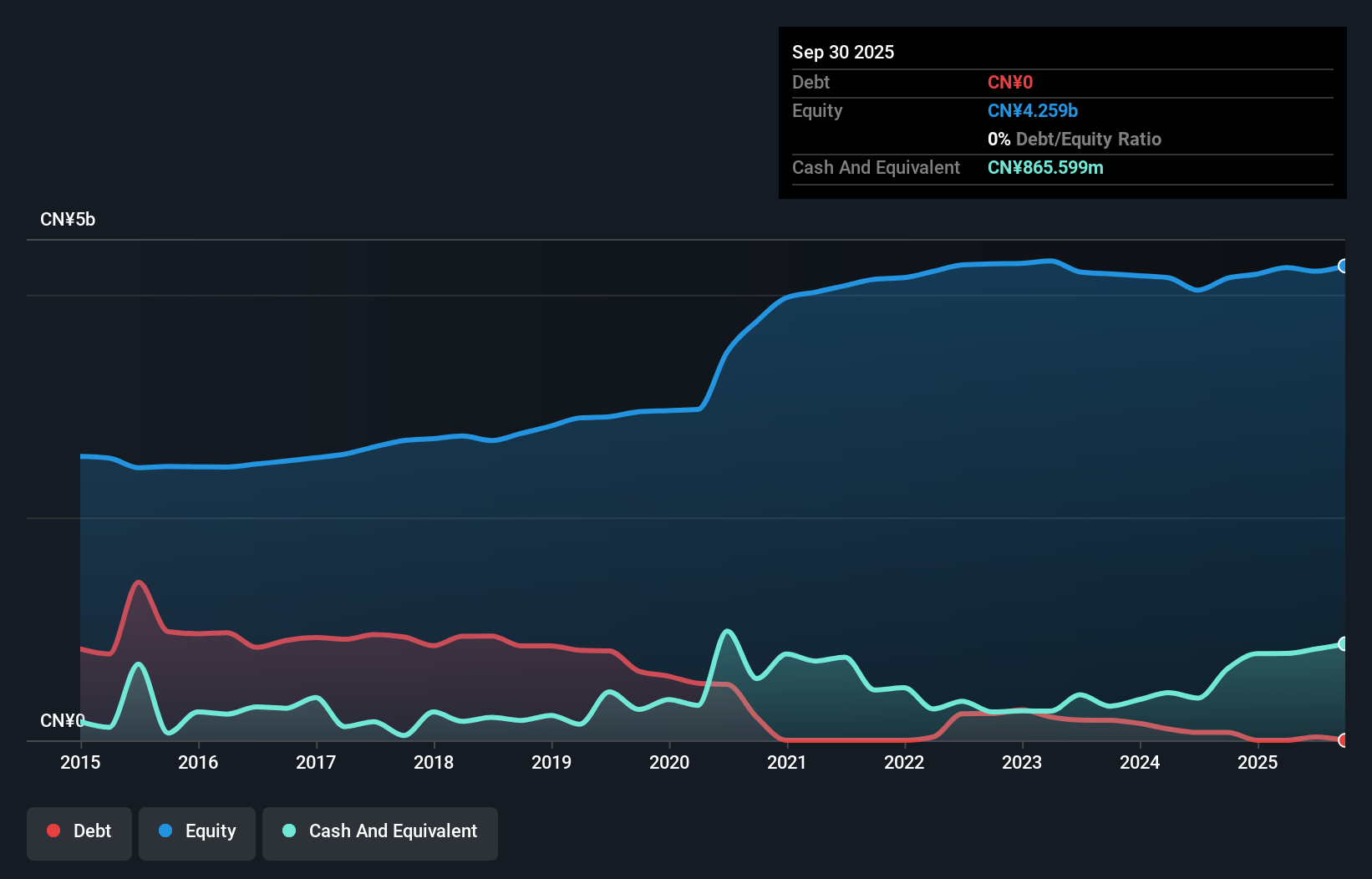

Overview: Gem-Year Industrial Co., Ltd. focuses on the research, development, production, and distribution of fasteners in China and has a market capitalization of CN¥4.52 billion.

Operations: Gem-Year Industrial Co., Ltd. generates revenue primarily from the production and distribution of fasteners in China. The company's financial performance includes a notable net profit margin trend, which provides insights into its profitability relative to total revenue.

