- China

- /

- Auto Components

- /

- SHSE:600676

Improved Revenues Required Before Shanghai Jiao Yun Group Co., Ltd. (SHSE:600676) Stock's 27% Jump Looks Justified

Despite an already strong run, Shanghai Jiao Yun Group Co., Ltd. (SHSE:600676) shares have been powering on, with a gain of 27% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

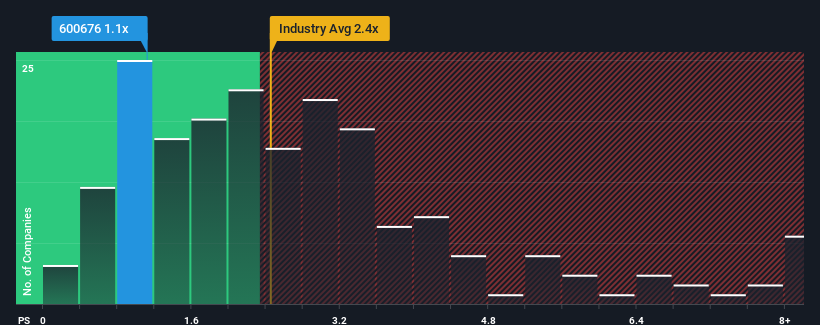

Even after such a large jump in price, considering around half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") above 2.4x, you may still consider Shanghai Jiao Yun Group as an solid investment opportunity with its 1.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Shanghai Jiao Yun Group

How Shanghai Jiao Yun Group Has Been Performing

For instance, Shanghai Jiao Yun Group's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Shanghai Jiao Yun Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Shanghai Jiao Yun Group's earnings, revenue and cash flow.How Is Shanghai Jiao Yun Group's Revenue Growth Trending?

In order to justify its P/S ratio, Shanghai Jiao Yun Group would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. This means it has also seen a slide in revenue over the longer-term as revenue is down 46% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 24% shows it's an unpleasant look.

With this in mind, we understand why Shanghai Jiao Yun Group's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Shanghai Jiao Yun Group's P/S

Despite Shanghai Jiao Yun Group's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Shanghai Jiao Yun Group revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Shanghai Jiao Yun Group that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600676

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives