- China

- /

- Entertainment

- /

- SZSE:300027

Chinese Growth Stocks With High Insider Ownership Growing Earnings Up To 99%

Reviewed by Simply Wall St

The Chinese stock market has recently experienced a mix of corporate earnings reports that fell short of expectations, resulting in a slight decline in the Shanghai Composite Index and the blue-chip CSI 300. However, despite these challenges, certain growth stocks with high insider ownership have shown promising potential. In today's market conditions, identifying companies with strong insider ownership can be crucial as it often indicates confidence from those closest to the business. This article will explore three such Chinese growth stocks that are not only backed by significant insider investment but also demonstrate impressive earnings growth.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Suzhou TFC Optical Communication (SZSE:300394) | 12.2% | 32% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 22.9% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 30.5% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

Let's explore several standout options from the results in the screener.

Shenzhen VMAX New Energy (SHSE:688612)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen VMAX New Energy Co., Ltd. engages in the research, development, production, and sale of power electronics and power transmission products in China and internationally, with a market cap of CN¥8.22 billion.

Operations: The company's revenue segments include power electronics and power transmission products, both domestically and internationally.

Insider Ownership: 39.8%

Earnings Growth Forecast: 25.1% p.a.

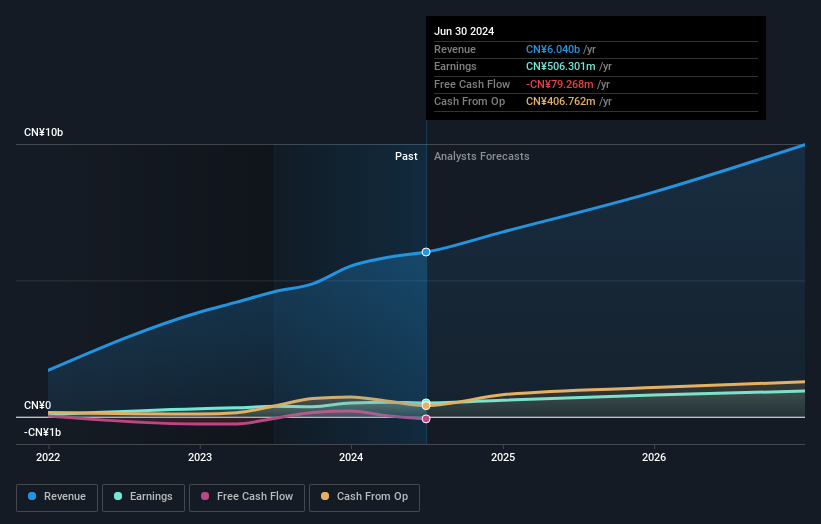

Shenzhen VMAX New Energy has shown strong revenue growth, reporting CNY 2.77 billion for the first half of 2024, up from CNY 2.25 billion a year ago. Despite a slight decline in earnings per share, the company is forecasted to grow its revenue and earnings significantly over the next three years, outpacing market averages. With high insider ownership and recent inclusion in major indices like the Shanghai Stock Exchange Composite Index, it remains an attractive growth prospect trading at a favorable valuation compared to peers.

- Take a closer look at Shenzhen VMAX New Energy's potential here in our earnings growth report.

- The analysis detailed in our Shenzhen VMAX New Energy valuation report hints at an deflated share price compared to its estimated value.

Huayi Brothers Media (SZSE:300027)

Simply Wall St Growth Rating: ★★★★★★

Overview: Huayi Brothers Media Corporation operates as an entertainment media company in China and internationally, with a market cap of CN¥5.69 billion.

Operations: The company's revenue segments include film and television production, artist management, and cinema operations.

Insider Ownership: 17.5%

Earnings Growth Forecast: 99.9% p.a.

