- China

- /

- Electrical

- /

- SHSE:600869

Shareholders in Far East Smarter Energy (SHSE:600869) have lost 43%, as stock drops 5.2% this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, you risk returning less than the market. We regret to report that long term Far East Smarter Energy Co., Ltd. (SHSE:600869) shareholders have had that experience, with the share price dropping 44% in three years, versus a market decline of about 34%. The more recent news is of little comfort, with the share price down 26% in a year. On top of that, the share price is down 5.2% in the last week.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Far East Smarter Energy

Because Far East Smarter Energy made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last three years, Far East Smarter Energy saw its revenue grow by 6.7% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Indeed, the stock dropped 13% over the last three years. Shareholders will probably be hoping growth picks up soon. But the real upside for shareholders will be if the company can start generating profits.

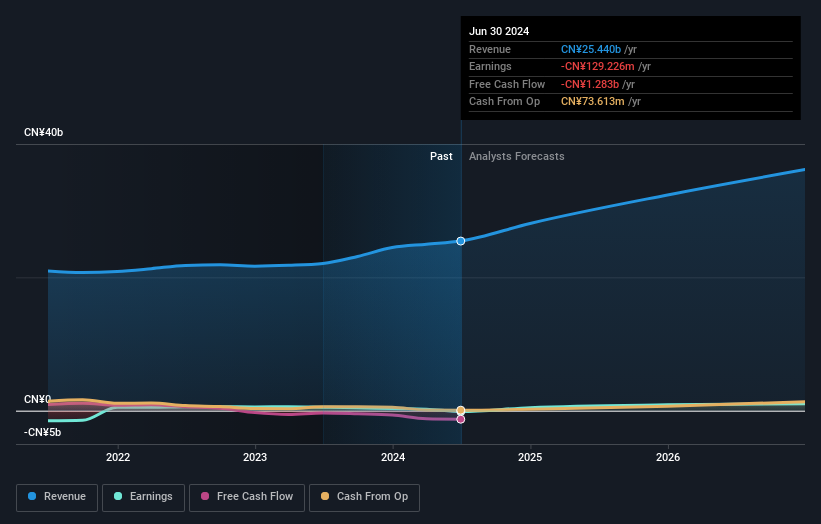

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Far East Smarter Energy's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Far East Smarter Energy shareholders are down 25% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 20%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Far East Smarter Energy has 3 warning signs (and 2 which can't be ignored) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600869

Far East Smarter Energy

Provides smart energy and smart city services in China and internationally.

Reasonable growth potential and fair value.