- China

- /

- Oil and Gas

- /

- SHSE:601001

Exploring Inner Mongolia MengDian HuaNeng Thermal Power And Two Other Top Dividend Stocks In China

Reviewed by Simply Wall St

Amid fluctuating global markets, China has recently implemented significant measures to stabilize its housing sector, reflecting broader economic strategies. As investors navigate this evolving landscape, understanding the fundamentals of dividend stocks like Inner Mongolia MengDian HuaNeng Thermal Power becomes crucial, especially in a market striving for balance and growth.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Shandong Wit Dyne HealthLtd (SZSE:000915) | 6.01% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.11% | ★★★★★★ |

| Midea Group (SZSE:000333) | 4.48% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.17% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.31% | ★★★★★★ |

| Jiangsu Yanghe Brewery (SZSE:002304) | 4.95% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.22% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.03% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 4.99% | ★★★★★★ |

Click here to see the full list of 192 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

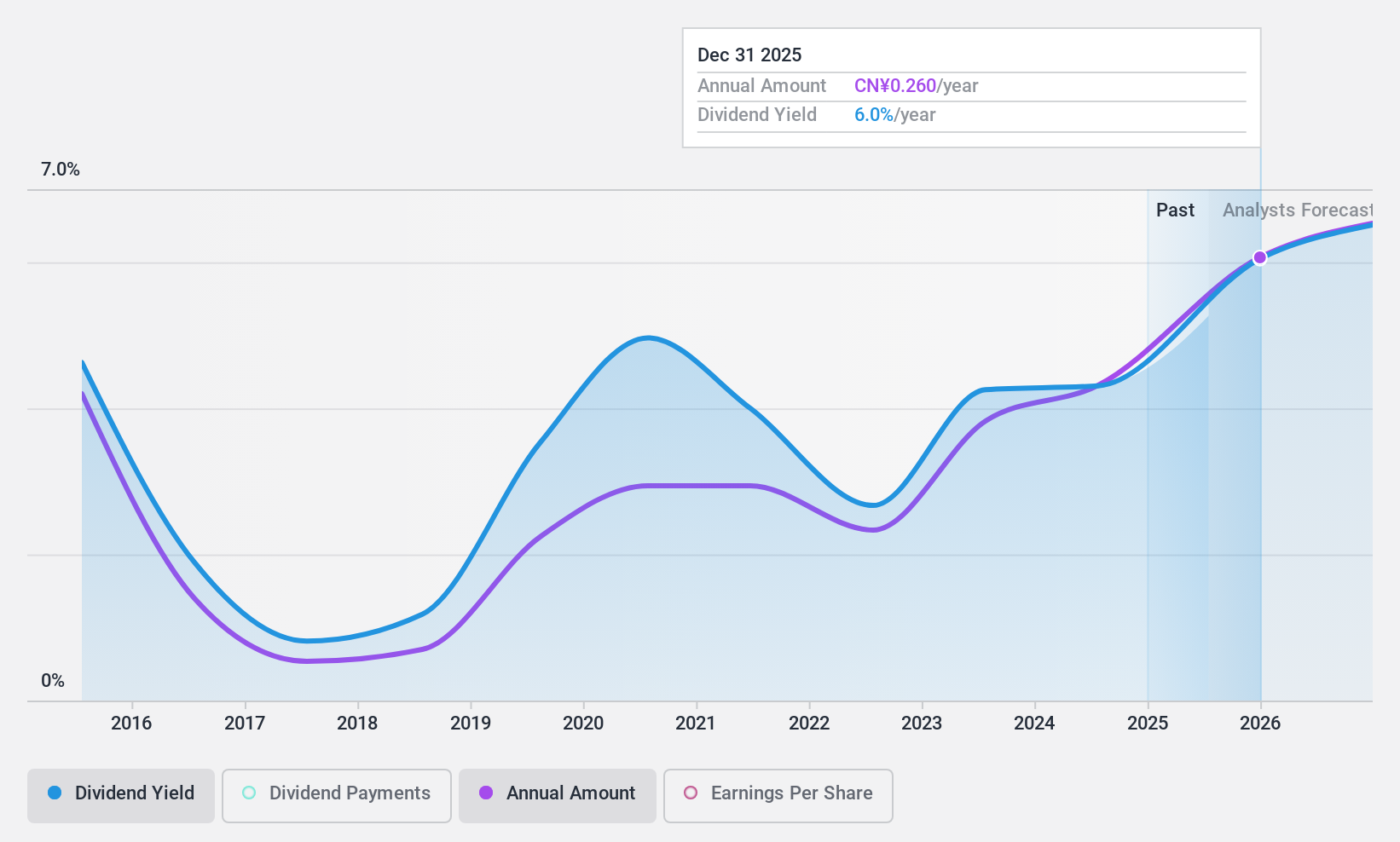

Inner Mongolia MengDian HuaNeng Thermal Power (SHSE:600863)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inner Mongolia MengDian HuaNeng Thermal Power Corporation Limited operates in the thermal power generation sector and has a market capitalization of approximately CN¥30.35 billion.