Gem-Year Industrial, a small cap player in the machinery sector, has shown impressive earnings growth of 886% over the past year, outpacing its industry. The company reported a net income of CNY 81.47 million for the first nine months of 2024, bouncing back from a loss in the previous year. With high-quality earnings and trading at 90.7% below its estimated fair value, it seems undervalued. Additionally, Gem-Year's debt to equity ratio improved significantly from 21% to just 1.7% over five years, indicating sound financial management and potential for future stability in cash flow generation.

Jiangsu Seagull Cooling TowerLtd (SHSE:603269)

Simply Wall St Value Rating: ★★★★★☆

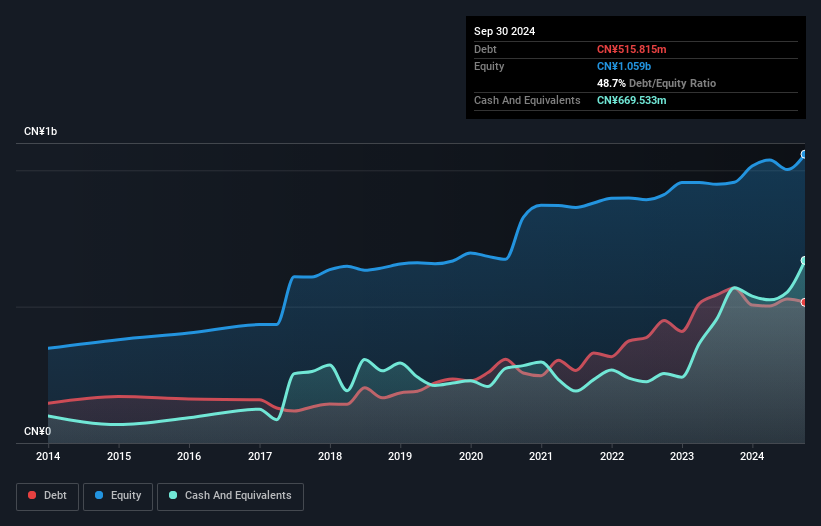

Overview: Jiangsu Seagull Cooling Tower Co., Ltd. specializes in the design, research and development, manufacturing, and installation of cooling towers both in China and internationally, with a market capitalization of CN¥2.31 billion.

Operations: Seagull Cooling Tower generates revenue primarily from its General Equipment Manufacturing segment, amounting to CN¥1.60 billion.

Jiangsu Seagull Cooling Tower Co.,Ltd. seems to be an intriguing player in its field, with earnings growth of 24.3% over the past year outperforming the construction industry average of -3.9%. The company reported net income of CN¥40.95 million for the nine months ending September 2024, up from CN¥37.07 million a year ago, indicating solid performance despite a large one-off gain of CN¥34.4 million affecting recent results. Trading at 75.5% below estimated fair value and boasting more cash than total debt, Jiangsu Seagull likely holds potential for those seeking undervalued opportunities in niche markets.

Stark Technology (TWSE:2480)

Simply Wall St Value Rating: ★★★★★☆

Overview: Stark Technology Inc. offers system integration services for information and communication technology products in Taiwan, with a market cap of NT$14.68 billion.

Operations: Stark Technology generates revenue primarily from its computer services segment, amounting to NT$7.27 billion.

Stark Technology, a nimble player in its field, has been making waves with its recent performance. Sales for the third quarter reached TWD 1.76 billion, slightly higher than last year's TWD 1.69 billion, while net income stood at TWD 181.61 million compared to TWD 184.21 million previously. Despite a minor dip in earnings per share from continuing operations to TWD 1.71 from TWD 1.73, the company remains profitable and boasts high-quality earnings alongside positive free cash flow of US$833 million as of September 2024's end quarter—indicating robust financial health despite industry challenges and a rising debt-to-equity ratio over five years from 1.3% to now standing at about double that figure (2%).

- Delve into the full analysis health report here for a deeper understanding of Stark Technology.

Evaluate Stark Technology's historical performance by accessing our past performance report.

Where To Now?

- Click this link to deep-dive into the 4633 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2480

Stark Technology

Provides system integration services for information and communication technology products in Taiwan.

6 star dividend payer with excellent balance sheet.