- Chile

- /

- Renewable Energy

- /

- SNSE:MINERA

The total return for Minera Valparaiso (SNSE:MINERA) investors has risen faster than earnings growth over the last three years

Investors are understandably disappointed when a stock they own declines in value. But when the market is down, you're bound to have some losers. The Minera Valparaiso S.A. (SNSE:MINERA) is down 25% over three years, but the total shareholder return is 48% once you include the dividend. And that total return actually beats the market return of 6.4%. The falls have accelerated recently, with the share price down 18% in the last three months.

After losing 4.0% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Minera Valparaiso

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, Minera Valparaiso actually saw its earnings per share (EPS) improve by 17% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

We note that the dividend has declined - a likely contributor to the share price drop. In contrast it does not seem particularly likely that the revenue levels are a concern for investors.

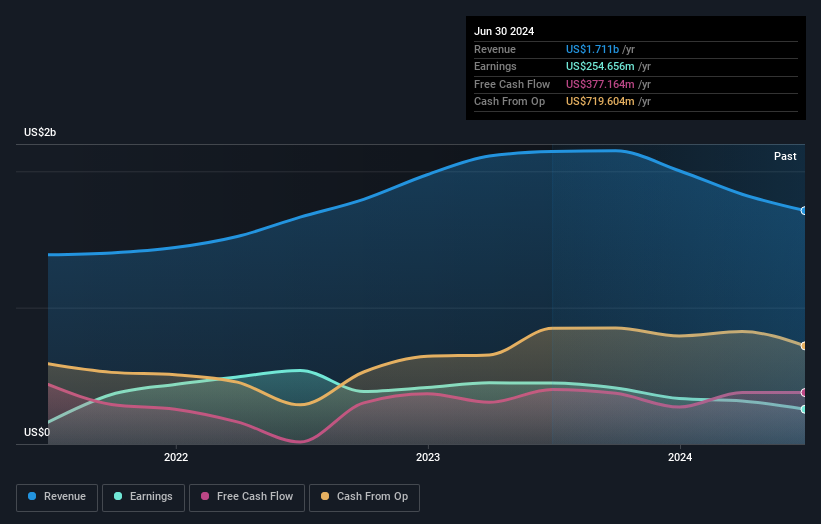

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Minera Valparaiso's TSR for the last 3 years was 48%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Minera Valparaiso's TSR for the year was broadly in line with the market average, at 13%. We should note here that the five-year TSR is more impressive, at 20% per year. More recently, the share price growth has slowed. But it has to be said the overall picture is one of good long term and short term performance. Arguably that makes Minera Valparaiso a stock worth watching. It's always interesting to track share price performance over the longer term. But to understand Minera Valparaiso better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Minera Valparaiso .

But note: Minera Valparaiso may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chilean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:MINERA

Minera Valparaiso

An investment company, engages in the generation and sale of electric power.

Established dividend payer and good value.