Stock Analysis

- China

- /

- Trade Distributors

- /

- SHSE:600766

YanTai Yuancheng Gold Co., Ltd.'s (SHSE:600766) 41% Cheaper Price Remains In Tune With Revenues

The YanTai Yuancheng Gold Co., Ltd. (SHSE:600766) share price has fared very poorly over the last month, falling by a substantial 41%. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 17%.

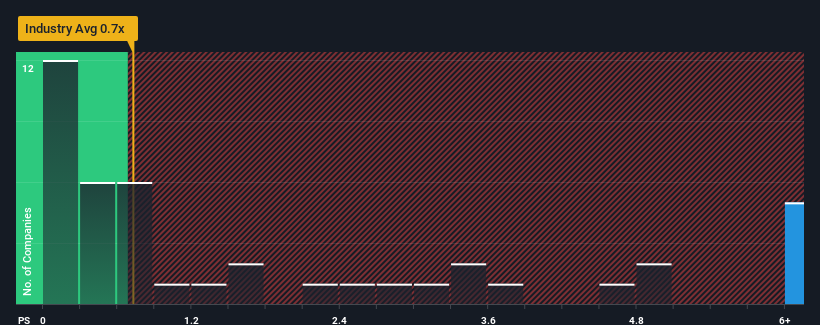

Even after such a large drop in price, when almost half of the companies in China's Trade Distributors industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider YanTai Yuancheng Gold as a stock not worth researching with its 11.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for YanTai Yuancheng Gold

What Does YanTai Yuancheng Gold's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, YanTai Yuancheng Gold has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for YanTai Yuancheng Gold, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

YanTai Yuancheng Gold's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 111%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 23% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why YanTai Yuancheng Gold's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

A significant share price dive has done very little to deflate YanTai Yuancheng Gold's very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of YanTai Yuancheng Gold revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with YanTai Yuancheng Gold, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on YanTai Yuancheng Gold, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether YanTai Yuancheng Gold is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600766

YanTai Yuancheng Gold

Engages in trading of steel products, coal, and fuel oil businesses in China.

Imperfect balance sheet with weak fundamentals.