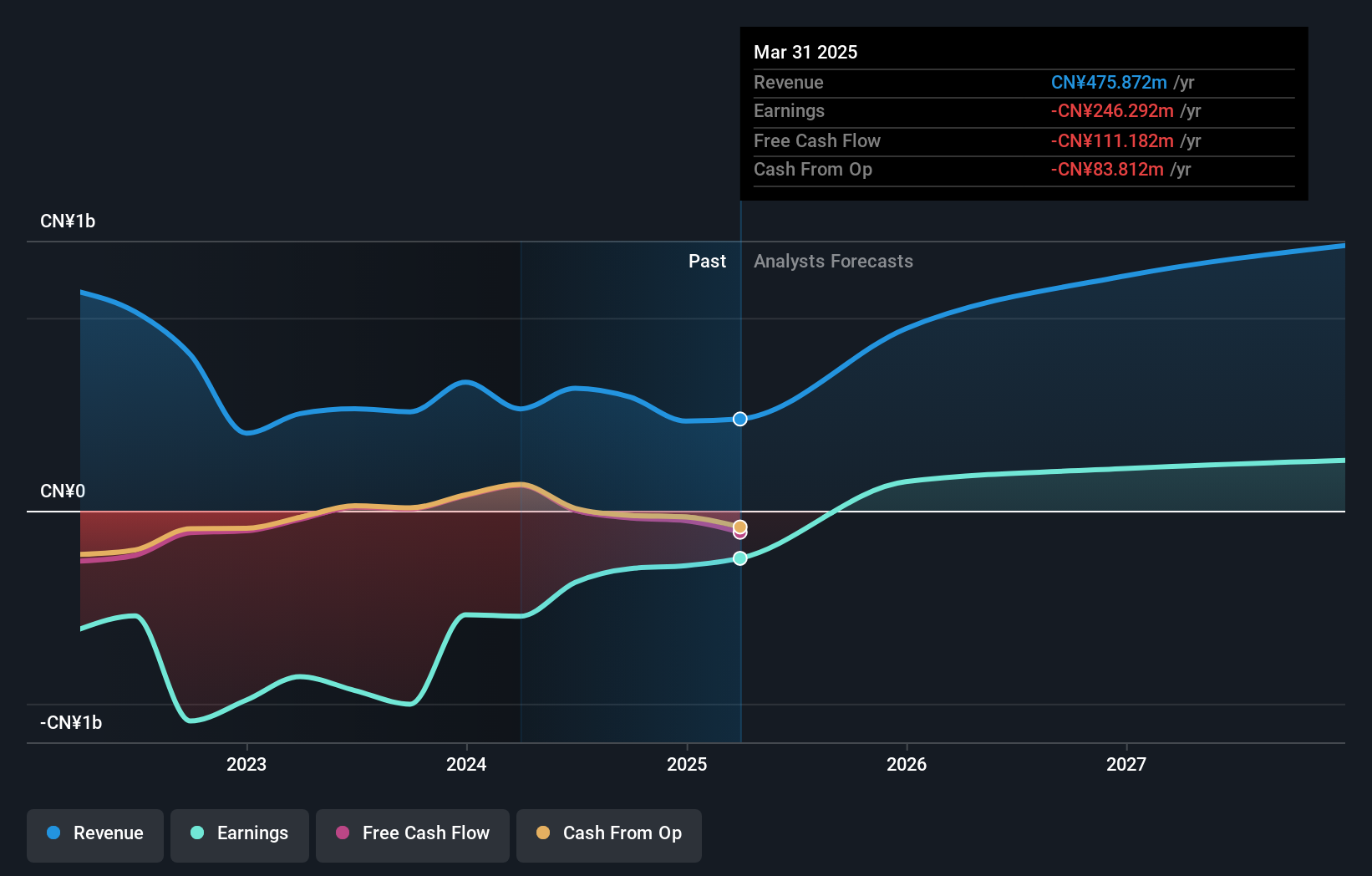

Huayi Brothers Media is poised for significant growth, with revenue forecasted to increase by 40.7% annually, outpacing the market. Despite recent volatility in share price and a complex series of shareholder meetings addressing private placements and equity transfers, the company remains attractive due to its substantial insider ownership and expected profitability within three years. Trading at 68.3% below estimated fair value further enhances its appeal as a growth investment in China's media sector.

- Dive into the specifics of Huayi Brothers Media here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Huayi Brothers Media's share price might be too pessimistic.

Shenzhen Dynanonic (SZSE:300769)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Dynanonic Co., Ltd. focuses on the R&D, production, import, sale, and export of nano-lithium iron phosphate and lithium-ion battery core materials in China with a market cap of CN¥6.86 billion.

Operations: The company's revenue from the research and development, production, and sales of nano-lithium iron phosphate is CN¥4.55 billion.

Insider Ownership: 31%

Earnings Growth Forecast: 98.3% p.a.

