Stock Analysis

Multiexport Foods (SNSE:MULTI X) investors are up 11% in the past week, but earnings have declined over the last five years

While not a mind-blowing move, it is good to see that the Multiexport Foods S.A. (SNSE:MULTI X) share price has gained 11% in the last three months.

On a more encouraging note the company has added CL$31b to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

See our latest analysis for Multiexport Foods

We don't think Multiexport Foods' revenue of US$852,978,000 is enough to establish significant demand. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that Multiexport Foods can make progress and gain better traction for the business, before it runs low on cash.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

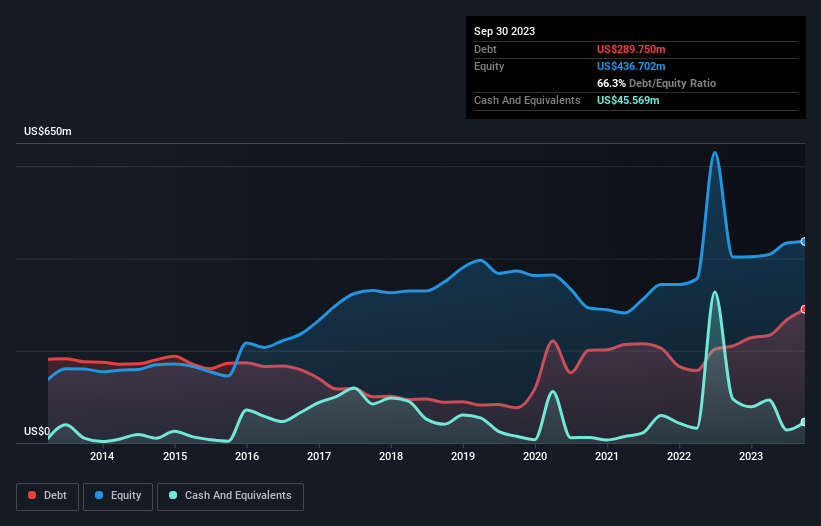

Our data indicates that Multiexport Foods had US$494m more in total liabilities than it had cash, when it last reported in September 2023. That makes it extremely high risk, in our view. But since the share price has dived 11% per year, over 5 years , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Multiexport Foods' cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It only takes a moment for you to check whether we have identified any insider sales recently.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Multiexport Foods' TSR for the last 5 years was 10%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Multiexport Foods shareholders are down 5.5% for the year (even including dividends), but the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Multiexport Foods is showing 5 warning signs in our investment analysis , and 4 of those make us uncomfortable...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chilean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Multiexport Foods is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:MULTI X

Multiexport Foods

Provides seafood products in Chile and internationally.

Good value with imperfect balance sheet.