Shanghai Hugong Electric GroupLtd (SHSE:603131 shareholders incur further losses as stock declines 10% this week, taking three-year losses to 25%

No-one enjoys it when they lose money on a stock. But it's hard to avoid some disappointing investments when the overall market is down. While the Shanghai Hugong Electric Group Co.,Ltd. (SHSE:603131) share price is down 25% in the last three years, the total return to shareholders (which includes dividends) was -25%. And that total return actually beats the market decline of 27%. The last week also saw the share price slip down another 10%.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Shanghai Hugong Electric GroupLtd

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

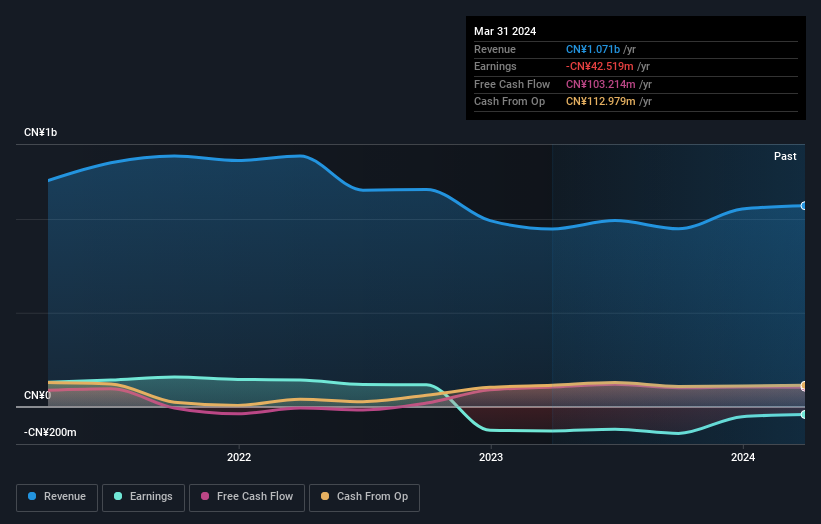

Shanghai Hugong Electric GroupLtd has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

We think that the revenue decline over three years, at a rate of 11% per year, probably had some shareholders looking to sell. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Shanghai Hugong Electric GroupLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Shanghai Hugong Electric GroupLtd shareholders have received a total shareholder return of 11% over the last year. That certainly beats the loss of about 2% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Shanghai Hugong Electric GroupLtd (1 can't be ignored!) that you should be aware of before investing here.

But note: Shanghai Hugong Electric GroupLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603131

Shanghai Hugong Electric GroupLtd

Manufactures and sells welding and cutting equipment in China.

Excellent balance sheet and slightly overvalued.