- China

- /

- Aerospace & Defense

- /

- SHSE:600184

November 2024's Select Stocks Priced Below Estimated Fair Value

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are keenly observing how policy changes might influence future economic growth and inflation. Amidst this backdrop of optimism driven by anticipated tax cuts and deregulation, identifying stocks priced below their estimated fair value becomes particularly appealing for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Arteche Lantegi Elkartea (BME:ART) | €6.05 | €12.01 | 49.6% |

| Appier Group (TSE:4180) | ¥1700.00 | ¥3393.11 | 49.9% |

| XPEL (NasdaqCM:XPEL) | US$45.67 | US$91.12 | 49.9% |

| Cettire (ASX:CTT) | A$1.475 | A$2.94 | 49.9% |

| AirBoss of America (TSX:BOS) | CA$4.05 | CA$8.27 | 51% |

| Mona YongpyongLtd (KOSE:A070960) | ₩3380.00 | ₩6757.77 | 50% |

| KeePer Technical Laboratory (TSE:6036) | ¥3900.00 | ¥7791.60 | 49.9% |

| Redcentric (AIM:RCN) | £1.1625 | £2.32 | 50% |

| Nayuki Holdings (SEHK:2150) | HK$1.59 | HK$3.16 | 49.7% |

| QuinStreet (NasdaqGS:QNST) | US$23.42 | US$46.52 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

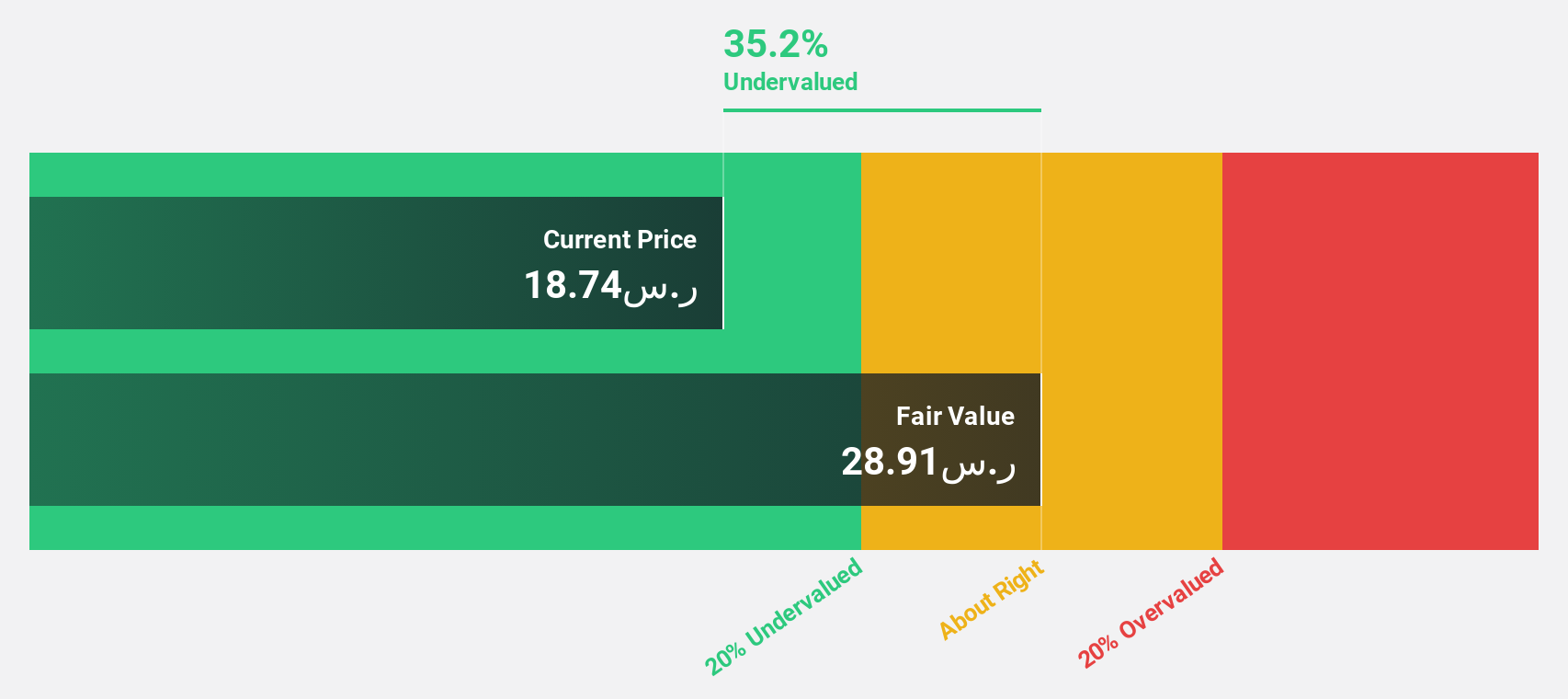

Yanbu Cement (SASE:3060)

Overview: Yanbu Cement Company, with a market cap of SAR3.72 billion, is involved in the manufacturing, production, and trading of cement and related products both within the Kingdom of Saudi Arabia and internationally.