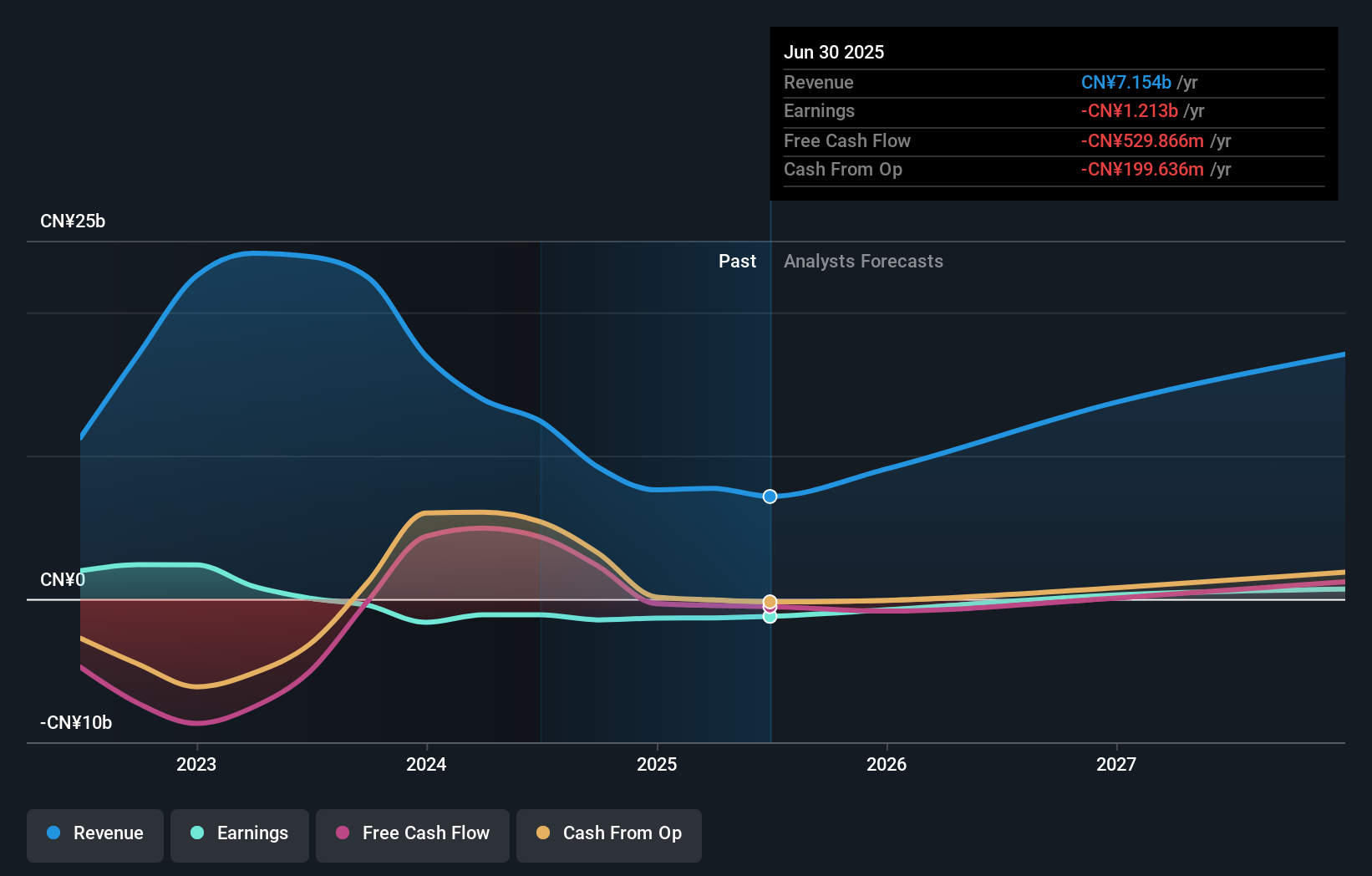

Shenzhen Dynanonic, despite reporting a net loss of CNY 515.82 million for the first half of 2024, is forecasted to achieve significant revenue growth at 22.7% annually and become profitable within three years. The company has substantial insider ownership and recently saw a 5% stake acquisition by Shanyue Songshan Aoyi No.1 Private Securities Investment Fund for CNY 331.97 million, indicating strong insider confidence in its long-term prospects amidst ongoing share buybacks totaling CNY 99.75 million.

- Click to explore a detailed breakdown of our findings in Shenzhen Dynanonic's earnings growth report.

- In light of our recent valuation report, it seems possible that Shenzhen Dynanonic is trading behind its estimated value.

Summing It All Up

- Click this link to deep-dive into the 380 companies within our Fast Growing Chinese Companies With High Insider Ownership screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Huayi Brothers Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300027

Huayi Brothers Media

Operates as an entertainment media company in China and internationally.

Exceptional growth potential and fair value.