- Taiwan

- /

- Tech Hardware

- /

- TWSE:6197

Discovering Undiscovered Gems With Potential In November 2024

Reviewed by Simply Wall St

As global markets continue to navigate geopolitical tensions and economic uncertainties, U.S. indexes are nearing record highs with small-cap stocks showing notable outperformance amidst broad-based gains. In this dynamic environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and adaptability, traits that can be particularly advantageous in the current market landscape where smaller-cap indexes are excelling.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Payton Industries | NA | 9.38% | 14.12% | ★★★★★★ |

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Liaoning Shidai WanhengLtd (SHSE:600241)

Simply Wall St Value Rating: ★★★★★★

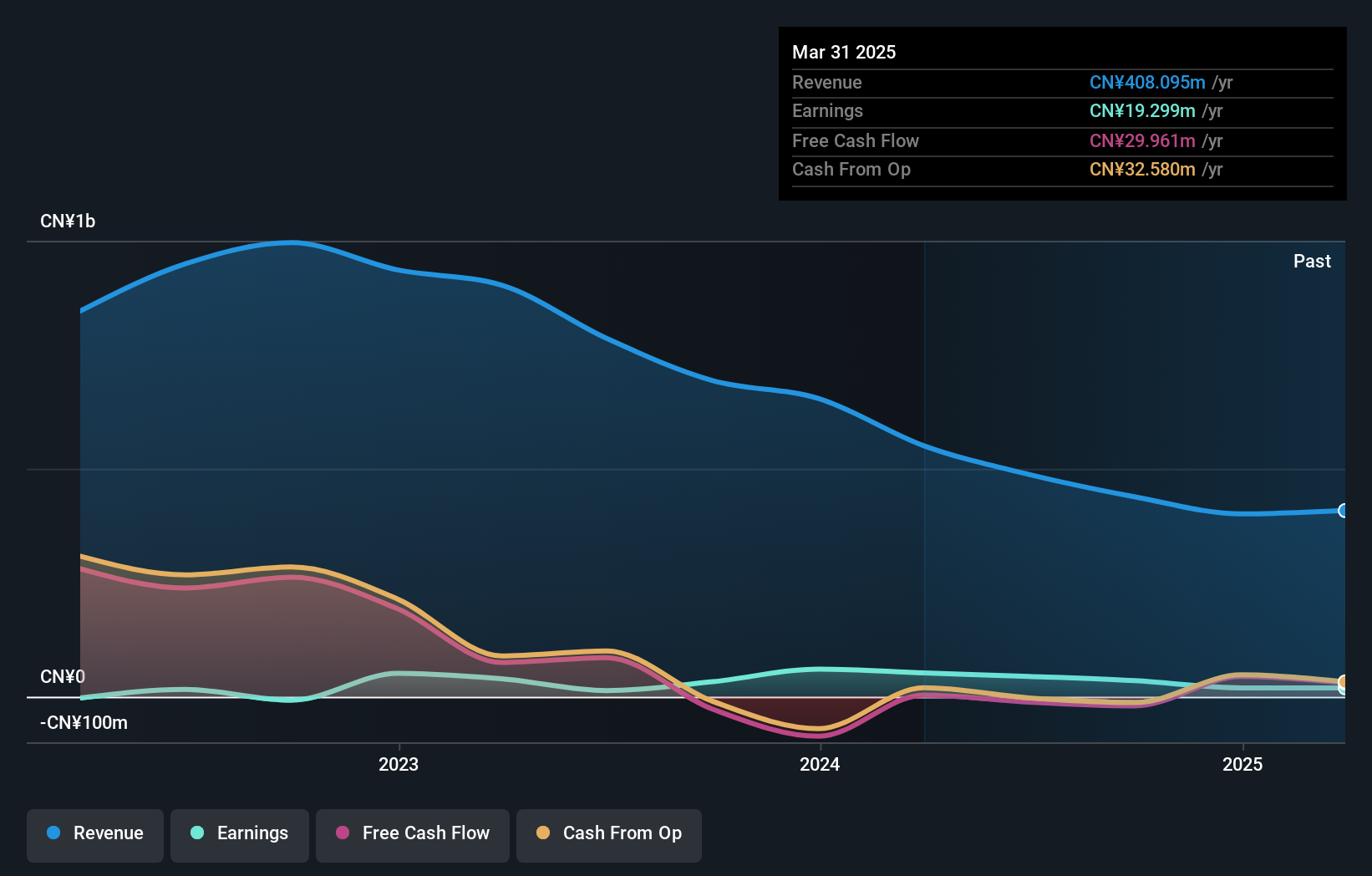

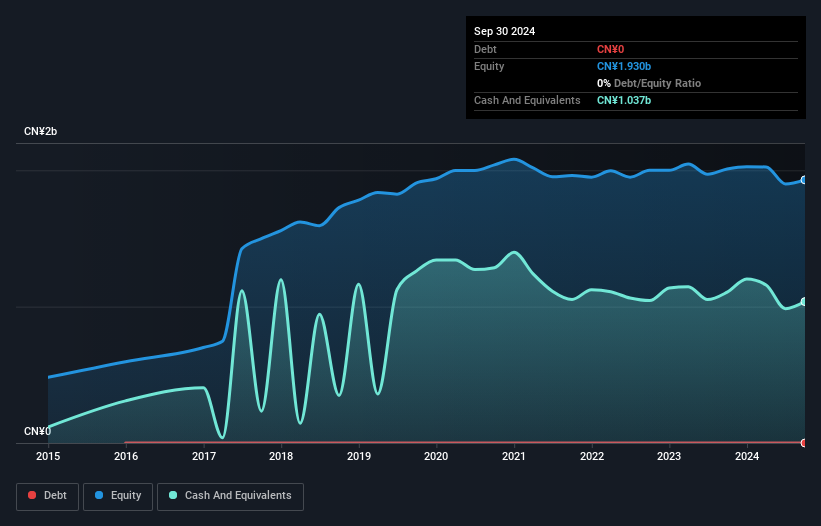

Overview: Liaoning Shidai Wanheng Co., Ltd., along with its subsidiaries, is involved in the research, development, production, and sale of energy batteries and has a market capitalization of approximately CN¥2.25 billion.

Operations: Liaoning Shidai Wanheng Ltd generates revenue primarily through the sale of energy batteries. The company's net profit margin is a key financial metric to monitor, reflecting its profitability after all expenses are accounted for.

Liaoning Shidai Wanheng Ltd., a smaller player in the market, has shown resilience despite recent challenges. With no debt on its books, the company is in a strong position financially compared to five years ago when its debt-to-equity ratio was 12.2%. Over the past year, earnings