Operations: The company's revenue is primarily derived from its cement manufacturing segment, which generated SAR822.17 million.

Estimated Discount To Fair Value: 43.8%

Yanbu Cement is trading at SAR 23.64, significantly below its estimated fair value of SAR 42.07, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow at a robust 25.8% annually, outpacing the Saudi Arabian market's growth rate of 7.5%. However, despite a dividend yield of 6.35%, it's not well covered by free cash flows, and the return on equity is expected to remain low at 10.4% in three years.

- Our expertly prepared growth report on Yanbu Cement implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Yanbu Cement.

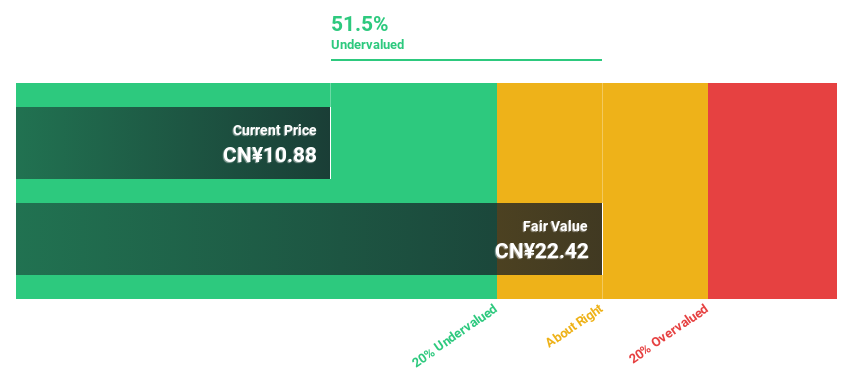

North Electro-OpticLtd (SHSE:600184)

Overview: North Electro-Optic Co., Ltd. engages in the research, development, production, and sale of optoelectronic materials and devices both in China and internationally, with a market cap of CN¥5.91 billion.

Operations: North Electro-Optic Co., Ltd. generates revenue through its activities in the research, development, production, and sale of optoelectronic materials and devices globally.

Estimated Discount To Fair Value: 48.5%

North Electro-Optic Ltd. is trading at CN¥11.62, well below its estimated fair value of CN¥22.57, highlighting potential undervaluation based on cash flows. Despite a forecasted significant earnings growth of 46% annually, recent financial results show declining performance with net income dropping to CN¥1.11 million from CN¥43.91 million year-over-year and reduced profit margins from 2.6% to 1.5%. Additionally, the company's return on equity is expected to remain low at 3.4% in three years.

- In light of our recent growth report, it seems possible that North Electro-OpticLtd's financial performance will exceed current levels.

- Take a closer look at North Electro-OpticLtd's balance sheet health here in our report.

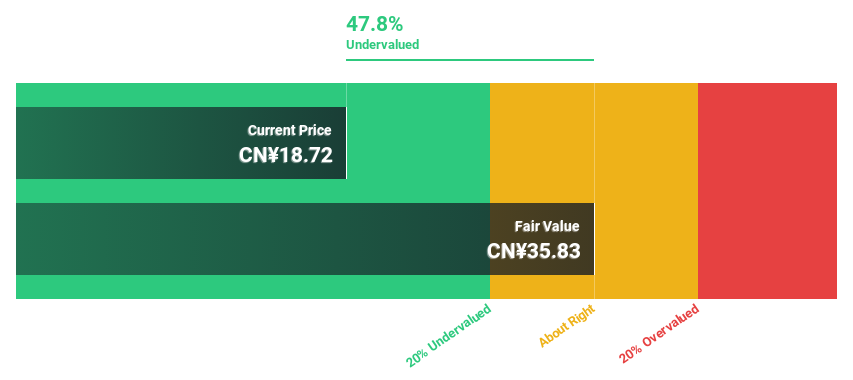

Delixi New Energy Technology (SHSE:603032)

Overview: Delixi New Energy Technology Co., Ltd. is involved in the research, development, design, manufacture, sale, and servicing of lithium battery equipment both in China and internationally with a market cap of approximately CN¥4.31 billion.

Operations: Revenue Segments (in millions of CN¥): The company generates revenue through its activities in research, development, design, manufacturing, sales, and servicing of lithium battery equipment domestically and internationally.

Estimated Discount To Fair Value: 48.7%

Delixi New Energy Technology is trading at CN¥18.4, significantly below its fair value estimate of CN¥35.85, indicating potential undervaluation based on cash flows. Despite recent earnings showing a drop in net income to CNY 16.3 million from CNY 157.01 million year-over-year, revenue is forecast to grow at 26.4% annually, surpassing market expectations. The company is expected to achieve profitability within three years and shows promising growth prospects despite current challenges.

- The growth report we've compiled suggests that Delixi New Energy Technology's future prospects could be on the up.

- Navigate through the intricacies of Delixi New Energy Technology with our comprehensive financial health report here.

Summing It All Up

- Access the full spectrum of 901 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North Electro-OpticLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600184

North Electro-OpticLtd

Researches, develops, produces, and sells optoelectronic materials and devices in China and internationally.

Flawless balance sheet and good value.