Operations: Inner Mongolia MengDian HuaNeng Thermal Power Corporation Limited primarily generates revenue through its thermal power generation business.

Dividend Yield: 4%

Inner Mongolia MengDian HuaNeng Thermal Power reported a slight decline in revenue and sales for the full year 2023 and Q1 2024, yet showed an increase in net income during these periods. Despite its low price-to-earnings ratio of 15.8x compared to the CN market average of 31.5x, suggesting good value, the company has a history of unstable and unreliable dividend payments with a notable annual volatility over the past decade. However, dividends are reasonably covered by both earnings (62.9% payout ratio) and cash flows (44.4% cash payout ratio), indicating some level of sustainability amidst financial fluctuations.

- Delve into the full analysis dividend report here for a deeper understanding of Inner Mongolia MengDian HuaNeng Thermal Power.

- Upon reviewing our latest valuation report, Inner Mongolia MengDian HuaNeng Thermal Power's share price might be too pessimistic.

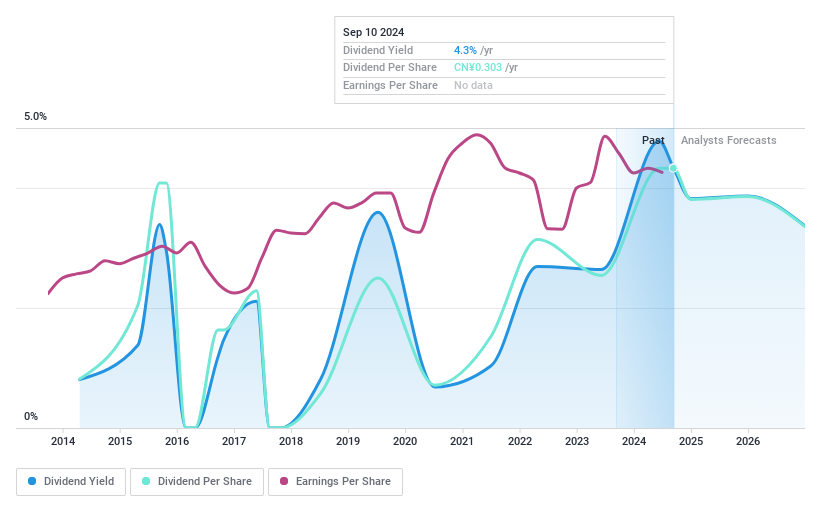

Jinneng Holding Shanxi Coal Industryltd (SHSE:601001)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jinneng Holding Shanxi Coal Industry Co., Ltd. operates in China, focusing on the production and sales of coal and related chemical products, with a market capitalization of CN¥32.08 billion.

Operations: Jinneng Holding Shanxi Coal Industry Co., Ltd. generates its revenue primarily from the production and sales of coal, alongside chemical products related to the coal industry.

Dividend Yield: 4.1%

Jinneng Holding Shanxi Coal Industry Co., Ltd. exhibits a mixed dividend profile; despite a low payout ratio of 39.1%, ensuring earnings sufficiently cover dividends, its dividend history shows significant volatility over the past decade. Recent financials indicate stability with a net income rise to CNY 780.3 million in Q1 2024 from CNY 710.86 million year-over-year, supporting ongoing dividend payments amidst fluctuating market conditions. However, investors should note the inconsistent dividend growth when considering long-term investment stability.

- Unlock comprehensive insights into our analysis of Jinneng Holding Shanxi Coal Industryltd stock in this dividend report.

- Our valuation report unveils the possibility Jinneng Holding Shanxi Coal Industryltd's shares may be trading at a discount.

Jiangsu Linyang Energy (SHSE:601222)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Linyang Energy Co., Ltd. operates in the manufacturing and distribution of energy meters, system products, and accessories both domestically and internationally, with a market capitalization of approximately CN¥14.13 billion.

Operations: Jiangsu Linyang Energy Co., Ltd. generates its revenue primarily through the sale of energy meters, system products, and accessories across both domestic and international markets.

Dividend Yield: 4.4%

Jiangsu Linyang Energy has demonstrated a 20.4% growth in earnings over the past year with recent quarterly revenue reaching CNY 1.55 billion, up from CNY 1.06 billion year-over-year. Despite its attractive dividend yield of 4.38%, ranking in the top quartile for Chinese markets, the dividends have shown inconsistency and are poorly covered by both earnings and cash flows, reflecting potential risks in sustainability. The company trades at a favorable P/E ratio of 13.4x compared to the broader Chinese market average of 31.5x, suggesting relative undervaluation amidst its financial growth.

- Navigate through the intricacies of Jiangsu Linyang Energy with our comprehensive dividend report here.

- According our valuation report, there's an indication that Jiangsu Linyang Energy's share price might be on the cheaper side.

Turning Ideas Into Actions

- Access the full spectrum of 192 Top Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601001

Jinneng Holding Shanxi Coal Industryltd

Engages in the production and sales of coal and related chemical products in China.

Flawless balance sheet, undervalued and pays a dividend.