- China

- /

- Electrical

- /

- SHSE:688408

3 Chinese Stocks Estimated To Be Undervalued By Up To 47.1%

Reviewed by Simply Wall St

Recent stimulus measures announced by China have sparked optimism in global markets, with significant gains seen across Chinese indices such as the Shanghai Composite and CSI 300. As investors look to capitalize on these developments, identifying undervalued stocks becomes crucial for those seeking potential opportunities in a market buoyed by economic support initiatives.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| JinGuan Electric (SHSE:688517) | CN¥14.82 | CN¥28.98 | 48.9% |

| Sinomine Resource Group (SZSE:002738) | CN¥36.54 | CN¥70.81 | 48.4% |

| Zhejiang Huahai Pharmaceutical (SHSE:600521) | CN¥19.59 | CN¥37.02 | 47.1% |

| Neusoft (SHSE:600718) | CN¥10.25 | CN¥19.45 | 47.3% |

| Zhejiang Great Shengda PackagingLtd (SHSE:603687) | CN¥7.11 | CN¥14.16 | 49.8% |

| Jiangsu Hualan New Pharmaceutical MaterialLtd (SZSE:301093) | CN¥24.74 | CN¥47.06 | 47.4% |

| Crystal Growth & Energy EquipmentLtd (SHSE:688478) | CN¥29.28 | CN¥56.41 | 48.1% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥29.46 | CN¥55.81 | 47.2% |

| Thunder Software TechnologyLtd (SZSE:300496) | CN¥52.55 | CN¥104.19 | 49.6% |

| Ningbo Jifeng Auto Parts (SHSE:603997) | CN¥13.70 | CN¥25.90 | 47.1% |

We'll examine a selection from our screener results.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems in China and internationally, with a market cap of CN¥49.23 billion.

Operations: The company's revenue segments include the production and sale of power distribution and utilization systems both domestically and globally.

Estimated Discount To Fair Value: 15.1%

Ningbo Sanxing Medical Electric Ltd. is trading at CN¥34.89, below its estimated fair value of CN¥41.11, suggesting undervaluation based on cash flows. Recent earnings show strong revenue growth to CN¥6.99 billion from CN¥5.55 billion a year ago and net income rising to CN¥1.15 billion from CN¥869.71 million, indicating robust financial health despite an unstable dividend track record and forecasted earnings growth slightly below the market average at 18.8% annually.

- The growth report we've compiled suggests that Ningbo Sanxing Medical ElectricLtd's future prospects could be on the up.

- Navigate through the intricacies of Ningbo Sanxing Medical ElectricLtd with our comprehensive financial health report here.

China Southern Power Grid TechnologyLtd (SHSE:688248)

Overview: China Southern Power Grid Technology Co., Ltd. operates in the energy sector, focusing on power grid technology and solutions, with a market cap of CN¥19.31 billion.

Operations: I'm sorry, but it seems the revenue segment information is missing from the provided text. If you have more details or another section with this information, I would be happy to help summarize it for you.

Estimated Discount To Fair Value: 17%

China Southern Power Grid Technology Ltd. is trading at CN¥34.2, below its estimated fair value of CN¥41.2, reflecting undervaluation based on cash flows. The company reported half-year sales of CN¥1.55 billion, up from CN¥1.25 billion a year prior, with net income increasing to CN¥184.48 million from CN¥115.78 million, showcasing strong financial performance despite an unstable dividend track record and a forecasted low return on equity in three years (17.4%).

- Insights from our recent growth report point to a promising forecast for China Southern Power Grid TechnologyLtd's business outlook.

- Delve into the full analysis health report here for a deeper understanding of China Southern Power Grid TechnologyLtd.

Arctech Solar Holding (SHSE:688408)

Overview: Arctech Solar Holding Co., Ltd. manufactures and supplies solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects worldwide, with a market cap of approximately CN¥16.89 billion.

Operations: Arctech Solar Holding Co., Ltd. generates revenue through the production and supply of solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for large-scale utility and commercial solar installations globally.

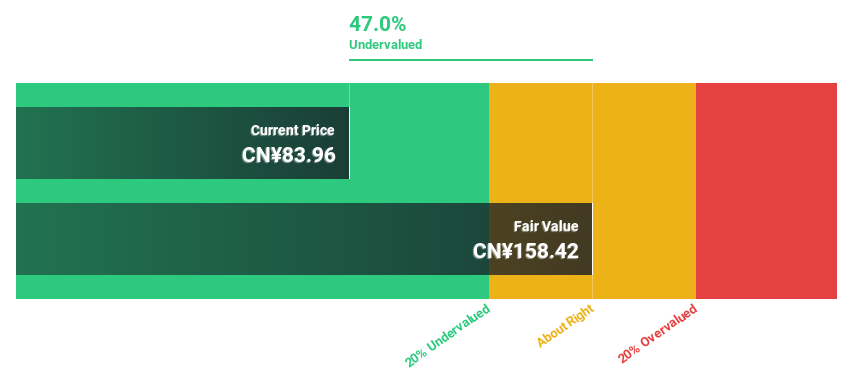

Estimated Discount To Fair Value: 47.1%

Arctech Solar Holding is trading at CN¥83.96, significantly below its estimated fair value of CN¥158.6, highlighting its undervaluation based on cash flows. Recent earnings results show revenue rising to CN¥3.38 billion from CN¥1.92 billion a year ago, with net income increasing to CN¥231.33 million from CN¥98.08 million, demonstrating robust growth despite high share price volatility and a low dividend coverage by free cash flows.

- Our earnings growth report unveils the potential for significant increases in Arctech Solar Holding's future results.

- Take a closer look at Arctech Solar Holding's balance sheet health here in our report.

Summing It All Up

- Get an in-depth perspective on all 114 Undervalued Chinese Stocks Based On Cash Flows by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688408

Arctech Solar Holding

Manufactures and supplies solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects worldwide.

Exceptional growth potential with proven track record.