grew by 6.8%, outpacing the Electrical industry's growth of 1.1%. However, recent financial results highlight some hurdles; for nine months ending September 2024, sales were CNY 298.24 million versus CNY 513.98 million last year and net income fell to CNY 18.81 million from CNY 44.42 million previously.

- Unlock comprehensive insights into our analysis of Liaoning Shidai WanhengLtd stock in this health report.

Understand Liaoning Shidai WanhengLtd's track record by examining our Past report.

Thinkingdom Media Group (SHSE:603096)

Simply Wall St Value Rating: ★★★★★★

Overview: Thinkingdom Media Group Ltd. is involved in the planning, publication, and distribution of books and e-books in China, with a market cap of CN¥2.83 billion.

Operations: The company generates revenue primarily through the planning, publication, and distribution of books and e-books in China. It has a market cap of CN¥2.83 billion.

Thinkingdom Media Group stands out with its robust earnings growth of 13.1%, surpassing the media industry's -10.2% downturn, showcasing its resilience in a challenging market. Trading at a price-to-earnings ratio of 17.9x, it offers good value compared to the broader CN market's 34.6x, indicating potential for investors seeking undervalued opportunities within smaller companies. The company remains debt-free, enhancing its financial stability and reducing risk exposure for stakeholders. Recent earnings showed slight declines in sales (CNY 639 million) and net income (CNY 127 million), yet these figures reflect strong operational performance amidst industry pressures.

Jess-link Products (TWSE:6197)

