- Chile

- /

- Gas Utilities

- /

- SNSE:NTGCLGAS

Not Many Are Piling Into Naturgy Chile Gas Natural S.A. (SNSE:NTGCLGAS) Just Yet

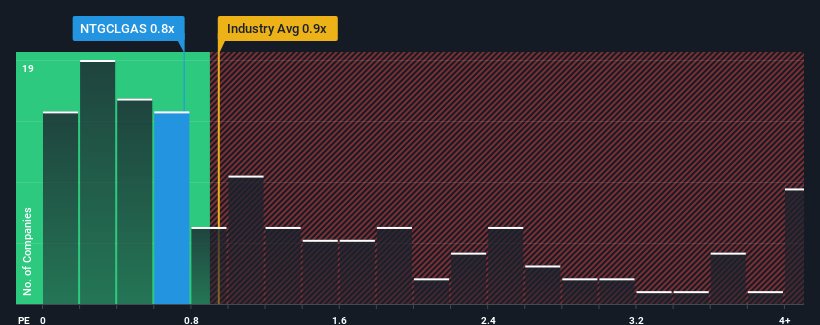

Naturgy Chile Gas Natural S.A.'s (SNSE:NTGCLGAS) price-to-sales (or "P/S") ratio of 0.8x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Gas Utilities industry in Chile have P/S ratios greater than 1.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Naturgy Chile Gas Natural

How Has Naturgy Chile Gas Natural Performed Recently?

As an illustration, revenue has deteriorated at Naturgy Chile Gas Natural over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Naturgy Chile Gas Natural will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Naturgy Chile Gas Natural will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Naturgy Chile Gas Natural's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.6%. Still, the latest three year period has seen an excellent 71% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 15% shows it's noticeably more attractive.

In light of this, it's peculiar that Naturgy Chile Gas Natural's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Naturgy Chile Gas Natural's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We're very surprised to see Naturgy Chile Gas Natural currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Naturgy Chile Gas Natural (1 is potentially serious) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Naturgy Chile Gas Natural might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:NTGCLGAS

Naturgy Chile Gas Natural

Engages in the distribution, supply, and transportation of natural gas in Chile and Argentina.

Excellent balance sheet and good value.

Market Insights

Community Narratives