Chinese Exchange's Top Insider-Owned Growth Companies October 2024

Reviewed by Simply Wall St

As Chinese stocks experience a surge amid optimism about Beijing's comprehensive support measures, the market's resilience is highlighted despite ongoing challenges such as contracting factory activity and weak demand. In this environment, companies with high insider ownership often signal confidence from those closest to the business, potentially indicating robust growth prospects even in uncertain times.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 17.9% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 38.9% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

We're going to check out a few of the best picks from our screener tool.

Shenzhen VMAX New Energy (SHSE:688612)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen VMAX New Energy Co., Ltd. specializes in the research, development, production, and sale of power electronics and power transmission products both in China and internationally, with a market cap of CN¥10.76 billion.

Operations: The company's revenue is primarily derived from its Electric Equipment segment, which generated CN¥6.04 billion.

Insider Ownership: 39.8%

Earnings Growth Forecast: 24.5% p.a.

Shenzhen VMAX New Energy, recently added to the S&P Global BMI Index, demonstrates strong growth potential with forecasted revenue and earnings growth surpassing market averages. Its price-to-earnings ratio of 21.2x suggests good relative value compared to the broader CN market. Despite a dividend yield of 2.01% not being well-covered by free cash flows, the company's substantial earnings increase over the past year highlights its robust performance in China's energy sector.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen VMAX New Energy.

- Insights from our recent valuation report point to the potential undervaluation of Shenzhen VMAX New Energy shares in the market.

Ninebot (SHSE:689009)

Simply Wall St Growth Rating: ★★★★★★

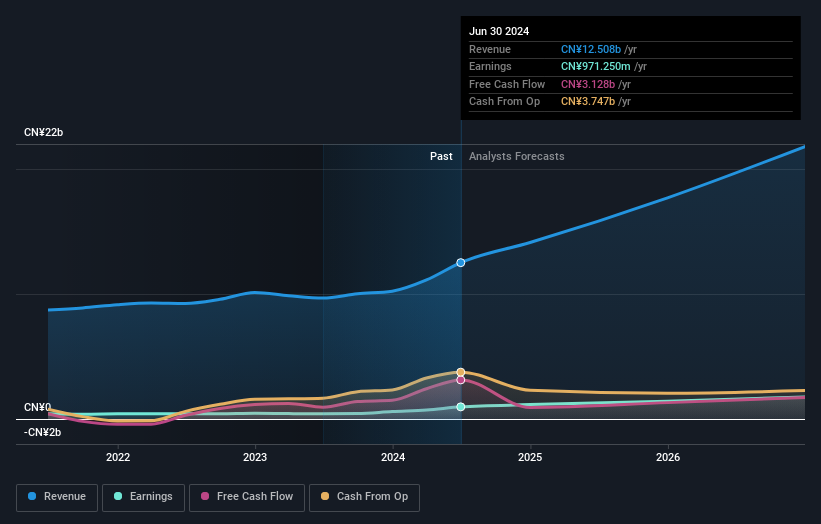

Overview: Ninebot Limited is involved in the design, research and development, production, sale, and servicing of transportation and robot products globally with a market cap of CN¥34.55 billion.

Operations: Revenue Segments (in millions of CN¥):

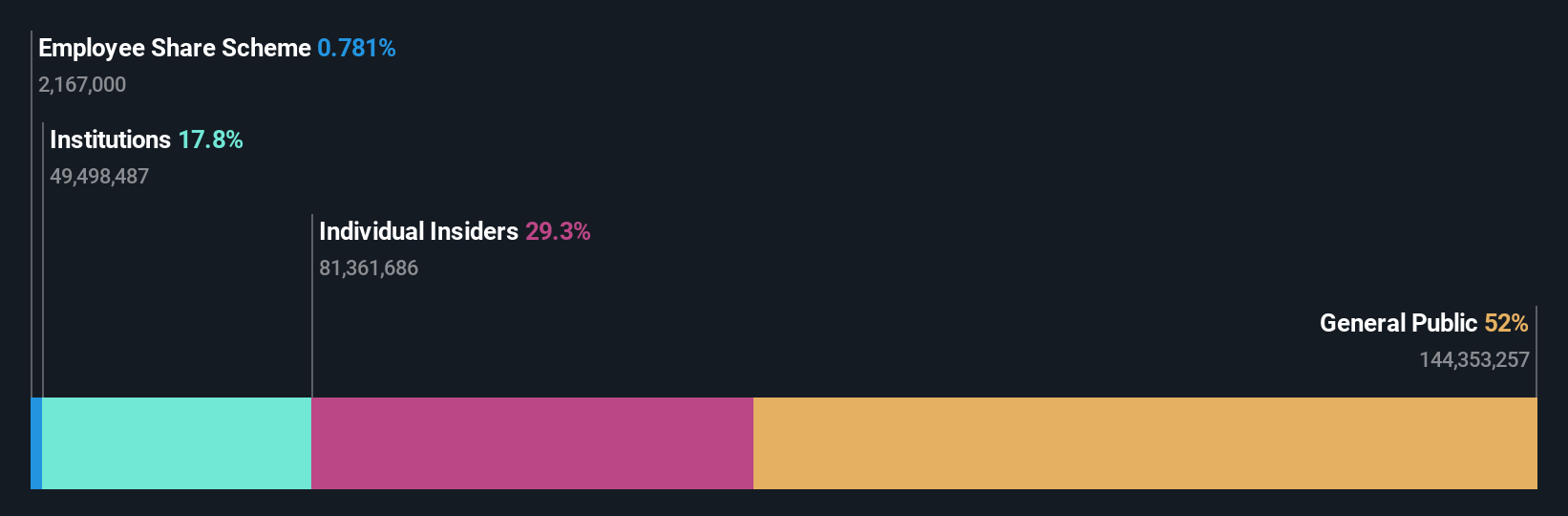

Insider Ownership: 16%

Earnings Growth Forecast: 23.4% p.a.

Ninebot Limited shows strong growth potential with its recent earnings report indicating a significant rise in net income to CNY 595.66 million, up from CNY 222.41 million a year ago. The company's revenue is expected to grow at 22.4% annually, outpacing the broader Chinese market, while earnings are forecasted to increase by 23.38% per year. Despite no substantial insider trading activity recently, high insider ownership aligns management interests with shareholders'.

- Click to explore a detailed breakdown of our findings in Ninebot's earnings growth report.

- Our expertly prepared valuation report Ninebot implies its share price may be too high.

Shenzhen Dynanonic (SZSE:300769)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Dynanonic Co., Ltd. specializes in the research, development, production, import, sale, and export of nano-lithium iron phosphate and lithium-ion battery core materials in China with a market cap of CN¥11.06 billion.

Operations: The company's revenue segment focuses on the research, development, production, and sales of nano-lithium iron phosphate, generating CN¥4.55 billion.

Insider Ownership: 31%

Earnings Growth Forecast: 98.6% p.a.

Shenzhen Dynanonic's revenue is forecast to grow at 22% annually, surpassing the broader Chinese market's growth rate. Despite a challenging half-year with sales and revenue halving compared to last year, the company reduced its net loss significantly. Earnings are expected to grow nearly 99% per year, with profitability anticipated within three years. The recent acquisition of a 5% stake by an investment fund highlights confidence in future prospects, though insider trading activity has been minimal recently.

- Get an in-depth perspective on Shenzhen Dynanonic's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Shenzhen Dynanonic is trading behind its estimated value.

Next Steps

- Discover the full array of 386 Fast Growing Chinese Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ninebot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:689009

Ninebot

Engages in the design, research and development, production, sale, and servicing of transportation and robot products worldwide.

Exceptional growth potential with flawless balance sheet.