Simply Wall St Value Rating: ★★★★★☆

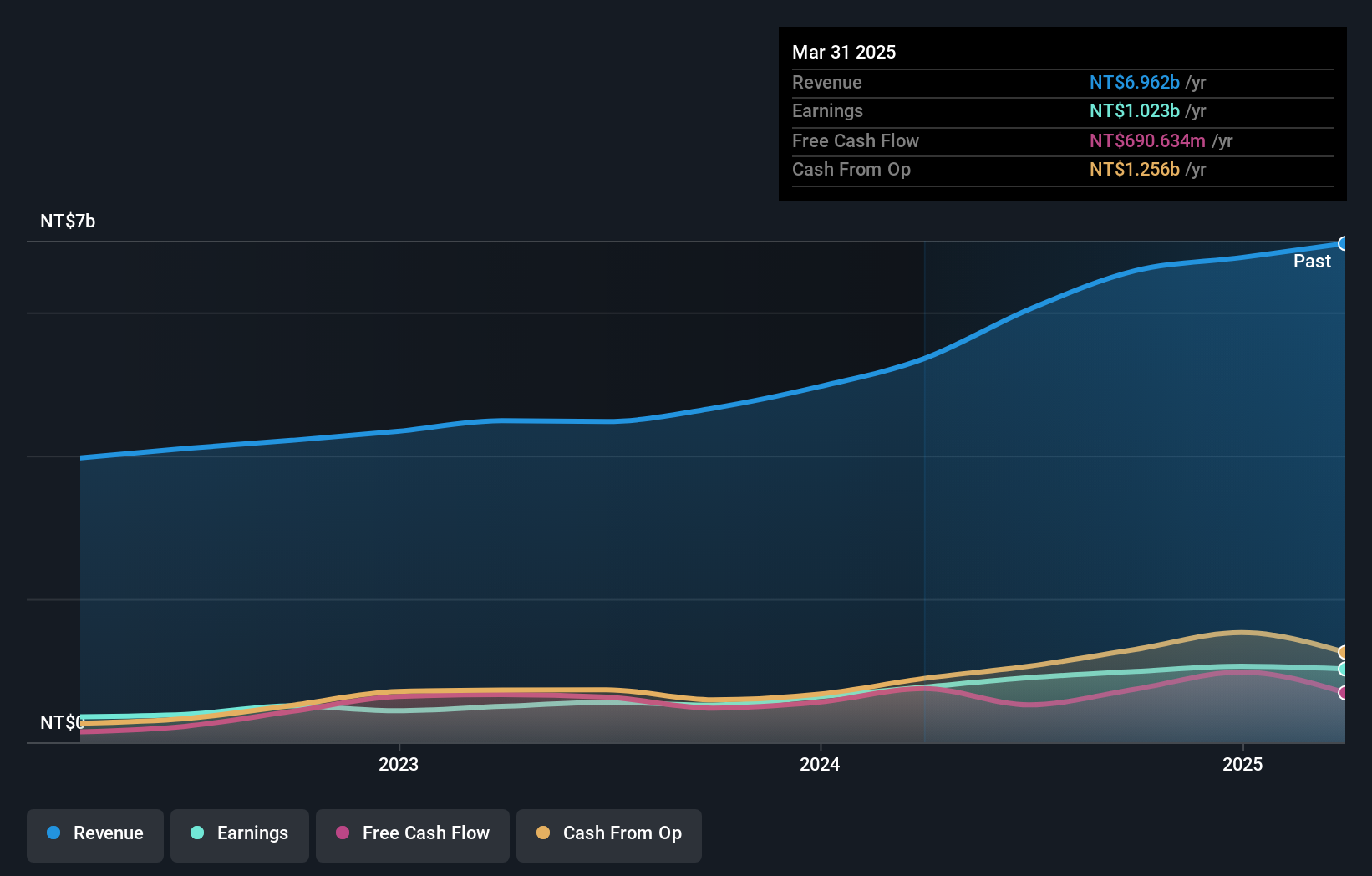

Overview: Jess-link Products Co., Ltd. is a company that offers a range of electronic products and components across Taiwan, China, the United States, Japan, Thailand, and other international markets with a market capitalization of NT$19.29 billion.

Operations: Jess-link generates revenue primarily from selling electronic products and components across various international markets. The company has a market capitalization of NT$19.29 billion, reflecting its significant presence in the industry.

Jess-link Products is making waves with its impressive earnings growth of 90.7%, outpacing the Tech industry's 10% increase, which underscores its potential in the market. Trading at a significant discount of 63.2% below estimated fair value, it presents an intriguing opportunity for investors seeking undervalued stocks. The company's debt-to-equity ratio rose from 4% to 12.3% over five years, yet it holds more cash than total debt, suggesting prudent financial management amidst growth challenges. Recent reports indicate robust sales and net income increases for Q3 and nine months ending September 2024, reflecting strong operational performance and promising future prospects in TWD terms.

- Navigate through the intricacies of Jess-link Products with our comprehensive health report here.

Gain insights into Jess-link Products' past trends and performance with our Past report.

Next Steps

- Click through to start exploring the rest of the 4635 Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6197

Jess-link Products

An investment holding company, manufactures and sells various electronic products and components in Taiwan, China, the United States, Japan, Thailand, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives